Topics

late

AI

Amazon

Image Credits:Jirapong Manustrong / Getty Images

Apps

Biotech & Health

mood

Image Credits:Jirapong Manustrong / Getty Images

Cloud Computing

Commerce Department

Crypto

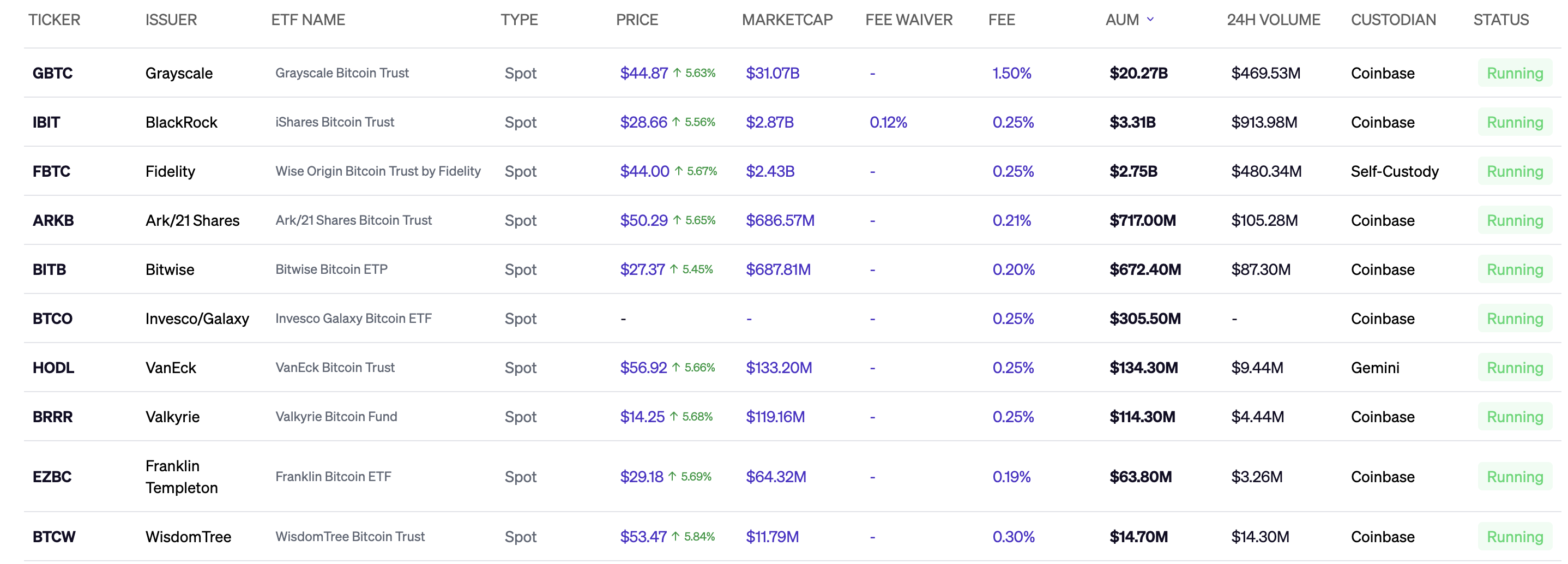

Image Credits:Blockworks Bitcoin Spot ETF tracker(opens in a new window)

Enterprise

EVs

Fintech

Fundraising

contrivance

gage

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

startup

TikTok

DoT

Venture

More from TechCrunch

effect

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

The Leontyne Price of bitcoin hit $ 50,000 today , a month after the U.S. Securities and Exchange Commissionapproved 11 applicationsfor spot bitcoin ETFs .

The issuers of those exchange traded fund have see requirement skyrocket beyondinitial predictionsof a few billion . Assets under management at these issuers total around $ 28.35 billion , do for a market cap of $ 39.8 billion , according to Blockworksdata . Trading mass across 24 hours was $ 1.38 billion .

Leading the spot bitcoin ETF pack is Grayscale Bitcoin Trust at $ 20.27 billion , followed by BlackRock ’s iShares Bitcoin Trust at $ 3.31 billion and Fidelity ’s Wise Origin Bitcoin Trust at $ 2.75 billion .

“ The free burning inflow and volumes are eminent than I anticipated , ” say Matt Hougan , chief investment funds officer at Bitwise Asset Management . “ The fact that there have n’t been just day - one flows , but strong positive inflows in 18 of the first 19 days is really sweet . It do me extremely affirmative on where bitcoin ’s monetary value is going , and its importance in the world . ”

Bitwise play the Bitwise Bitcoin ETP , presently the fourthly - turgid place bitcoin ETF by mart capital . But the route to this breaker point was n’t easy . In fact , Bitwise took over 20,000 meetings last year with financial adviser in formulation for the anticipated commendation , Hougan said .

“ It was face - wracking to found , while we ’re not BlackRock , we ’re not newfangled to this place . [ But ] we provide crypto asset funds so we ask to be relevant , ” Hougan enunciate . Now , he believes ETFs have extend to escape valve speed and are “ big enough to be sustainable from an economic position . ”

Bitwise ’s fee , 0.20 % , is the second - lowest of the lot , and Hougan believe it ’s a “ jolly estimable deal ” in an effort to be militant . But if its fund becomes passing large , he said he did not screw if that rate will beat .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ correctly now , we like our emplacement . ”

How down in the mouth can bitcoin ETF fees cast before it hurts a business ?

Hougan also believes that demand will continue to rise as more internal invoice platforms come online and inbound interest group from large mental home increases . “ It ’s not like they ’re buy $ 100 million of bitcoin today , but there ’s meaning inbound and get together with weapons platform that have billions of dollar bill in asset . ”

A month after the approvals were handed down , Hougan think spot bitcoin ETFs will maintain the title for the “ biggest ETF launching of all clock time . ”

“ Even after being in the exchange traded fund diligence for 15 years , it ’s unlike anything I ’ve ever seen … it ’s not just a little bigger ; it ’s much bigger . ”

https://techcrunch.com/2024/01/10/grayscale-ceo-spot-bitcoin-etf/

In the next 11 months , Hougan is optimistic that volume will continue to increase due to the passing of meter and bitcoin ’s toll goad demand . The rude audience for this product takes clip to determine and make decision and national account take time to amend them , he added .

“ I think it ’ll be up , tableland , re - acceleration , ” Hougan said . “ I do n’t think demand is slacken down for the next 18 month . I require these exchange traded fund to set records . ”

As for what ’s next , Bitwise is leaving the doorway open for other product .

“ We do n’t have a filing , but certainly thinking about Ethereum [ speckle ETFs ] and you’re able to imagine we ’re thinking of other things you’re able to do with bitcoin and ethereum , ” Hougan said . “ We ’ve move into the ETF earned run average of crypto and we ’ve proven investors require to access crypto through ETFs . We ’re going to provide those product to the extent potential under regularization . ”