Topics

Latest

AI

Amazon

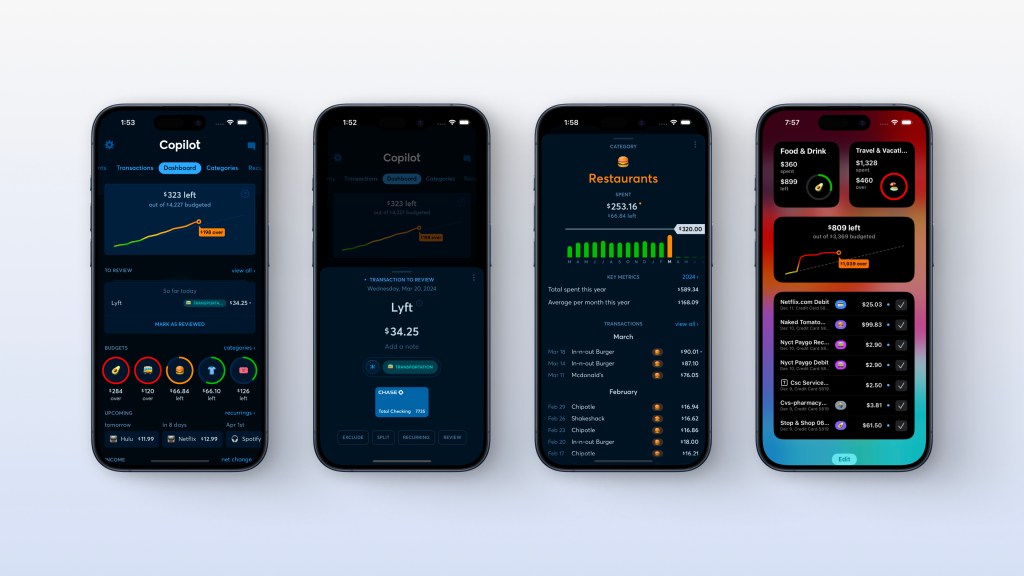

Image Credits:Copilot

Apps

Biotech & Health

Climate

Image Credits:Copilot

Cloud Computing

Commerce

Crypto

Enterprise

EVs

Fintech

Fundraising

gadget

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

adjoin Us

Intuit is wind down budgeting app Mint this hebdomad , and that ’s become full news for competitorCopilot . Mint ’s demise interpret both the closing of an era and proof that consumers want more from their finance app , founder Andrés Ugarte told TechCrunch .

“ That ’s good for an app that is not a societal internet , ” Ugarte said .

Other personal finance apps show where you are spending , even in categories that might not be relevant , he said . Copilot analyzes activity , let in recurring payment , and display the five to 10 budget score class that the user want so they can see where they are at in terms of spending and saving .

exploiter also save an norm of 5 % after starting with the app , co-pilot calculates . While that might not seem like a fortune , Ugarte notes that for someone make $ 100,000 , for example , that is $ 5,000 a class . Multiplied by 100,000 users , and the app is putting half a billion back into consumer ’ wallet , he said .

Beyond Mint

Like millions of others , Ugarte adjudicate some personal finance apps , including Mint , yet found them to be lacking . For example , Ugarte made a rental defrayment each calendar month , and Mint would flag it and alert him every month that a openhanded purchase was made . Only it did n’t actually enjoin him what the purchase was , just yield a notification to enter and find out what was break down on .

“ When it launched , Mint was groundbreaking , but the app ended up being asleep at the wheel , ” Ugarte said . “ Other startup offered option , however , when they would establish , they seemed like Mint , but with a fresh coat of paint . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

co-pilot is a subscription personal finance tracker drive to kill Mint

examine those apps also gave Ugarte perspective on how cumbersome it was to connect explanation — co-pilot drug user join an average of 10 item-by-item account . Therefore , he wanted to create an app that would reward user by taking in all that data and make horse sense of it for them .

Capturing Mint users

That growth has not discontinue , he says . The company acquire more in the last four months than in the old four twelvemonth . Copilot was able to double up that growth into a $ 6 million Series A round of funding result by Nico Wittenborn ’s Adjacent . Wittenborn previously induct in companies including Revolut , Calm , Niantic , PhotoRoom and BeReal .

TechCrunch reported onCopilot when it first launchedwith $ 250,000 in angel funding and then again when itadded backup for Apple Card . The new investment gives Copilot $ 10.5 million in total venture - backed capital .

Personal finance app Monarch sees bump in exploiter keep an eye on Intuit ’s news it is close Mint

The company reached profitability in 2023 , however , more customers were asking for an Android app so they could apportion it with family and friends . Copilot has been an iOS app since its launch . Ugarte decided to go after new capital so it could take that chance .

In plus to doing some hiring to build Android and internet capabilities , Copilot will accelerate AI and production exploitation effort .

“ We ’ve been doing a lot of simple machine learn over the days , however , we now have user saying they export their information from Copilot into ChatGPT and have conversations about their finances , ” Ugarte said . “ It make sense for us to provide that experience so that they have accurate entropy . ”

Ugarte did n’t give an accurate appointment on when the young capabilities would found , however , the end is by the end of the year .

Why last hebdomad felt like 2021 in fintech