Topics

Latest

AI

Amazon

Image Credits:Apple

Apps

Biotech & Health

Climate

Image Credits:Apple

Cloud Computing

Commerce Department

Crypto

Image Credits:Apple

go-ahead

EVs

Fintech

Fundraising

appliance

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

secrecy

Robotics

security department

Social

place

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

TV

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

Apple is making Apple Pay Later available to all user in the United States , after initiallyreleasingit to a limited number of users back in March . Apple Pay subsequently allow users to split the price of an Apple Pay purchase into four adequate payments over six weeks without interest group or tardy fee . The company firstannouncedthe feature in June 2022 during its Worldwide Developers Conference ( WWDC ) .

Thetech giant ’s websitenow advertises that you may use Apple Pay by and by for purchase between $ 75 and $ 1,000 made on iPhone and iPad .

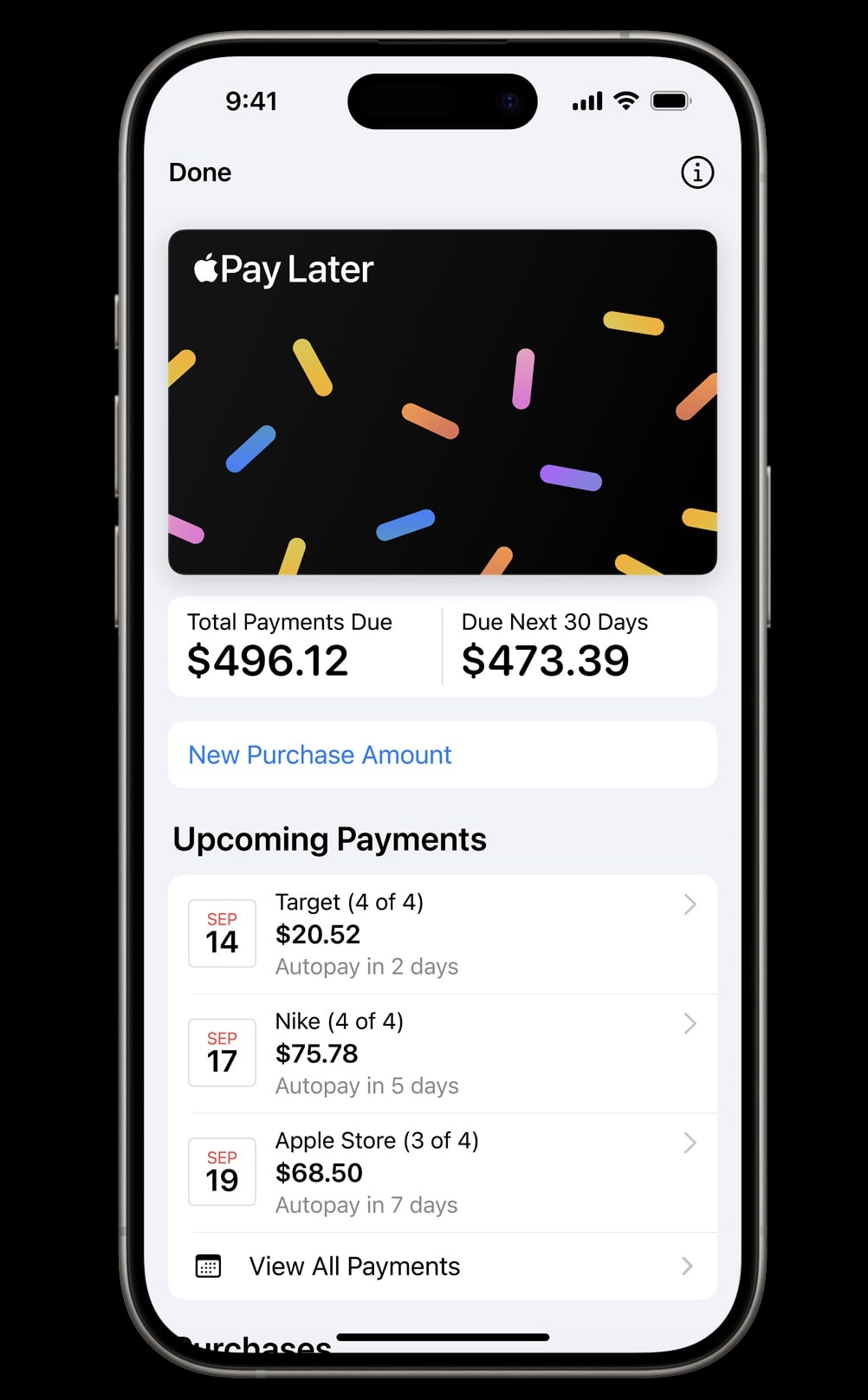

To get started with Apple Pay Later , you need to apply for a loan within the Wallet app . You will be take to enter the amount you desire to borrow and then agree to the Apple Pay Later terms . Once you have been approved , you will get down to see a “ Pay recent ” option when your select Apple Pay at check-out procedure online and in apps on iPhone and iPad .

Before you make out a leverage using Apple Pay Later , you will get an overview of your four new payments alongside your other upcoming Apple Pay Later payment . You have the option to utilise autopay to make the payments , or you could choose to pay them manually . You will get alerts and admonisher as the due dates for your payments set about , and can also access all of your payment entropy in the Wallet app .

The technical school behemoth ’s website notes that your bank may charge you fees if your debit poster business relationship contains insufficient funds to make loan repayment .

To be eligible for Apple Pay Later , you need to be at least 18 class onetime and be a U.S. citizen or lawful resident with a physical U.S. reference . You ’re also require to jell up Apple Pay with an eligible debit card on your gadget . Apple remark that you may potentially have to affirm your identicalness with a driver ’s licence or state of matter - issued exposure ID .

The citation assessment and loaning for Apple Pay after is handle by Apple Financing . In term of the merchandiser side of things , Apple Pay Later is enable through the Mastercard Installments program , while Goldman Sachs serves as the issuer of the Mastercard payment credential used to complete all Apple Pay late purchase .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

With this all-encompassing launch , Apple Pay by and by is now going head - to - head with bargain now , devote later ( BNPL ) service from PayPal , Affirm , Klarna and countless others .

After much delay , Apple finally launches Apple Pay Later