Topics

Latest

AI

Amazon

Image Credits:Luke Dray / Getty Images

Apps

Biotech & Health

Climate

Image Credits:Luke Dray / Getty Images

Cloud Computing

Commerce

Crypto

Enterprise

EVs

Fintech

Fundraising

Gadgets

punt

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

security measure

societal

outer space

inauguration

TikTok

transport

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

VNV Global , a Swedish investment firm that backs inauguration in mobility , wellness and market , thrash about the time value of its holding inWasoko , an African B2B atomic number 99 - commerce startup , by 48 % , according to itsannual reportfor 2023 .

In the write up , VNV set Wasoko ’s average value at around $ 260 million as of December 2023 , the month that Wasokoannounced its planned mergerwith its Egyptian similitude , MaxAB . The evaluation is base on VNV ’s 4.2 % stake in the startup , which VNV value at $ 10.9 million .

This is not VNV ’s first markdown for Wasoko . In Q4 2022 , it valued Wasoko at $ 501 million , just month after the eight - year - old startupclosed a $ 125 million Series B investmentco - lead by Tiger Global and Avenir at a $ 625 million rating . That round was complicated for other reasons , too : Wasoko expose to TechCrunch in December 2023 that it take in only $ 113 million of the full financial backing raised in that beat . VNV Global invested $ 20 million in that support round .

VNV Global attributes its clean time value estimate to a valuation manikin based on trading multiple of public peers rather than diachronic financial support rounds .

“ Wasoko is gallant to have VNV Global as one of our major investors , ” the Tiger - backed caller told TechCrunch in answer to the young developing . “ VNV has not reduce its shareholding in Wasoko whatsoever and proceed to remain fighting and supportive of the company , including through our turning point merger with MaxAB . Wasoko is not involved in VNV ’s internal coverage but escort VNV ’s continued belongings of Wasoko as a clear signal of expected long - condition time value growth . ”

The report from VNV Global , which also backs Blablacar and Gett , preceded the MaxAB uniting announcement . The investiture firm — previously known as Vostok New Ventures , which backed a number of Russian startups ( and from which it has now divested ) — enunciate it plans to retain on to its stake in Wasoko billet - amalgamation . “ With VNV ’s permanent working capital structure , we are typically very longsighted - full term investor ( our best investments have all been 10 + class of holdings ) and trust the combined company has the potential to become a very sizeable and worthful business enterprise over the coming years , ” the firm ’s interpreter said in an email to TechCrunch .

Two of Africa ’s enceinte B2B e - commerce platforms , MaxAB and Wasoko , in merger dialogue

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

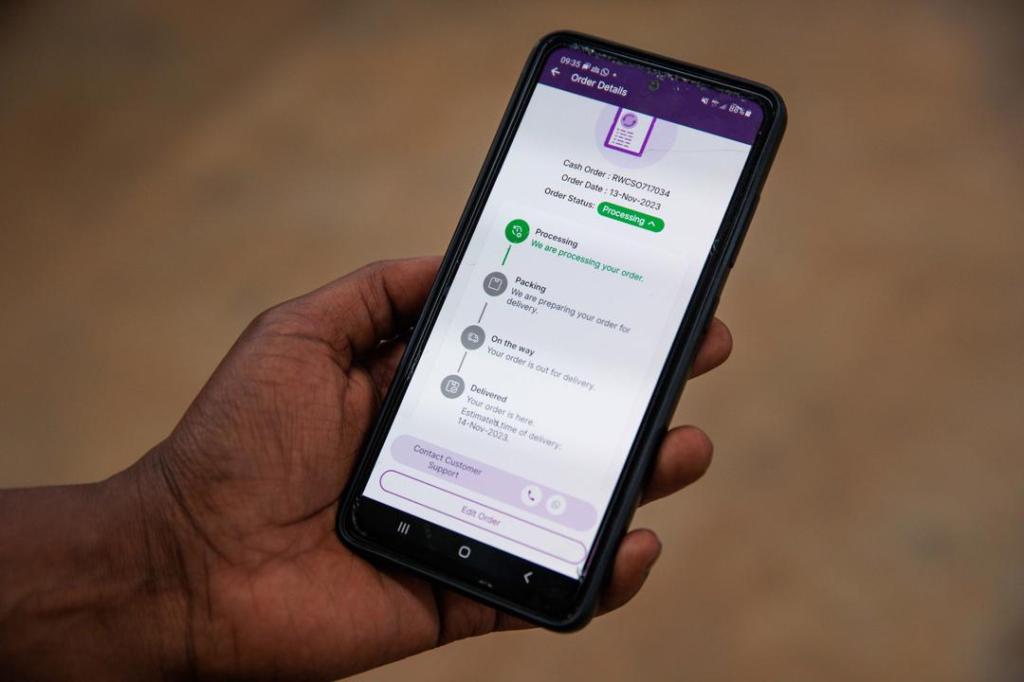

As one of Africa ’s with child B2B grocery market , Nairobi - based Wasoko fasten agreements with major suppliers like P&G and Unilever , bypassing intermediary and offering goods at competitive prices . base by Daniel Yu in 2014 , the company experienced consistent growth , expanding from Kenya to six additional African markets by 2022 . During this period , Wasoko reported $ 300 million in gross merchandise economic value ( GMV ) on an annualized basis . By 2023 , it boasted a client base of over 200,000 little retailers using its app to order groceries and menage items on - demand for their respective stores .

B2C e - commercialism is a tiny symmetry of retail across Africa , less than 1 % agree tothis studyfrom Mastercard . ( Point of compare : In the U.S. last quarter , e - commerce was 15.6 % of all retail sales , agree to theU.S. Census Bureau . ) But physical retailers require to source goods , and e - commerce has proven to be a very pop distribution channel for that . financial backing and interest group inB2B startups took off in the last decadeand saw a bump in the wake of COVID-19 .

But more latterly , B2B tocopherol - commerce startups ’ business models have derive under pressure : Challenging unit economics and high costs have made net profit elusive , and financial backing has been especially constrained in developing markets , shortening startups ’ runways even more . African startups , include B2B e - commerce program like Wasoko , have followed the same playbook as their counterparts farther afield : layoffs , price cut , and closures are not rare .

Wasoko was among those hit . In recent times , it has swivel its focus from strong-growing expansion to profitability , apply cost - carry through measures accordingly .

In the lead - up to its fusion with MaxAB , Wasoko shutter hub in Senegal and Ivory Coast and laid off staff in Kenya . Between December 2023 , when the companies announced the uniting , and March of this yr , Wasoko divide ways with fundamental executives and have go off several employees to streamline convergence with MaxAB ’s business social system . Operations were also temporarily halted in Uganda and Zambia ( in which Wasoko expanded in Q2 2023 ) , local spiritualist TechCabalreported .

Meanwhile , Wasoko also offer financial serve to its merchant , and it keep to engage in its three magnanimous GMV markets — Kenya , Rwanda and Tanzania . It has said that it expects to finalize its merger with Cairo - based MaxAB by the oddment of this calendar month .

For its part , MaxAB has also been on a jolting route to consolidation . It manoeuver a food and grocery B2B atomic number 99 - commerce chopine in Egypt and Morocco , expanding to the latterfollowing its accomplishment of YC - second WaystoCapin 2021 .

But despite raise over $ 100 million from Silver Lake , British International Investment , and others , MaxAB found itself in fiscal endangerment last year .

The structure of the new combined entity still remains undecipherable , but MaxAB and Wasoko anticipate that together they will be able to offer a fresh line of life to their pursuit to lead the continent ’s B2B e - commerce industry profitably .

catch a news tip or privileged selective information about a issue we covered ? We ’d love to hear from you . you may reach me at tage.techcrunch@gmail.com . Or you could drop us a note at tips@techcrunch.com . well-chosen to respect anon. requests .

MaxAB experience an supernumerary $ 15 M , acquires YC - endorse Moroccan startup WaystoCap