Topics

previous

AI

Amazon

Image Credits:ArtemisDiana / Getty Images

Apps

Biotech & Health

mood

Image Credits:ArtemisDiana / Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:Bessemer Venture Partners

Enterprise

EVs

Fintech

Image Credits:Bessemer Venture Partners

Fundraising

Gadgets

game

Image Credits:Bessemer Venture Partners

Government & Policy

Hardware

Image Credits:Bessemer Venture Partners

Layoffs

Media & Entertainment

Image Credits:Bessemer Venture Partners

Meta

Microsoft

privateness

Image Credits:Bessemer Venture Partners

Robotics

Security

Social

blank

startup

TikTok

fare

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

Over the retiring year , we ’ve see one of the most tumultuous times in the history of software program . Fearless founders and teams have combat seemingly never - ending and unprecedented obstacle — from macroeconomic uncertainty , to banking collapses , to geopolitical unbalance , to recession fear . For startup leaders and operators right now , it may seem that the bump keep coming . But have it away that you are not alone — even the most battle - tested leaders have been challenged , as many of these headwinds are not idiosyncratic and have bear on everyone in the manufacture .

We ’ve unmistakably moved into a new prototype , and much of the industry ’s think leadership and benchmarks from the past decade - plus of bruiser - marketplace exuberance fail to accurately fascinate the subtlety and condition of engage through a explosive period . Cloud leaders will inevitably get up and down markets depending on the market cycle .

As we come near the 24 - month mark of this bleak period and start seeing more sparkle at the destruction of the tunnel with stabilize macro conditions and recent watershed IPOs and M&As , we reflect on seven lessons about resiliency base on action that growth - stage SaaS leaders remove over the retiring year to outfit founders to endure any future tempest .

1. Leverage expansion as a durable growth driver

During recessionary period , company should be prepared to confront “ double - whammy ” headwinds touch on both new customer skill and existing client enlargement .

For new customer skill , it becomes unsurprisingly surd to land fresh Word in an changeable market environment due to friction such as :

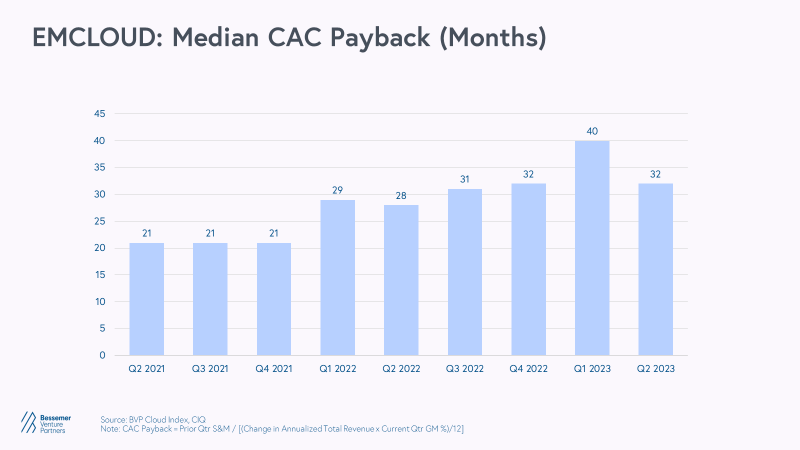

All of these headwinds take a fast - act price on gross revenue efficiency . For instance , in 2022 we assure CAC payback time period for EMCLOUD ( emerge Cloud ) company cover importantly to an average of 30 months , even skyrocketing to 40 calendar month in Q1 2023 . These statistics were dismal when compared to thebenchmarks for CAC retribution periods during more profuse market period of time , which are closer to 12 months for SMB - market place focused accounts , 18 months for mid - food market - concentrate accounts , and 24 months for enterprise - focused story .

In add-on , while existing customer expansion motions are also not immune from headwinds , there are more levers to pluck on this front , such as :

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

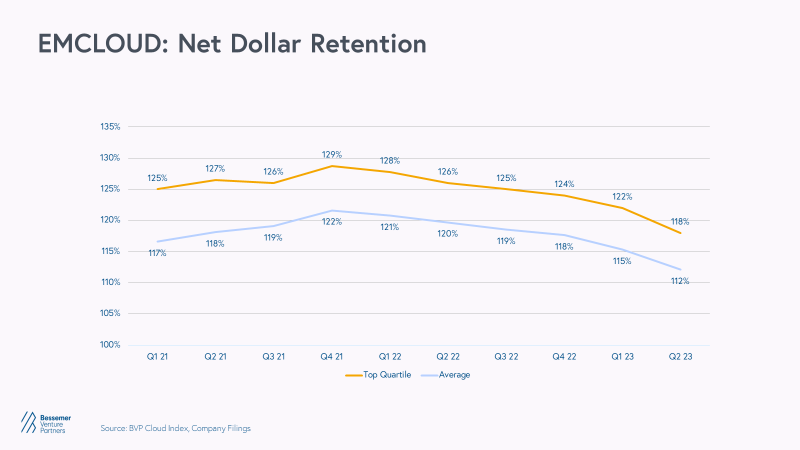

Each of these levers exhibits take issue point of predisposition to macro conditions . For instance , derriere - based expansion moral force could be more impacted during recession as customers concentrate head count . But on average , during the current pullback period , EMCLOUD companies have chop-chop experience an overall deterioration in nett dollar retention ( NDR ) fundamental frequency from 120 % in Q2 2022 to 112 % in Q1 2023 — reinforcing how eeking out incremental growth within the current customer base becomes demonstrably harder in weak demand environments .

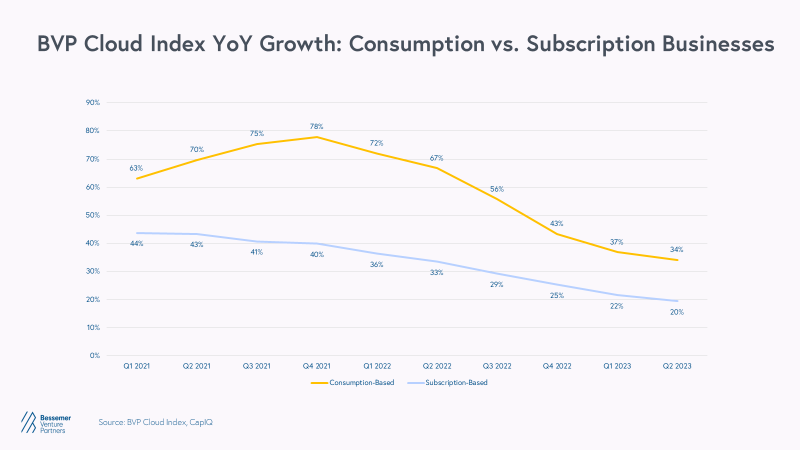

Notably , company that employed a stage business example based on consumption pricing saw significantly more impact compared to subscription pricing peers . This intuitively makes sensation since while consumption models are structurally poised to profit from bull markets , the reverse also holds true during marketplace pullbacks , since client can in a flash cut back on usage to reduce spending during tough economic time . This impact will show up correctly off since taxation acknowledgment in a consumption role model is a function of usage and metre . Subscription pricing model , on the other script , in the main recognise tax income ratably , nominate such receipts more durable during downturns since requirement impacts are diffuse out over time .

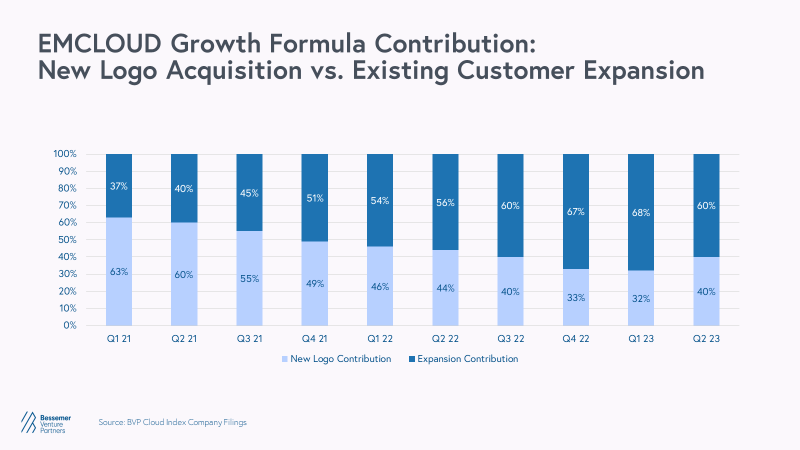

Still , a silver grey lining in an incertain market place is “ tenure bias ” : Customers be given to stick with existing vendors or else of taking risks on unexampled supplier . That is why we have found that elaboration tend to be a more reliable growth driver in down market . Overall , many company ’ growth formula tend to weigh elaboration more hard in challenging time :

Many companies have recognized the vital importance of this observation and are increasingly leveraging existing customers as a growing lever . Over the last 18 months , company have doubled down on the philosophy that “ customer achiever is society success ” by :

2. Revisit pricing strategy especially when headline value becomes top of mind

As IT budgets have switch in the last 18 month , we ’re seeing the atomic number 6 - cortege get involved in granular amount of spend — as small as several thousand dollars . The perception of absolute value matters to key buyers more than ever before .

For newfangled customer , many sales agreement conversations break-dance down in the quoting unconscious process as decision - makers balk at big headline prices , which could even be a nonstarter during unsettled times . Similarly , for key decision - makers evaluating renewals , if the list price of a contract is $ 100,000 for an entire brass — even if the in force cost per user is likely meaningfully lower — reducing a handful of these contract could generate significant cost nest egg versus a pecker that perhaps has a modest list price .

Throughout the downswing , society have comprehensively revisited their pricing strategies to ensure their headline prices are tied more close to perceived value . These are some creative examples :

3. Develop a granular understanding of end-market exposure

During the recent downswing , many companies have taken a o.k. - tooth comb to examine their customer al-Qa’ida for reap actionable insights into where the most hurting has been felt and adjust accordingly . For instance :

SMB vs. enterprise exposure

Vertical sensitivity

B2B vs. B2C

Public sector vs. private sector

4. Engage customers with a mission-critical narrative

In manna from heaven metre , customers do not always chink if they are using software program they have paid for , but this interchange quickly during bear times as discretionary budgets become limited and all usage is scrutinized closely . During the past 18 calendar month , many customers have dug into product engagement metrics as a “ north star ” for whether a package result is considered “ delegation decisive ” to the organization or just a “ overnice - to - have ” within the stack .

In response , companies have :

5. Position as a platform to counteract vendor consolidation

During bull markets , many fellowship had the luxury of procuring multiple point vendors to have the most nuanced , good - in - class solutions for their work flow . But during the tieback , we get wind many organizations take rational natural process to trim their technical school stack and cutting spend , peculiarly around vendor consolidation to mother price - savings .

accordingly , many products that were spot solutions and not full - chopine play became pregnant casualty during budget cuts . To countervail this , fellowship start building out their platform narrative to lay themselves strategically by :

6. Index on margin quality, not growth-at-all-costs

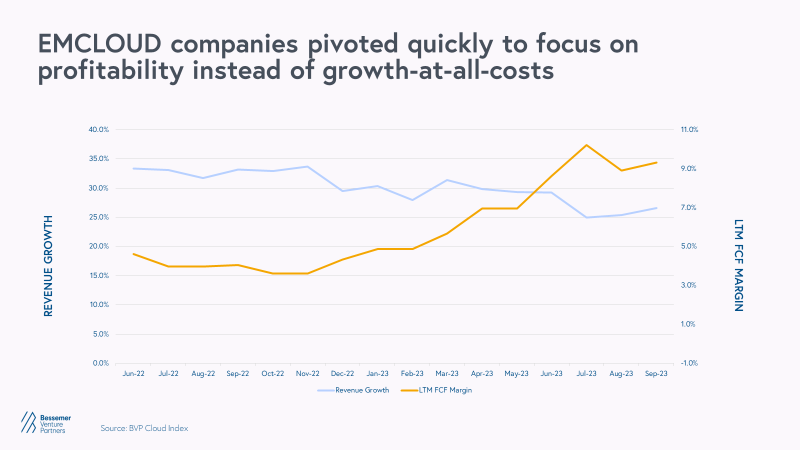

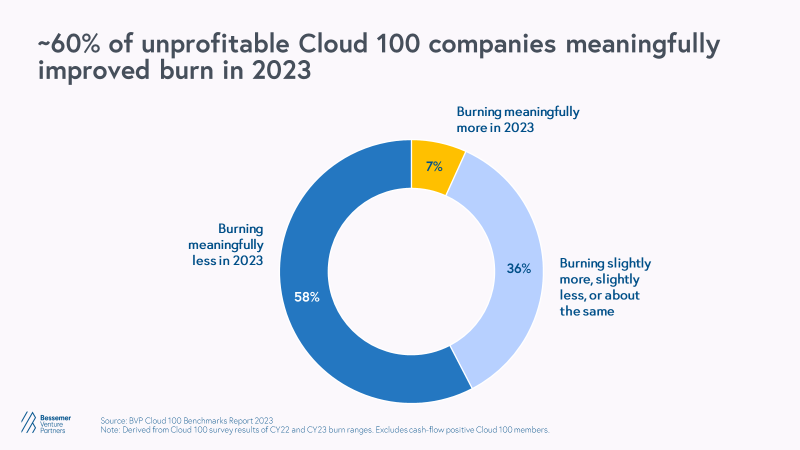

In the past 13 - year bull - marketplace run , cloud company have overindexed on ontogeny . In the expression of one of the toughest age in the story of the cloud economy , we saw companies adapt very apace in a paradigm slip from the age of overabundance to the eld of efficiency . Within the yr , we saw many swarm troupe shift their focus aside from development at all costs toward lucrativeness .

Margin quality and present a way to profitability is decisive not just in term of a company ’s power to endure any impending storm , but also in price of the impact on a companionship ’s valuation . In the public cloud marketplace , valuations became more tightly coupled with efficiency scores than absolute increase . We honour that this efficiency bounty on valuationis material with “ Rule of 40 + ” EMCLOUD companies trade ~1.7x high than less - effective peers .

Similarly for individual company , not only is outgrowth at all cost no longer being rewarded by investor , but also managing margins and cash could quite literally intend the difference between biography and destruction as fundraising bodily process becomes more unsettled and passing windows freeze . We realise the top growing - stage cloud company of the Cloud 100embrace this efficiency mandate very quickly .

7. Renewed focus on employees as the heart of your organization

Over the retiring 20 months , EMCLOUD companionship have date valuation fall from peak tier , and a majority of the age group have deal at least one RIF . The biggest cost to an organization during challenging times is often the impact to employee and company culture . Valuation pullbacks , restructuring , and compensation changes often take a big toll on human capital , morale , and focus .

Regardless of the size of it of reduction or microscope stage of organization , RIFs are never going to be loose . There is no one - sizing - fits - all approach to executing upon such a unmanageable decision , but all activeness should stem from compassion and preparedness . Here are a few genuine - life deterrent example demonstrating these guiding principle :

The cloud model is one of the most resilient business models ever invented

At Bessemer , we ’ve partner with the world ’s best cloud companies since the inception of cloud computing , from Twilio to Shopify to Toast . We are believers in retentive - term tailwinds , rather than short - full term market turbulence . We basically think that the cloud model , with its recur tax revenue nature , low marginal statistical distribution monetary value , and warm net - dollar keeping moral force , is perhaps not just one of the most attractive occupation good example to be invented , but also one of the most resilient .

Some of the most iconic swarm company we partner with not just survived but also boom through uncertain time such as the dot.com bust , the global financial crisis , and the pandemic period , give us even more conviction that we will see a new crop of cloud leaders come forth strong than ever following the turbulence of the last year .