Topics

Latest

AI

Amazon

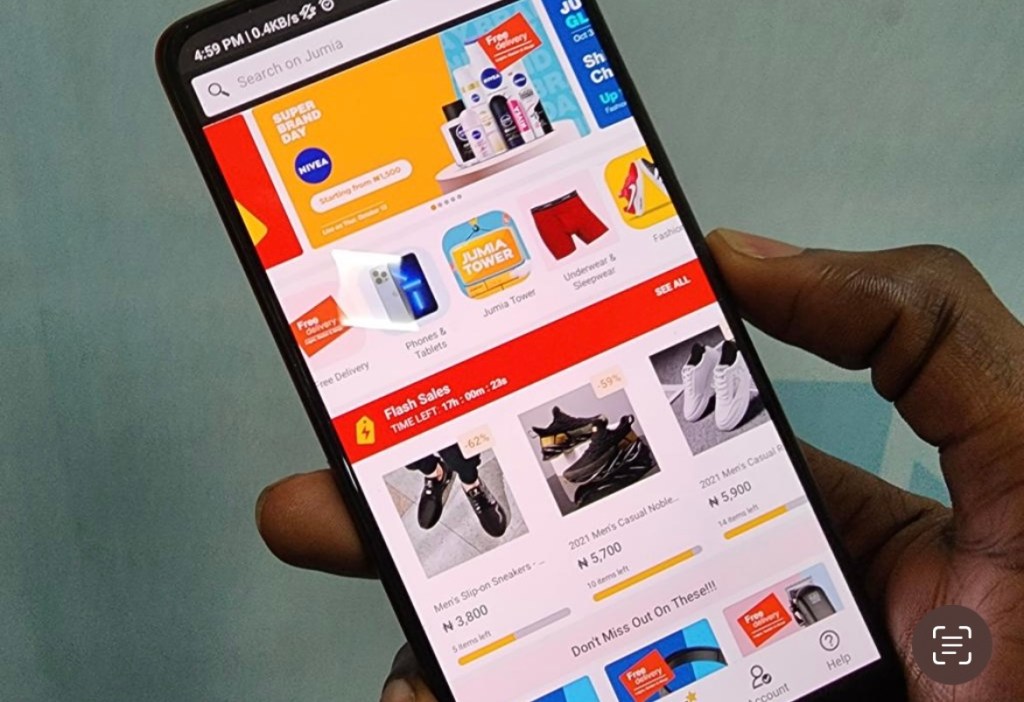

Image Credits:Jumia

Apps

Biotech & Health

Climate

Image Credits:Jumia

Cloud Computing

Commerce

Crypto

Enterprise

EVs

Fintech

fund raise

widget

Gaming

Government & Policy

computer hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

blank

Startups

TikTok

Transportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Almost two weeks ago , TechCrunchreportedthat African e - commerce giant Jumia was planning to trade 20 million American depositary share ( ADSs ) and raise more than $ 100 million , sacrifice its part price of around $ 5.70 at the metre .

The e - tailer has now completed the at - the - market transaction offering of 20,227,736 ADSs . Jumia sell the portion at an average price of $ 4.92 per ADS , engender aggregate gross return before commission and offer expense of $ 99.6 million . TechCrunch report that Jumia would likely sell at that price .

Jumia CEO Francis Dufay said in a instruction that the capital will “ further strengthen our balance tabloid and help us quicken our development trajectory as we progress along our path to gainfulness . ”

Jumia ’s John Cash position presently stands at $ 92.8 million ( make up $ 45.1 million in cash and John Cash equivalents and $ 47.7 million in terminal figure deposits and other financial assets ) from its Q2 2024 , itsmost late fiscal report . That ’s compared to the political program ’s liquidness view of $ 120.6 million in Q4 2023 and $ 101.5 million in Q1 2024 .

Jumia land up the 2nd quarter of the class with 2 million active quarterly customers , representing a 6.0 % quarter - over - twenty-five percent increment compare to Q1 2024 and flat year - over - yr growth between Q2 2023 and Q2 2024 . “ Our client base is still comparatively minor , around two million dynamic consumer per quarter , while we make in marketplace with over 600 million people . So we can do much more on the customer al-Qa’ida , ” Dufaytold TechCrunch before guarantee his first secondary share sales agreement as chief executive officer earlier this calendar month .

Between 2020 and 2021 , when private and public markets were aflush with capital , the e - tailer raised almost $ 600 million by selling lowly part .