Topics

tardy

AI

Amazon

Image Credits:Kabir Jhangiani / NurPhoto / Getty Images

Apps

Biotech & Health

Climate

Image Credits:Kabir Jhangiani / NurPhoto / Getty Images

Cloud Computing

Commerce

Crypto

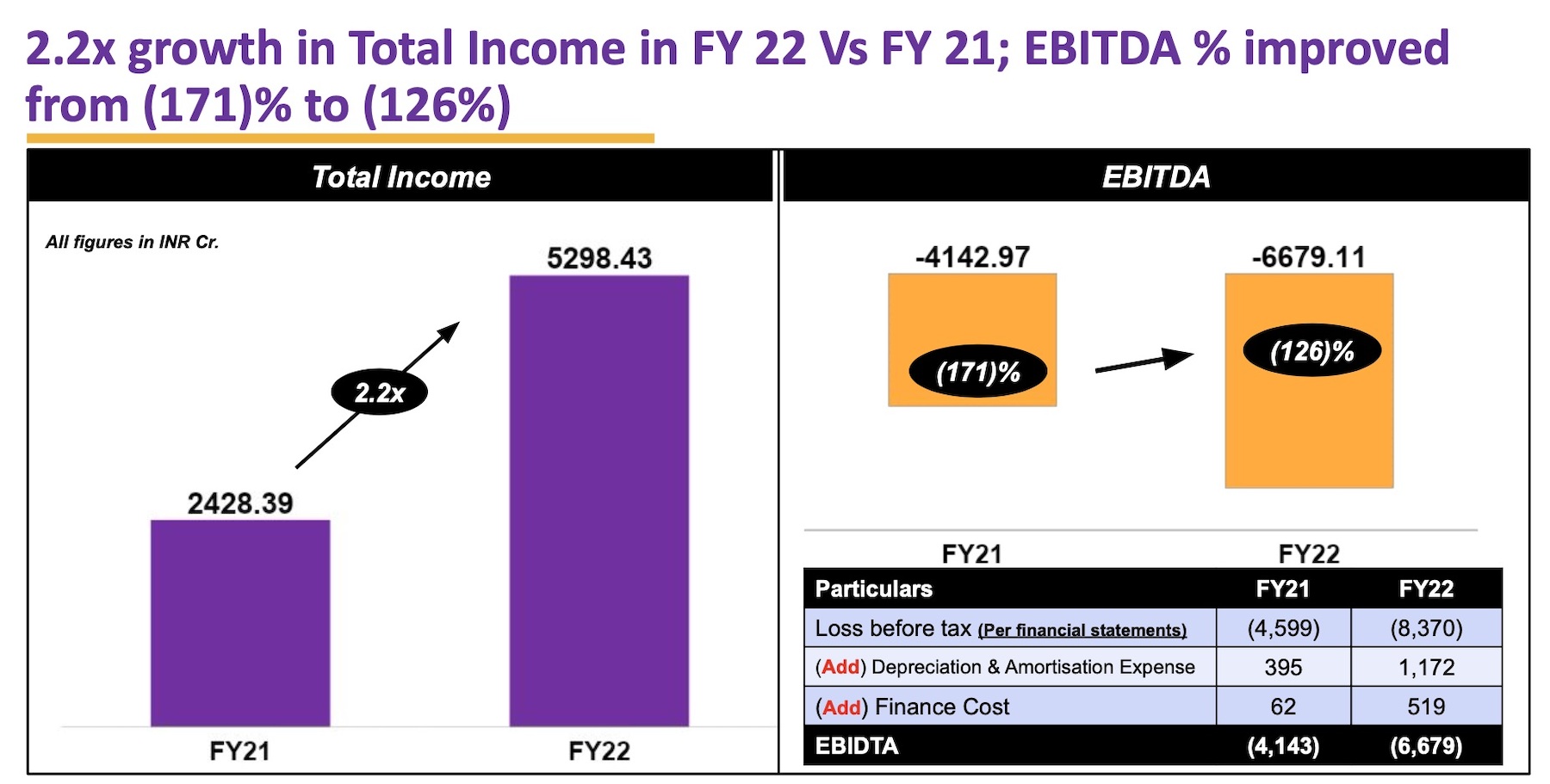

Byju’s financials for the year ending March 2022. The startup has yet to file the financials for the year ending in March 2023.

Enterprise

EVs

Fintech

Fundraising

gadget

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

privateness

Robotics

Security

Social

Space

startup

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Byju ’s , once valued at $ 22 billion , is uncoerced to cut its valuation to below $ 2 billion as it hunt down for new funding , a somebody conversant with the matter evidence TechCrunch .

The Bengaluru - headquartered inauguration , once India ’s most worthful , is looking to enhance $ 100 million to $ 200 million in fresh funding via a rights issue , allot to two masses intimate with the matter . The edtech radical ’s chief administrator and co - founder Byju Raveendran is likely to invest in the new funding , a author with lineal knowledge of the affair said , requesting namelessness as the topic is private and the rights issue has n’t yet launch . Byju ’s plans to load about 10 % in the raw right issue , implying the rating may attain as broken as $ 1 billion .

Byju ’s willingness to edit the valuation is a stunning reversal of fortune for the startup , once the placard child of the Indian startup ecosystem . The startup , which spent more than $ 2.5 billion in 2021 and 2022 acquiring over half a dozen business firm globally , was onceshowered a evaluation as gamy as $ 50 billionby marquee investiture bankers , TechCrunch originally reported .

A Byju ’s spokesperson declined to comment .

Byju ’s has been chasing for new funding for nearly a year . The startup was in final stage toraise about $ 1 billion last yr , but the talk derail after the listener Deloitte and three key control board members stop the inauguration . Instead , Byju ’s end up raise less than $ 150 million in that round from Davidson Kempner and had to repay the investor the full committed amount aftermaking a technological nonpayment in a separate $ 1.2 billion condition loan B.

The unexampled financing deliberation follows BlackRock trim down the time value of its holding in Byju ’s , slash the imply valuation of the Indian startupto about $ 1 billion , accord to disclosures made by the asset manager .

Byju ’s was prepare to go public in early 2022 through a SPAC deal that would have valued the companionship at up to $ 40 billion . However , Russia ’s invasion of Ukraine in February sent markets downward , force Byju ’s to put its IPO plans on hold , according to a origin familiar with the matter . As grocery precondition worsened , so too did the business outlook for Byju ’s . The fellowship began face mounting air pressure from investors to address issues that it had antecedently left open .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

The inauguration has been backed by over a dozen movers and shakers in the industry , from Peak XV Partners to Lightspeed , UBS and Chan Zuckerberg Initiative . Byju ’s , which gained initial popularity in India because its tutors used intuitive way of life — undertake complex concepts using literal - life object such as pizza pie and cake — has raised over $ 5 billion in fairness and debt in the past decade .

Byju ’s today is careen from a series of challenges : It ’s scramble to raise capital , make payroll and pay up off its billion - plus debt . Itmissed its tax revenue targetfor the financial year ending in March 2022 , the inauguration disclosed in a much - delayed account last calendar month . Prosuspublicly slammed the Bengaluru - headquartered startupin July for not develop sufficiently and disregarding the investor ’s advice and recommendations despite repeated attempts .