Topics

previous

AI

Amazon

Image Credits:Tek Image Science Photo Library(opens in a new window)/ Getty Images

Apps

Biotech & Health

clime

Image Credits:Tek Image Science Photo Library(opens in a new window)/ Getty Images

Cloud Computing

Department of Commerce

Crypto

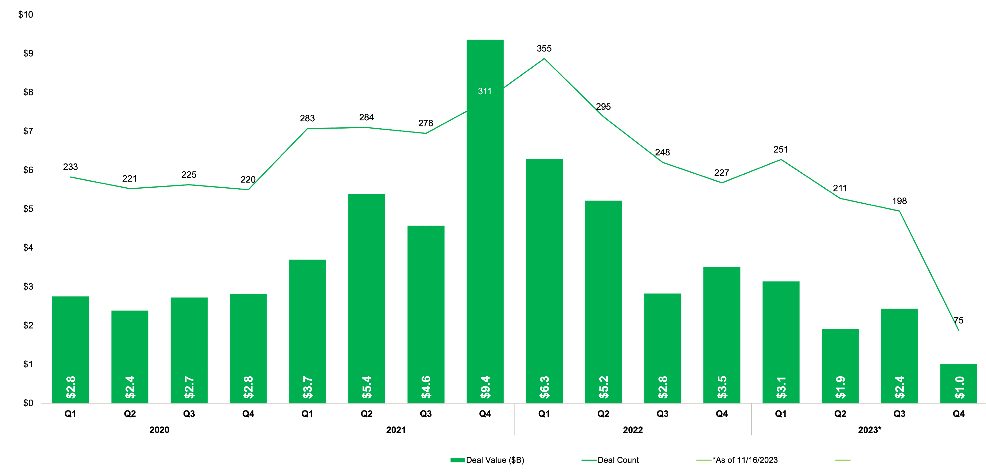

Image Credits:PitchBook data

enterprisingness

EVs

Fintech

fund-raise

Gadgets

bet on

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

surety

societal

place

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Ballistic Ventures , a speculation capital firm commit to funding and incubating cybersecurity startup , is take care to raise as much as $ 300 million for a new fund , fit in to a regulatory filing .

The San Francisco - based VC business firm Wednesdayfiledwith the U.S. Securities and Exchange Commission to raise $ 300 million for its 2d stock — over a year after launching itsfirst investment company of the same amountin May 2022 .

Ballistic spokesperson Michelle Kincaid declined to comment on the filing when reached by TechCrunch .

Aimed at early - microscope stage cybersecurity and cyber - relate startups , Ballistic Venturesis co - found by Kleiner Perkins ’ general partner Ted Schlein , along with Barmak Meftah , Jake Seid and Roger Thornton as the three other general married person , and Mandiant founder Kevin Mandia as its strategic partner . The VC house also has Derek Smith as a strategic advisor and Agnes So as the business firm ’s finance and functioning chief .

So far , Ballistic has backed a dozen startup , per the particular available on the house ’s website . Ballistic says it has founded , operated and funded over 90 cybersecurity firms . To date , the party has invested inAuthMind , OligoandNudge Security , among others . The house alsorecently appointedformer U.S. National Cyber Director Chris Inglis and U.S. cybersecurity agency CISA former chief of staff Kiersten Todt as advisor .

Investment in cybersecurity in 2023 to date has been far below the record high of old years . speculation funding for cybersecurity startups worldwide drop over 14 % to $ 2.4 billion in the third - quarter of 2023 , from $ 2.8 billion in the same quarter last year , consort to PitchBook datum share with TechCrunch .

The number of deals done during the most recent quartern also decreased from 248 to 198 .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Nonetheless , as the digital economy expands globally , cyberattacks and online crimes have become more prevalent . Investors are also optimistic about growth in cybersecurity startups and investments with preponderant advancements in generative AI and cloud deployments .

8 VCs explain why there ’s good reason to be affirmative about cybersecurity