Topics

Latest

AI

Amazon

Image Credits:Getty Images

Apps

Biotech & Health

Climate

Image Credits:Getty Images

Cloud Computing

Commerce

Crypto

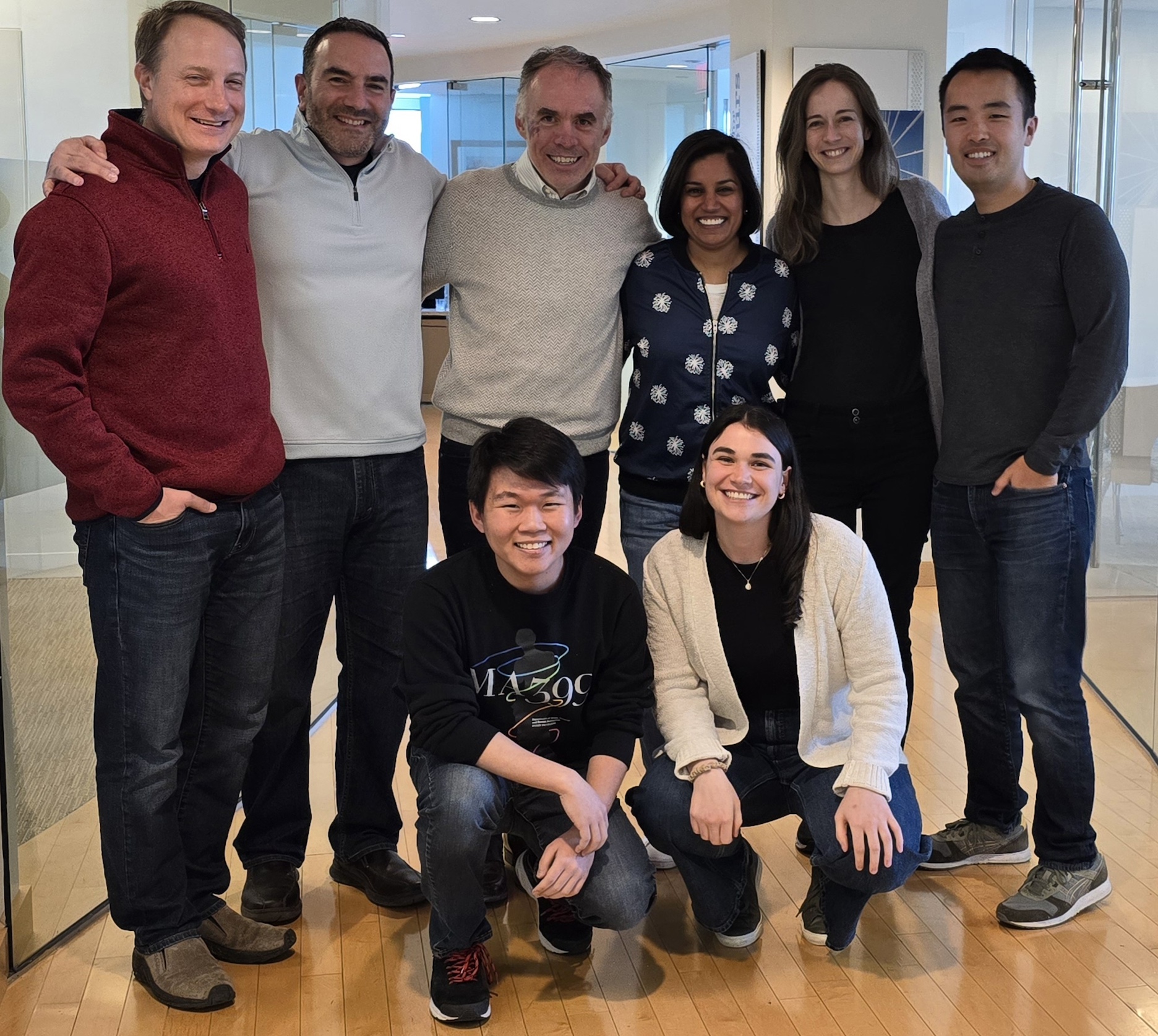

.406 Ventures investing team: Standing, from left, Graham Brooks, Greg Dracon, Liam Donohue, Payal Agrawal Divakaran, Kathryn Taylor Reddy and Kevin Wang. Kneeling, from left, Austin Kwoun and Rebecca Redfield. Missing from photo: Trip Hofer.Image Credits:.406 Ventures

Enterprise

EVs

Fintech

Fundraising

contrivance

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

startup

TikTok

transportation system

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

adjoin Us

.406 Ventures , a Boston - based speculation firm investing in go-ahead - focus startup in healthcare , data point and AI , and cybersecurity , closed its fifth stock with $ 265 million in capital committal .

The firm was base by Liam Donohue , who was the founder of Boston venture business firm Arcadia Partners , and two other cooperator , including Maria Cirino , atomic number 27 - founder of the managed - security measures services company Guardent , and former Razorfish CFO Larry Begley .

The novel fund is support by a grouping of new and exist limited partners , including university endowments , foundations , pension plans and strategic investor . let in the new monetary fund , the 18 - twelvemonth - old firm has raised more than $ 1.4 billion across its five core fund and three opportunity funds .

It ’s been awhile since TechCrunch catch up with the business firm . Speaking recently with Donohue , he say .406 Ventures ’ focus has n’t change much during that time . The firm continues to invest in those same three industries and leverage theBoston tech ecosystem , though it does invest across the nation .

However , unlike some of the firm ’s premature store , Donohue is seeing more repeat founders coming back for Modern investment funds .

“ We wanted to be a partner so that a founder would come back to us for their next thing , ” Donohue told TechCrunch . “ In store one and two , we had a couple of repetition founding father . In the more recent funds , I ’m excited to see so many great repeat partners make out back that a third of the 4th fund was repetition founding father , and I ’d expect about the same in investment firm five . ”

Boston - base .406 Ventures Closes Its Third Fund with $ 217 Million

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Over the two decades , the house has put together a portfolio of 87 companies , many of which have exited or start public . Most of late those have include Iora Health , acquire by OneMedical in 2021 and now part of Amazon Health . behavioural health caller AbleTo is under Optum Health . Meanwhile , Carbon BlackandCloudHealth Technologiesare part of VMware while cybersecurity insurance troupe Corvus was acquired by traveler in 2023 .

.406 Ventures has already made investment funds in four caller from the new store , let in Portrait Analytics , the developer of a generative AI political program for investiture inquiry and dissertation universe . It will gift in more than 20 companies with the new investment trust , Donohue said .

When reckon at startups within the three vertical of healthcare , data and AI , and cybersecurity , the firm view a number of factors , like the plan for infrastructure , especially now that AI is everywhere . It also exploit into executive councils of over 100 C - rooms manipulator from Fortune 500 companies .

“ We take ourselves , ‘ What are the new technology that are either going to need to be protect or will enhance and deepen the scourge factors ? ’ Donohue said . “ We ’re always look forwards three to five years and previse where the vulnerabilities are going to be and then who is building the protections for this . ”

5 investors discuss Boston ’s resilient technical school ecosystem