Topics

in vogue

AI

Amazon

Image Credits:Getty Images

Apps

Biotech & Health

mood

Image Credits:Getty Images

Cloud Computing

commercialism

Crypto

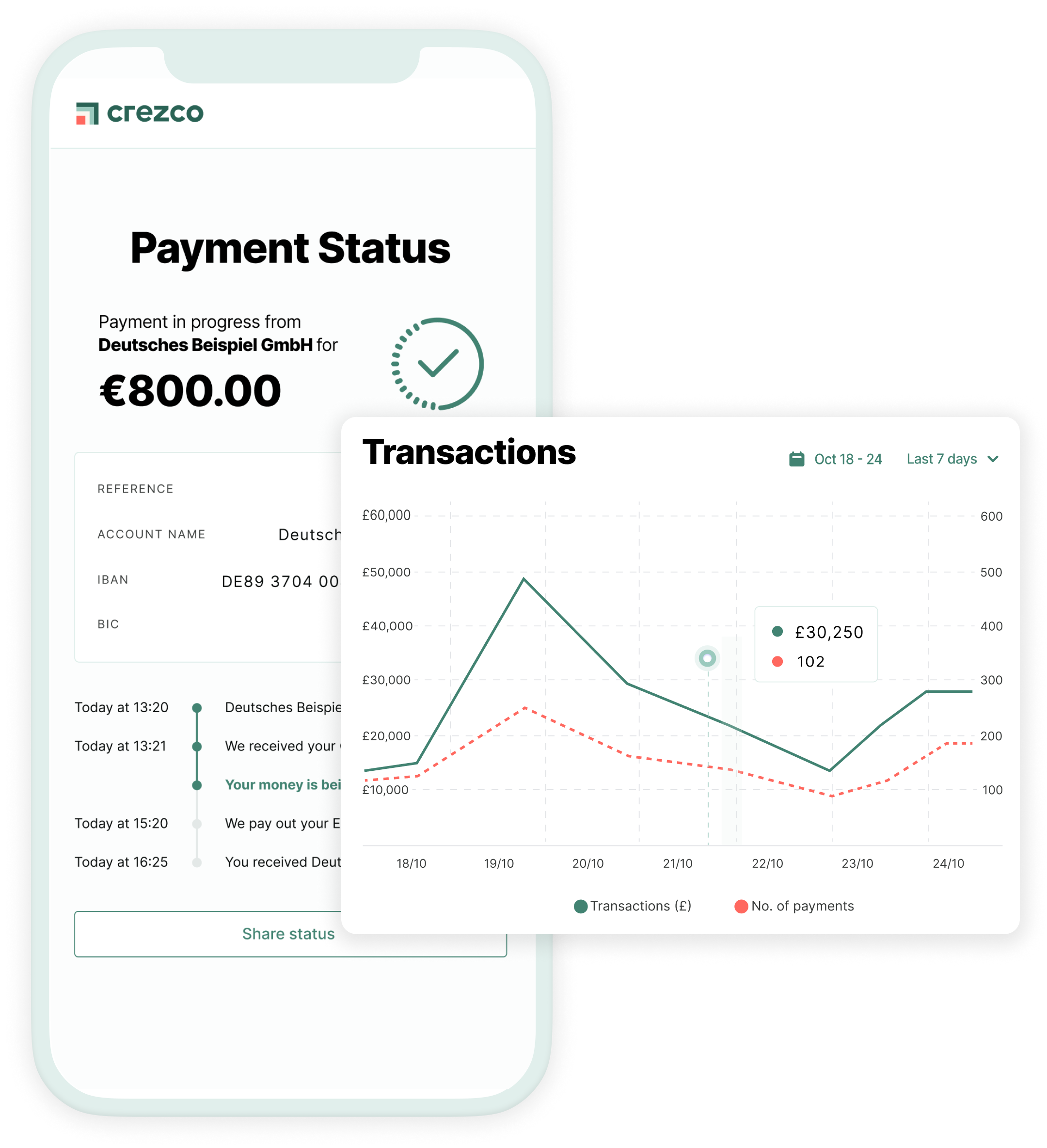

Image Credits:Crezco

endeavour

EVs

Fintech

Fundraising

widget

Gaming

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

security measures

Social

blank

inauguration

TikTok

Transportation

speculation

More from TechCrunch

consequence

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

get through Us

Integrating with a payment API is something most — if not all — line of work - to - consumer platforms are force to do at some point . It ’s practically inescapable if they wish to take credit rating scorecard payment . The problem is , for platforms cope in bill and bill , not just one - off charges , few payment APIs have all the features necessary to lodge their workflow .

That ’s why Ralph Rogge foundedCrezco .

“ Having worked with thousands of small business organisation , it wasclear that invoice payment remained an inconvenience , especially when compared to the frictionless checkout of consumer card payments , ” Rogge say . ( Previously , Rogge work at YouLend , a startup offering a range of funding solutions targeted at merchants and small- and medium - business owners . ) “ Businesses should be building and selling products , not spending clock time and money set up measure and invoice payments . Crezco makes these payments easy . ”

So , does Crezco actually make payment well-off ? From the sound of it , yes .

Crezco construct workflows for collecting bill payments — specifically account - to - story bill collection workflows . With these , defrayment , admit overseas payment , are made directly from one story to another without transaction intermediaries like card networks involve .

With Crezco , business get machinelike invoice reconciliation integrated with their existing accounting software and tools that allow them to father payment links , collect recurring payments and split payments between multiple accounts . Crezco also extend a built - in fraud detection system , plus “ clamant ” payment notification via the web and mobile .

“ It ’s not about replacing menu defrayal with something tawdry , but replacing manual coin bank transfers with something more convenient , ” Rogge say . “ Account - to - accounting and real - time defrayment are the hereafter . They ’ll be progressively adopted country - by - nation . It ’s Crezco ’s job to unite these international payment rails to a undivided API for our partners and their customers ; the ending goal is to make it well-to-do for businesses to send and receive payment , domestically and internationally , carry through prison term and money . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Crezco does n’t exist in a vacuum . Some of its more formidable competitor includeIntuitandWise , as well asBrite Payments , TrueLayer , Plaid , MelioandTink(which Visa bought latterly for $ 2 billion ) .

Rogge sees Crezco ’s fraud prevention tech as a discriminator , among other capacity .

“ Beyond using business relationship - to - explanation to process requital , Crezco leverages open banking to enhance its fraud system by examine historic savings bank transactions , ” Rogge said . “ Most tools employ the same few information point , which are check against public datasets , such as government sanction listing . Open banking provides 10 years of every historical cite and debit transaction . ”

Crezco claim to have more than 10,000 participating customers — and it ’s hop to dramatically increase that figure through a partnership with Xero , the U.K. accounting technical school firm . Crezco will exchange Wise , with which Xero previously had a hatful for embedded bill payment resolution .

investor seem pleased with Crezco ’s trajectory . Today , the company announced that MMC Ventures and 13books invested $ 12 million in its Series A round , bring Crezco ’s total upraise to $ 18 million . Rogge says that the proceeds will be put toward thrive Crezco ’s accounts - to - accounts product and expanding the size of its team from 25 to 45 .

“ The structural tailwinds in occupation - to - business payment are significant , ” Rogge say , “ including the forced adoption of electronic invoicing , the rising utilisation of accounting software and line - to - business organization chopine globally , the increase borrowing of report - to - business relationship defrayment and exposed banking , and continued grow cross - border payments . ”