Topics

Latest

AI

Amazon

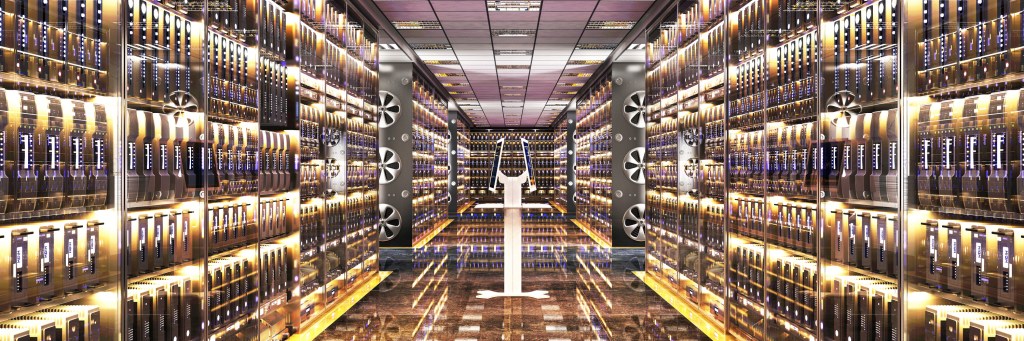

Image Credits:sl-f / Getty Images

Apps

Biotech & Health

Climate

Image Credits:sl-f / Getty Images

Cloud Computing

Commerce

Crypto

Enterprise

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

security measures

Social

Space

startup

TikTok

deportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

While the engineering world breathlessly awaitsReddit ’s public debut , another ship’s company you might never have heard of is about to go public : Astera Labs . And it may be a more significant psychometric test of investors ’ returning appetite for tech initial offering .

Astera this calendar week declare ina public filingthat its public debut would be big than it initially planned in every way : It will deal more shares — 19.8 million versus the previous programme of 17.8 million — and at a higher price , expect to sell at $ 32 to $ 34 per share , versus the previous $ 27 to $ 30 reach . Astera expects to set up $ 517.6 million at the middle of its raised range , it said , up from $ 392.4 million . initial public offering security guard await it to debut this workweek .

Update : Astera Labspricedits IPO at $ 36 per parcel , above its raised mountain chain . More when it starts trading . For more , impinge on playbelow :

While Reddit ’s initial offering could do well from investors face to buy a well - known social media companionship that has an interesting , burgeoning AI datum line of work , Astera Labs is an AI ironware taradiddle . And no , it ’s not takingon Nvidia , the American chip giantthat created the world ’s most in - need AI flake .

Astera Labs make connectivity ironware for cloud calculation data centers . Because AI command massive amounts of information move into , out of and around data centers , Astera has seen recent tax revenue efflorescence . After generate $ 79.9 million in 2022 , revenue swell 45 % in 2023 to $ 115.8 million .

With 271 mentions of “ AI ” in its most late SEC filing , the fellowship is working hard to convince investors that it ’s part of the expectant unreal intelligence roaring .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Just how much AI - juice Astera really has for long - terminus success is up for debate . Nick Einhorn , vice president of research at Renaissance Capital , a troupe that track the IPO market and offers public - offering focused ETFs , is a touch sceptical . Astera is “ not an AI company , ” Einhorn told TechCrunch . The companionship , is , however , “ profit from the trend , ” in his view , especially data point center spendingdriven by AI.So much so , that in 2022 , Amazon signed a indorsement agreement that give up it to buy just shy of 1.5 million shares , which is n’t proof that Amazon Web Services is a customer , but does hint at it .

Then again , while the society does have an AI story to tell , its speedy recent growth and demonstrated other profitability could be the fundamental drivers to its public - market place investor interest .

Companies can grow and make money at the same time

In startup land , ontogenesis and red often take the air bridge player - in - hand . Startups raise upper-case letter from secret - market investor , investing the investment firm into their surgical process to expand head count so that they can work up , and sell more rapidly . Often by the fourth dimension that a inauguration reaches the need scurf to file for a public offer , it is still unprofitable and not likely to start render adjusted net income , let alone profit accord to more stringent accounting standards , in the near time to come

Up until the 4th poop of 2023 , Astera Labs appear to be just that sorting of party . Its business grew rapidly last yr , with sticky loss to match .

On its 2022 $ 79.9 million in revenue , it post a net going of $ 58.3 million ; on its 2023 $ 115.8 million in taxation , nett loss tallied $ 26.3 million . So , on an yearly basis , this isfar from the variety of profitable company IPO expert say this harsh mart require . Even when the company removed the non - cash costs of paying its worker partially in shares , the company ’s adjusted profits were still negative in 2023 .

But when we travail in , its financial achiever becomes more nuanced . In the third quarter of 2023 , Astera Labs ’ revenue began growing dramatically : from $ 10.7 million in Q2 2023 to $ 36.9 million in Q3 , and $ 50.5 million in Q4 .

And while that spike in ontogenesis is impressive on its own , the company ’s profitability picture has also radically better as 2023 come to a close . After post a last red of $ 20.0 million in Q2 2023 , net personnel casualty evaporate to a simple $ 3.1 million in Q3 2023 .

And for Q4 , Astera Labs sweep to a profit : $ 14.3 million Charles Frederick Worth of net income .

Einhorn discourage that the caller ’s Q4 2023 solution may not predict the company ’s new normal . “ One of the challenges for companies like this , ” he explained , “ is that you run to have a lot of client concentration and customer buying design can be very lumpy . ” honorable recent quarters do not always incriminate alike next quarter . Another weakness : in 2023 , its biggest three client represented about 70 % of its revenue , Astera disclosed .

Putting it all together : Astera Labs has caught a wave thanks to AI data heart spending . Its resulting financial luminescence - up is telling , and serve explicate why its initial public offering is set up to go on at a valuationof around $ 5.2 billion , a healthy lift from of its last secret - grocery priceof $ 3.15 billion .

If the society is able to attract a strong following after its first day of trading , it could deposit the IPO doorway open for other businesses seeing newfound emergence as a by - product of AI . And perhaps that will be enough for more technology offerings to mouse out this year .