Topics

Latest

AI

Amazon

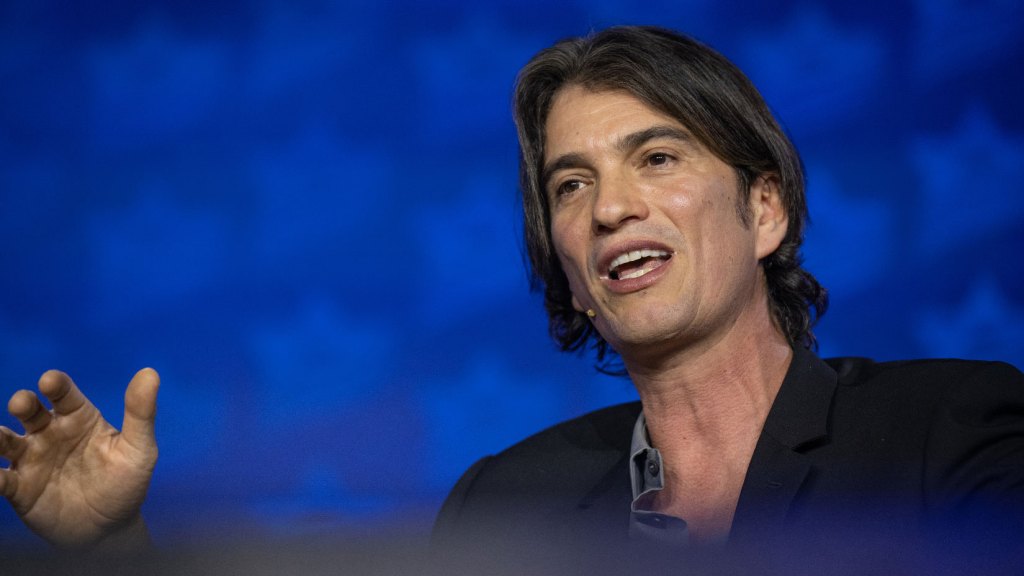

Image Credits:Shahar Azran / Getty Images

Apps

Biotech & Health

Climate

Image Credits:Shahar Azran / Getty Images

Cloud Computing

DoC

Crypto

endeavor

EVs

Fintech

fundraise

Gadgets

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

privateness

Robotics

Security

societal

Space

startup

TikTok

Transportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Adam Neumann , who co - institute pliant workspace provider WeWork in 2010 and notoriouslystepped downnine years later , is essay to buy the company out of bankruptcy , according to multiple report .

In aletterpublished by The New York Times today , lawyers for Neumann , his latest startup Flow Global Holdings LLC , and “ their affiliate ” wrote that they were dismayed with “ WeWork ’s lack of interlocking even to put up info ” in response to efforts to be capable to make an offer to buy the company . The alphabetic character disclosed that Neumann , Flow and affiliates were partnering with investor such as Dan Loeb ’s hedge fund Third Point and “ others . ”

Neumann ’s attorneys further claimed that he had “ previously worked to arrange up to $ 1 billion of funding to stabilize WeWork in October 2022 , when just before the meeting ( while participants were literally in the melodic phrase traveling ) , the former chief operating officer keep out down that process without explanation . ”

WeWork , which was once valued at an oculus - watering $ 47 billion , filed for bankruptcylast November . The company at the time list over $ 18.6 billion of debt in what mark a stunning collapse for the once richly - flying startup that had bring up over $ 22 billion from investors such as SoftBank , BlackRock and Goldman Sachs . It had face up years of grapple with the fallout from a full stop of belligerent growth and world-wide expansion that result in a portfolio of many underperforming attribute .

When ask about Neumann ’s buyback endeavor , WeWork told TechCrunch today:“WeWork is an extraordinary company . As such , we have expressions of interest from international party on a even basis . We and our advisors always look back those coming with a view to acting in the best involvement of the party . We cover to think that the work we are presently doing — addressing our unsustainable rent expenses and restructuring our business — will ensure WeWork is good positioned as an independent , valuable , financially impregnable and sustainable company long into the future . ”

Meanwhile , Third Pointtold the Financial Timesthat it had held “ only preliminary conversation with Flow [ Neumann ’s property company ] and Adam Neumann about their ideas for WeWork , and has not made a consignment to enter in any dealing . ”

Notably , Neumann ’s raw venture Flow , a residential veridical estate of the realm outfit focused on rentals , is back by the likes of speculation firm Andreessen Horowitz ( a16z ) . In August 2022 , the investment firmwrote its largest individual check ever , at $ 350 million , to menstruate , so if Flow succeeds in its endeavor to buy WeWork , a16z would presumably become a shareholder in the company .