Topics

late

AI

Amazon

Image Credits:IR_Stone / Getty Images

Apps

Biotech & Health

mood

Image Credits:IR_Stone / Getty Images

Cloud Computing

Commerce Department

Crypto

Image Credits:Jamin Ball, Clouded Judgement, Altimeter CapitalImage Credits:Jamin Ball, Altimeter Capital

endeavour

EVs

Fintech

Image Credits:Synergy ResearchImage Credits:Synergy Research

Fundraising

gizmo

gage

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

concealment

Robotics

security measures

societal

Space

Startups

TikTok

Transportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

TV

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

For the last several quarters we ’ve seen a lull in the expansion of the cloud base marketplace , with depressed increment bit than we ’ve been habituate to seeing in the past . That exchange this quarter thanks in large part to interest in productive AI . The new receipts undulation began just last year , driven bythe ChatGPT plug bike , but has already press cloud infra revenue in the fourth quarter of 2023 to $ 74 billion , up $ 12 billion over last twelvemonth at this time and $ 5.6 billionover Q3 , the largest quarter - over - quarter increase the cloud market place has experience , per Synergy Research .

The cloud substructure marketplace for the integral year grew to an eye pop $ 270 billion , up from $ 212 billionin 2022 . Synergy ’s John Dinsdale predicts that the growth we saw in the last year is here to stay , even as the food market continues to mature and the law of nature of large numbers require increase effect . “ Cloud is now a massive market and it takes a lot to move the needle , but AI has done just that . Looking ahead , the law of orotund numbers means that the cloud market will never return to the growth rates seen prior to 2022 , but Synergy does betoken that outgrowth rates will now brace , resulting in vast ongoing annual growth in cloud outgo , ” he said in a statement .

Jamin Ball , a better half at Altimeter Capital , writing in his excellentClouded Judgement newssheet , sees a similarly bright future for these trafficker :

The hyperscalers are really starting to see the tailwind of new workload maturation overtake the headwind of optimizations . Sometimes fresh workload are AI related . Sometimes they ’re classic cloud migrations . The hyperscalers benefit from massive scale , distribution , combine and depth of client relationships in ways no other computer software companionship do . They also are seeing AI revenue ( largely compute ) show up rather than anyone else .

clod ’s data brook Dinsdale ’s claim around diminishing growing rates , but in a mart so heavy , ontogenesis for development ’s sake becomes a far less important metrical :

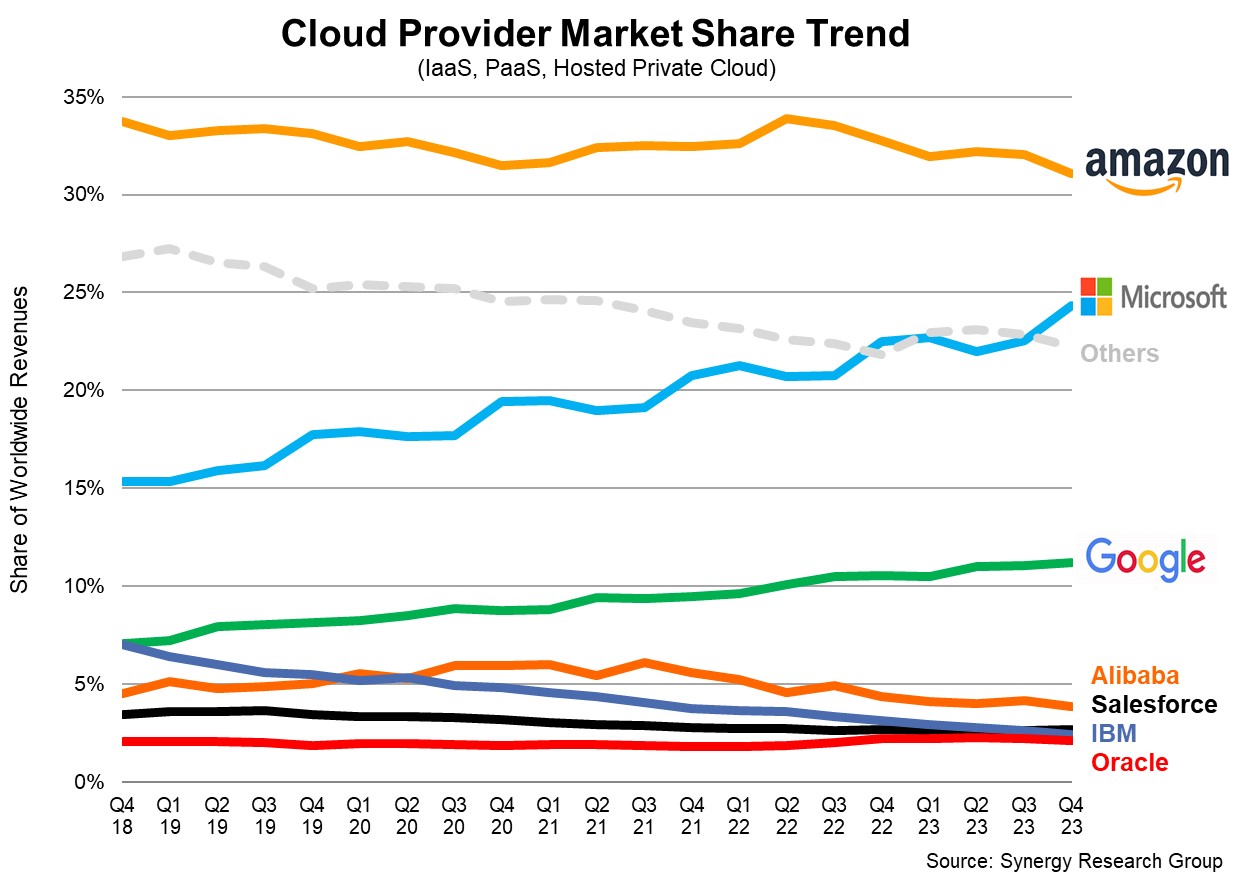

For now , it appears that Microsoft ’s lucrativeinvestment / partnership with OpenAIis giving it an edge in the market place as we saw the companionship ’s market share develop two full percentage points to 25 % in the fourth poop , a remarkable one - one-quarter increase . Amazon is still king of the wad with 31 % plowshare , albeit down two head from last quarter . It would be easy to say Amazon ’s loss was Microsoft ’s gain , although it ’s probably not quite that simple and there are probably more nuanced impacts across the market . Meanwhile Google held unfaltering at around 11 % share .

Synergy reports that the Big 3 constitute 67 % of overall market portion , or or so $ 50 billion in full cloud revenue coming from the three largest fellowship for a single stern .

From a dollar perspective , the numbers are , per usual , a moment mind boggling , with Amazon coming in at $ 23 billion , Microsoft at $ 18.5 billion and Google with around $ 8 billion . If these numbers do n’t match the account numbers exactly , that ’s because these companies often coalesce different types of cloud tax income to arrive at the reported figures . synergism wait at IaaS , PaaS and hosted individual cloud services , and the companies ’ reported cloud numbers may admit SaaS and other tax revenue that Synergy does n’t consider .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

In terms of quarterly percentage outgrowth , keeping in judgment those caution about how the companies mensurate gross , AWS was up 13 % , Azure was up 30 % and Google Cloud was up around 25 % ( although they do n’t separate out SaaS revenue in that turn ) .

One thing was clear last year , Microsoft was putting the warmth on Amazon and leave thecompany on its heel , perhaps for the first time , with its strong-growing deal making with OpenAI .

Scott Raney , a partner at Redpoint , told TechCrunch at re : Inventin December that Amazon was distinctly play catch up when it came to AI , and it was an unusual position for the troupe to find itself . “ This might be the first time where the great unwashed looked and say that Amazon is n’t in the perch position to take advantage on this monolithic chance . What Microsoft ’s done around Copilot and the factQ comes out [ this week]means that in realism , they ’re perfectly 100 % playing catch - up , ” Raney order at the time .

While procreative AI represents a massive chance for all the swarm vendors , it ’s still very much other days . We always like to say that first to market is a immense advantage , and it surely has been for Amazon all these years . Whether Microsoft ’s aggressive approach to AI exemplify a similar advantage is n’t clean-cut yet , but it ’s arduous to ignore a two percentage point market share increment in a individual quarter . For now it feel like Microsoft has taken the lead when it comes to AI in the enterprise , but Google and Amazon still have plenty of time left on the clock to figure it out .