Topics

Latest

AI

Amazon

Image Credits:Arc Technologies / Don Muir, co-founder and CEO of Arc Technologies

Apps

Biotech & Health

Climate

Image Credits:Arc Technologies / Don Muir, co-founder and CEO of Arc Technologies

Cloud Computing

Commerce

Crypto

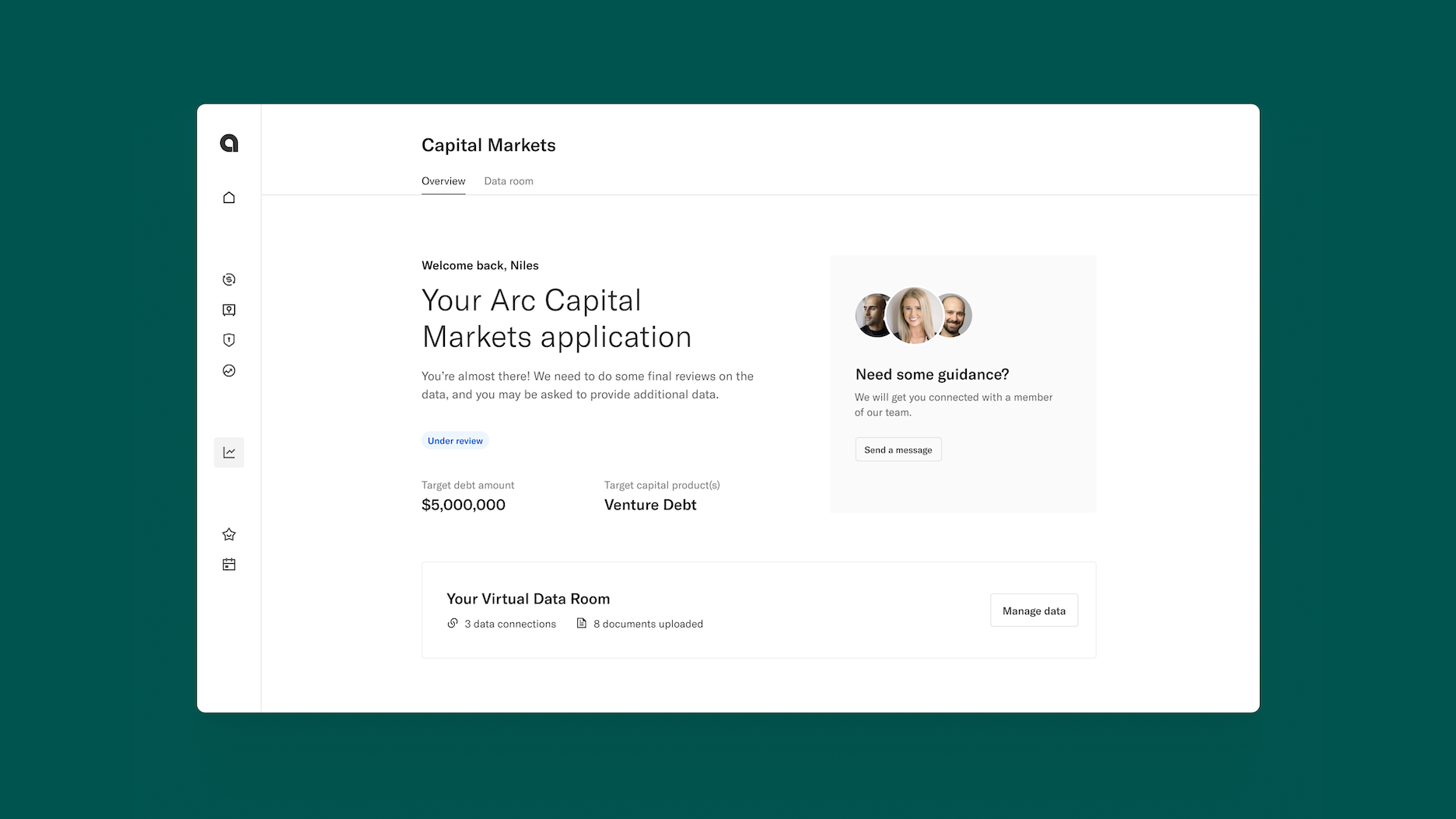

Arc Capital Markets’ venture debt marketplace dashboard.Image Credits:Arc Technologies

go-ahead

EVs

Fintech

fund raise

Gadgets

game

Government & Policy

ironware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

newssheet

Podcasts

television

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Venture debt has its merit . It can be abettor and cheaper alternative to raising fairness , specially if you are building a ship’s company in acapital intensive manufacture . However , recently , some citizenry do n’t seem to be fans .

citizenry can diss heavily on venture debt , especially conform to theSilicon Valley Bank troublesin former 2023 , as my fellow worker Anna Heim remark while recapping a TechCrunch Disrupt 2023 panel .

That ’s why it ’s interesting that startup finance companyArc Technologiesis choosing now to take on the $ 30 billion venture debt industry with a venture debt marketplace for Silicon Valley . Arc was founded in 2021 and has raise around $ 180 million in equity and debt backing , most of late a$20 million Series A roundin 2022 .

YC - backed Arc , a digital bank for ‘ high - increase ’ SaaS startups , lands $ 20 M Series A

Don Muir , co - founder and CEO of the San Francisco - based company , was forthright when he told TechCrunch that “ venture debt is n’t for everyone . ”

“ In 2021 , you could flick your finger’s breadth and grow a $ 50 million equity round with no customer and no tax income , ” Muir said . “ That does n’t exist anymore . Today , equity and debt investor care about fundamentals . There ’s a larger pool of debt capital that ’s now usable to these companies because they ’re solid and more live . And the value airplane propeller of debt , which is much less expensive than fairness , is relatively more attractive . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

When Silicon Valley Bank was stimulate its moment , a phone number of companies , likeBrex , family offices , credit funds and novel banks , rapidly step up to provide opportunity for alternative capital . Muir notice that all that activity made it difficult for inauguration to know the sound seat to go .

That ’s what Arc is solving with its Arc Capital Markets debt marketplace . In 10 minutes , companies can onboard into Arc Capital Markets and receive indicative debt terminal figure for up to $ 250 million within five day from a web of lenders .

The company ’s underwriting model claim in historical fiscal data level and then pre - qualifies startup and makes a lender match based on what the startup is qualified for , fiscal health and visibility . electric arc tipster it can save companionship month and thousands in fees with its market place as there is no cost for startups to receive financing term .

Brex CEO is trying to upraise over $ 1B in a weekend for SVB - related bridge circuit loanword

“ Based on the credit metric that we calculate through our underwriting algorithm , we recognise that stage business is well suitable , for case , for a full term loan from one of our in-between - grocery lenders , ” Muir enunciate . “ We can also distinguish the five top lenders who are , most probable in the shortest period of meter , to put fore indicative term for that stage business . ”

Though it ’s still early on , Arc ’s platform seems to be doing well . More than 350 minutes have closed thus far with closely $ 100 billion in available plus under management .

fall up , the company intends to build additional banking products and loaner experiences , including a young intersection , that Muir declined to talk to right now , in the first half of 2024 .

“ A much gravid swath of speculation - indorse technical school companies are looking at venture debt today than just a few years ago and we ’re here to make that grocery , ” Muir said . “ We desire to help oneself founders and chief financial officer brave the ongoing storm in the speculation uppercase backing itinerary and ensure that they ’re continuing to uprise efficiently with minimum dilution . ”

Taking another look at speculation debt