Topics

Latest

AI

Amazon

Image Credits:Getty Images

Apps

Biotech & Health

Climate

Image Credits:Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:Briter BridgesImage Credits:Briter Bridges

initiative

EVs

Fintech

fundraise

gismo

Gaming

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

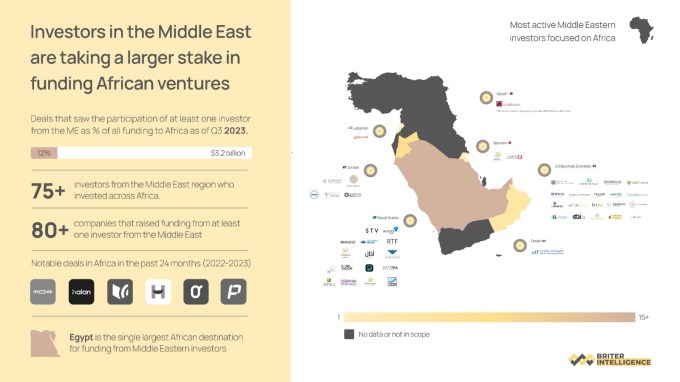

Middle Eastern investors and LPs may require recipients to deploy funds within the region

African startup funding has seen a significant declineof more than 50%over the past three quarters compare to the old twelvemonth , asreported by The Big Deal . To engagement , startups on the continent have secured funding in the range of $ 2.5 billion to $ 3.4 billion , establish on data from The Big Deal andBriter Bridges . With one tail remaining , it appear improbable that this name will attain the levels seen in2021and2022 , when venture cap peaked at $ 5 to $ 6 billion , encompassing fairness and debt mass .

It ’s essential to note that this decline is n’t exclusive to Africa . Venture capital worldwide has reconstruct to pre - COVID levels . However , Africa ’s diminishing numbers are peculiarly refer given its trust on external funding , especially compared to other emerging tech ecosystems such asIndiaandLatin America .

According to areportfrom the African Private Equity and Venture Capital Association ( AVCA ) , 77 % of the venture capitalists who funded African startups last twelvemonth were outside the continent . However , as global investors retract their commitments this year , this percentage may change significantly by the end of the year . While we await those public figure , it ’s worth foreground a crucial discovery from the report that drop Inner Light on where African founder are looking for their next source of capital .

The U.S. and the U.K. jointly accounted for 50 % of foreign speculation capitalists commit in Africa . unco , the UAE represented the third - big source of extraneous Washington for African inauguration in 2022 , chip in 4 % , outpacing nation like France and China . datum from Briter Bridges indicates that over 80 Middle Eastern investor have participate in African proceedings since they begin supervise this surface area . In 2019 , 16 mediate Eastern investor supported African ventures , a number that grew to 50 last year .

This growing connection between African startups and VCs and investor and LPs from or based in the Middle East was prominently exhibit last week at GITEX , a global technical school show organized by and held in the UAE . The upshot attracted over170,000 attendees , with 33 % from the Middle East , 21 % from Africa , 20 % from Asia , 18 % from Europe , and 8 % from the Americas .

Only 22 % of the950 investorshailed from the Middle East at the event . However , I verbalize with several African founders , primarily in the early stages of building their businesses who serve the event mean to forge relationship with investor in the UAE and neighboring GCC countries . Traditionally , they had seek financial support from westerly investors , and GITEX offered them the opportunity to research new and diversified options , considering the current challenge in raising venture capital . While ongoing conversation with both sets of investors are taking piazza , whether these will lead to investment remains uncertain .

On the sidelines of the event , executive from some of the most valuable African technology companies , include MNT Halan , Fawry , Andela , and Interswitch , participated and engaged with government official , customers , and investors in the region .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Meanwhile , investors focused on Africa had deviate experiences . Some look the event to get in touch with their existing throttle better half ( LPs ) in the Middle East and expand their meshing to let in a broader spectrum of institutional investor , not restricted to the part . Additionally , a couple of venture capitalists noted that while the Middle East is a stead to found worthful connections , building trustfulness is essential before they can secure institutional upper-case letter . As a result , the region remains a long - term strategic focus for their funds .

In contrast , certain early - stage venture capitalists were explicitly seeking institutional investors from the Middle East . One investor mention that during some of the conversation , they sense a competitor between African and U.K. investors vying for the attending of Middle East limited partners ( LPs ) , particularly government - backed funds and family offices .

Over the past class , investor have been progressively drawn to the Middle East , seeking to establish enduring relationships with sovereign wealth funds . speculation working capital firms are facing one of the most substantial funding shortages in nearly a decennium . Notably , prominent venture capital house like Tiger Global and a16zwere reportedly exploring opportunitiesin Saudi Arabia , the UAE , and Qatar before this year . They try institutional investors interested in diversify their portfolio forth from oil and into engineering science sectors like artificial intelligence and robotics , two of the most prominent technical school themes at GITEX .

For a long time , the Middle East and GCC have been comprehend as source of readily available financing . However , the landscape of regional investiture has become more advanced , involving more comprehensive due industry and selectivity than in the yesteryear . Now , startup founder and speculation capitalists from outside the region must cope with specific criteria to gain financial support . In a conversation with an African investor outside GITEX , I find out that some institutional investor based in Dubai and Riyadh need him to have previously supported regional startups before they would look at commit . Fortunately , he was able-bodied to relate with more accommodating partner .

Philip Bahoshy , the founder of MAGNITT , a Dubai - based datum , analytics , and perceptiveness platform , who was present at GITEX , shared insights with TechCrunch . He noted that there has been a growing perceptual experience in late months that sovereign entities and speculation capital business firm in the Middle Easthave been more fighting than elsewhere in the global venture food market . Withthe return of event in Q4 , it was expected that more startups and VCs would confabulate the realm to bring up investment company , he noted .

“ While it is true that there are more autonomous entity like Dubai Future District Fund in Dubai , Saudi Venture Capital and Jada in Saudi Arabia , the deployment of the capital has been selective and mainly focused on those await to progress and deploy locally , ” said Bahoshy . “ So , where a VC is looking for LP funding or a inauguration is looking to resurrect funds , it is crucial to work out how you be after to deploy that for expansion into the GCC or MENA region . ”

Octavius Phukubye , an investor from the pan - African other - stage fund Microtraction who was also at GITEX , pointed out that Middle East circumscribed partners are eager to support African universal partners ( GPs ) . However , he observed that these investor frequently investigate about the GPs ’ investing architectural plan in the MENA region . This research stems from the pressure on institutional investors to establish their use in catalyse the region through technical school investment .

“ Dubai is position itself as the mecca to bring forth 40 unicorns in 2030 . But there ’s a mismatch . LPs from the Middle East have fund but do n’t have many local VC fund led by experienced GPs , and the ecosystem is too nascent to manufacturing plant - produce stellar founders , ” said Phukubye . “ There were talks of GPs currently raise to separate their funds to let in MENA focus or set up Modern finances to be domiciled in Dubai . And abroad GPs to migrate their portfolio troupe to set up in Dubai so that Middle Eastern LPs or GPs could back those portcos to scale in the MENA and expectant GCC region . ”

A rare illustration of how this coming could do work for a sub - Saharan set up startup isMoove , the mobility fintech ship’s company headquarter in Lagos and Amsterdam . Despite its launch from Lagos in 2019,Moovehas significantly elaborate its reach , with a comportment in 13 cities worldwide , include Dubai . In Dubai , the company boasts over 300 employees and maintains extremely fighting operations . Moove has positioned itself as Uber ’s primary vehicle supply spouse in the EMEA realm . It operate on the largest electric fomite fleet , measure out in supply hours , on the Uber platform in the UAE . In August , Moovesecured $ 76 million in financial backing , with the equity portion take by Abu Dhabi - based Mubadala Investment Company – label Mubadala ’s first investment funds in an African inauguration .

African startups are n’t just eyeing the UAE for capital ; Dubai ’s solicitation lie in its efficient inauguration incorporation and tax system and its facilitation of abode permits and visas for entrepreneurs . In Africa , Egyptian inauguration have been the primary donee of speculation capital from GCC - based investor , including firms like BECO Capital , Saudi Technology Ventures , Middle East Venture Partners ( MEVP ) , and Global Ventures . Notably , while some of the most well - funded companies , like Swvl and Vezeeta , have relocated their headquarters from Cairo to Dubai to attract more investment and heighten their global emplacement , early - level startups are increasingly make this move to escape the current economical challenges in Egypt .