Topics

late

AI

Amazon

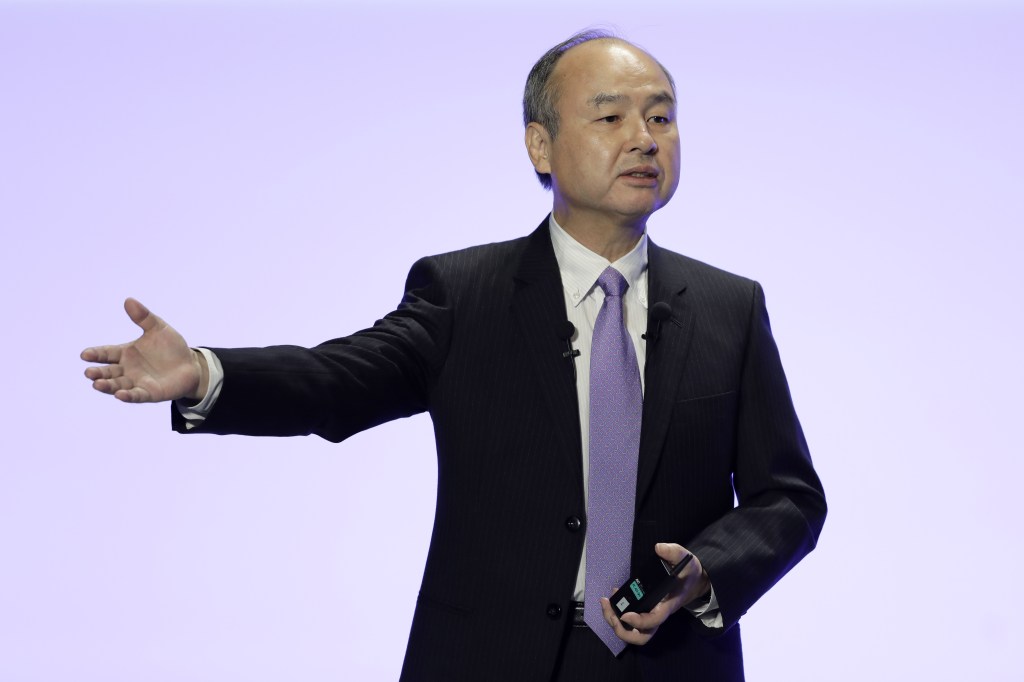

Image Credits:Kiyoshi Ota / Bloomberg / Getty Images

Apps

Biotech & Health

clime

Image Credits:Kiyoshi Ota / Bloomberg / Getty Images

Cloud Computing

Commerce

Crypto

Enterprise

EVs

Fintech

Fundraising

Gadgets

gage

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

get through Us

Not so long ago , things were lookingbleakfor SoftBank , the investing holding company headed by eclectic — and controversial — tech top executive Masayoshi Son . The Vision Fund , SoftBank ’s speculation arm , posted a $ 6.2 billion loss in Q2 2023 , tie to WeWork and other unfortunate bets .

But — thanks in no small part to microchip design menage Arm — SoftBank ’s fortunes appear to be turning around . While consensus stay sundry on the Vision Fund ’s long - full term prospects , it ’s on the upswing for now — and what an upswing it is .

SoftBank ask Arm populace in September and still have about 930 million shares , or 90 % , of the scrap fellowship ’s broth . Arm had a blockbuster tail , blowing past analysts ’ expectations for both gross and earnings . The ship’s company reported adjusted earnings per share of 29 cents , topping the average analyst estimate of 25 centime , consort to LSEG ( viaCNBC ) , while the companionship ’s revenue rose 14 % to $ 824 million , beating the $ 761 million ordinary estimate .

Arm contrive tax income increase into the next quarter will be even warm : 38 % .

investor rewarded Arm ’s public presentation , drive the companionship ’s inventory price up as high as 57.4 % on Wednesday . The chip company tote up about $ 38 billion to its mart cap , more than $ 34 billion of which fall to SoftBank . As CNBCpointedout , SoftBank made more in Arm ’s trading than the total amount it lost on now - bankrupt WeWork ( $ 14 billion ) .

The AI boom drive much of Arm ’s recent business .

Arm , based in Cambridge , makes most of its money certify the chips it design to customer and charge royalties for each chip sold that use its technologies . Arm ’s bread - and - butter work remains roving chip for equipment like smartphones , tablets and smartwatches ; 35 % of overall units shipped this stern were smartphone - bound , accordingto Arm finance headman Jason Child . But an increasing share of the jillion of chips Arm ’s customers give rise each quarter is hardware designed to accelerate AI work load .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

BothMicrosoftandAmazon , among others , are deploy custom - designed limb chips to run AI models . So arecountlessstartupsin the expanding grocery for cut AI chips .

While the volume of Arm ’s AI chip sales are indirect at present , often paired with GPUs in data centers , the company expect direct sales to increase as consumers bribe newfangled laptop and other equipment with microprocessor chip - speed AI features . In another blessing for Arm , AI - supporting chips will overtop higher royalty receipts . Arm charges approximately double the royalty pace for its late processor computer architecture ( v9 ) versus the previous generation .

All this is medicine to SoftBank ’s spike , I ’d approximate — peculiarly at a sentence when tempestuous U.S.-China sexual relation have put a damper on the hold fellowship ’s investments in key Asian economy .

buoy up by Arm , SoftBank ’s Vision Fund this afternoon post its first quarterly gain after four straight losses and its biggest gain in nearly three years : $ 4 billion . U.S. shares in SoftBank were up 17 % conform to the company ’s earnings report , mostly on news show of Arm ’s cheery quarter .

The question now is what SoftBank , which is presently restricted from selling Arm part as part of its agreement to take the company public , does in March , when it ’s let to commence sell Arm shares again . SoftBank could fuel a buyback of its own shares by deal limb lineage — or resolve to posture on that stock instead .

It ’ll count , one imagines , on whether the current enthusiasm for AI maintains .

Arm after the initial offering

SoftBank expects $ 24 billion in losses from Vision Fund , WeWork and OneWeb investments