Topics

late

AI

Amazon

Image Credits:Cherub

Apps

Biotech & Health

Climate

Image Credits:Cherub

Cloud Computing

Commerce

Crypto

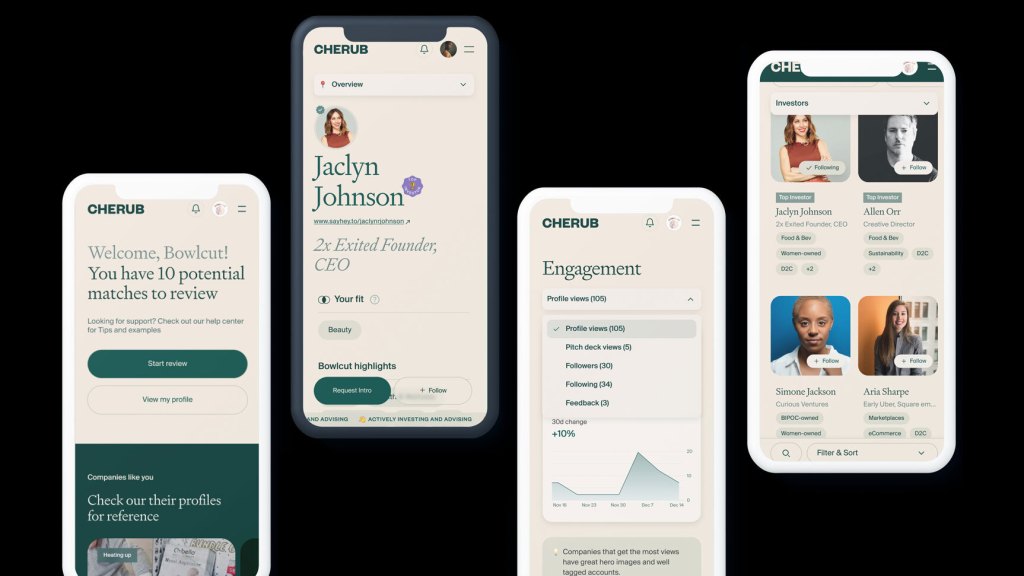

Image Credits:Co-founders Jaclyn Johnson and Angeline Vuong / Cherub

enterprisingness

EVs

Fintech

Fundraising

appliance

Gaming

Government & Policy

ironware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

security system

societal

Space

Startups

TikTok

Transportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Jaclyn Johnson and Angeline Vuong were on a hike deliberating how hard it can be for people to get start out in angel endow when they actualize they had stumbled upon a startup musical theme .

Today they are the co - founders ofCherub , a market that pairs Angel Falls investors with enterpriser .

Vuong spend nigh five years work in production and maturation at Opendoor . Johnson foundedCreate & Cultivate , a self - name “ media company for ambitious adult female ” and hadexperienced both side of the investing world — as a laminitis and an investor . Before starting Create & Cultivate , Johnson sold her own startup(No Subject ) in 2016 and invested in legion caller , include luggage company Away .

Johnson liken Los Angeles - based Cherub to Raya , anonline rank - based biotic community for dating , in that it matches founder and Angel Falls investor based on their preference .

“ you could go to this political platform as an enterpriser and you could go on the platform as an angel investor and get access code to both masses and express stake free-base on tags , ” she enounce in an interview with TechCrunch . “ So for instance , if I go on the app and I ’m interested in women - owned businesses in the CPG space doing their Series A or something specific , I ’ll get surface deal flow that is the highest match to what I ’m looking for . ”

With Cherub , investor and entrepreneur can see who is concerned in them on the back final stage . If they too are concerned , they can show it as such and it ’s a peer . Conversely , if an investor approaches a beginner but that founder does n’t see them as a potential paroxysm , they can pooh-pooh the invitation to connect . Or if an enterpriser ’s minimum investing is $ 25,000 but an holy person investor is only invest $ 10,000 per deal , they can see that and not reach out to connect .

“ We ’re sort of using dating app mechanics in a way , ” Johnson said . “ So we jokingly call it the Raya for deal flow . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Membership-based

Encouraged , the brace build out an alpha production last summer that featured about 40 party and give investors a way to quest a deck . All 40 experience requests for deck of cards vista , Johnson said . Half of those deck views resulted in an introduction , she said , where investors expressed that they were concerned in being pitched by the founder . Twenty percent of those introductions ended up getting fund in less than three calendar month , collectively raising $ 1.1 million in capital .

Of those deals , 40 % were new Angel Falls investor , meaning they were credit investors that had never written baulk before .

Cherub is now in the process of a obtuse launching , with 100 startups on the platform generating revenue of $ 50,000 . They design to grow that to 500 , and have a waitlist of 1,500 startup , Johnson say .

Cherub is free for investors to practice and charges startups via a membership mannikin . A $ 480 / year rank permit laminitis list their companies in the directory and includes analytics such as how many people viewed their pack of cards . The Cherub Select membership costs $ 950 a year and involve a more vetted process to show the troupe more actively to investor , Johnson say .

Johnson enunciate that Cherub also helps founder find incubators and accelerators and has partnership with the relate incubators of firms such asAndreessen Horowitz , Dream Ventures and New York Fashion Tech Lab .

investor also get access to information such as “ update on how a troupe is perform , whether they ’re raising or not and how much , ” Johnson said .

Of course Cherub is not the only platform teaming up angels with entrepreneurs . AngelList is the biggest and well make love . Israeli crowdsourcing firm OurCrowd is also huge , and then there are the unity tender by venture business firm , like Hustle Squad’sAngel Squadfor accredit investor , or others likeJason Calacanis’The Syndicate .

But Cherub is different in a number of style , Johnson says . For one , itfeatures startups with an emphasis on consumer packaged goods ( CPG ) companies . Though it also include AI companies , hotel projects and apps , among others .

AngelList is more of a B2B program , is very tech diligence centric and is best for those who already have knowledge or experience in startup investment and can afford to invest fairly sizable quantity , in Johnson ’s view .

Then there ’s crowdsourcing Wefunder or Republic , which will allow investors to enthrone bantam amounts , sometimes as lilliputian as $ 100 , which Johnson describes as “ the kickstarter of Angel Falls investment . ”

Cherub sits in the middle , she says . For example , like traditional VC firms , the company host “ founder - funder mixers . ” Last year , for example , Cherub team up with Sophia Amoruso ’s Trust Fund to host a cocktail party at which “ every exclusive matter on site was investable , ” such as the drink being serve and feature a pop - up shop class where guest could “ shop any products that they need to try drive . ”

“ From that outcome alone , over $ 400,000 in lot were generated , ” Johnson said .

Angel investor Allen Orr told TechCrunch that he had used other platforms such as AngelList in the past .

“ However , I felt that it was not a very personal experience and felt too transactional , ” he distinguish TechCrunch via email . “ What appealed to me about Cherub was the idea of a tailored and social approach to investing , ” he said , contribute “ I also liked that there are opportunities not just for investiture but also advising brands . ”

“ I think Cherub does a great job at work active investor into the way with founders who are look , ” she tell TechCrunch .

Cherub has stir $ 1.25 million of its own , naturally from angels , including Drybar ’s Alli Webb and Blavity ’s Morgan DeBaun , among others .