Topics

modish

AI

Amazon

Image Credits:Getty Images

Apps

Biotech & Health

Climate

Image Credits:Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:Dili

initiative

EVs

Fintech

Fundraising

contrivance

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

quad

startup

TikTok

exile

Venture

More from TechCrunch

upshot

Startup Battlefield

StrictlyVC

newssheet

Podcasts

picture

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Stephanie Song , formerly on the bodied growth and ventures team at Coinbase , was often frustrated by the volume of due diligence tasks she and her squad had to complete on a daily basis .

“ Analysts fire the midnight oil work hundreds of hours doing the work that nobody wants to do , ” Song told TechCrunch in an email interview . “ At the same time , funds are deploying less capital and looking for ways to make their teams more effective while come down operating cost . ”

Inspired to find a undecomposed way , Song teamed up with Brian Fernandez and Anand Chaturvedi , two ex - Coinbase colleagues , to launchDili(not to be discombobulate by thecapital of East Timor ) , a platform that set about to automatise primal investiture due diligence and portfolio management tone for private equity and VC house using AI .

Dili , a Y Combinator graduate , has raised $ 3.6 million in venture funding to engagement from backers , including Allianz Strategic Investments , Rebel Fund , Singularity Capital , CoreNest , Decacorn , Pioneer Fund , NVO Capital , Amino Capital , Rocketship VC , Hi2 Ventures , Gaingels and Hyper Ventures .

“ [ AI ] affects all parts of an investing fund , from analyst to partners and back - office functions , ” Song said . “ Investment professionals at funds are expect for a severalise border on decision - making , and can now expend their wealth of data to combine their understanding of the deal with how it fits into the funds . . . Dili has a unparalleled opportunity to emerge as a solution for store in a harsh macro surroundings . ”

Song ’s not wrong about funds face for an boundary — or any new promising way to palliate investment risk , for that subject . VCsreportedlyhave $ 311 billion in unspent cash , and last year elevate the lowest total — $ 67 billion — in seven twelvemonth as they grew more and more conservative about early - leg ventures .

Dili is n’t the first to apply AI to the due industriousness process . Gartnerpredictsthat by 2025 , more than 75 % of VC and early - stage investor executive reviews will be informed using AI and data analytics .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Several startup and incumbents are already tap AI to teem through financial documents and voluminous amounts of data to craft market equivalence and reports — including Wokelo ( whose customers are private fairness and VC funds , like Dili’s),Ansarada , AlphaSenseand Thomson Reuters ( through its Clear Adverse Media building block ) .

But Song insists that Dili uses “ first - of - its - kind ” engineering .

“ [ We can ] surrender very gamy accuracy on specific tasks like pulling fiscal metrics from big amorphous documents , ” she added . “ We ’ve build up usage indexing and recovery pipelines tune for specific documents to offer [ our AI ] fashion model with high timber context . ”

Dili leverages generative AI , specifically turgid language model along the lines of OpenAI ’s ChatGPT , to streamline investor work flow .

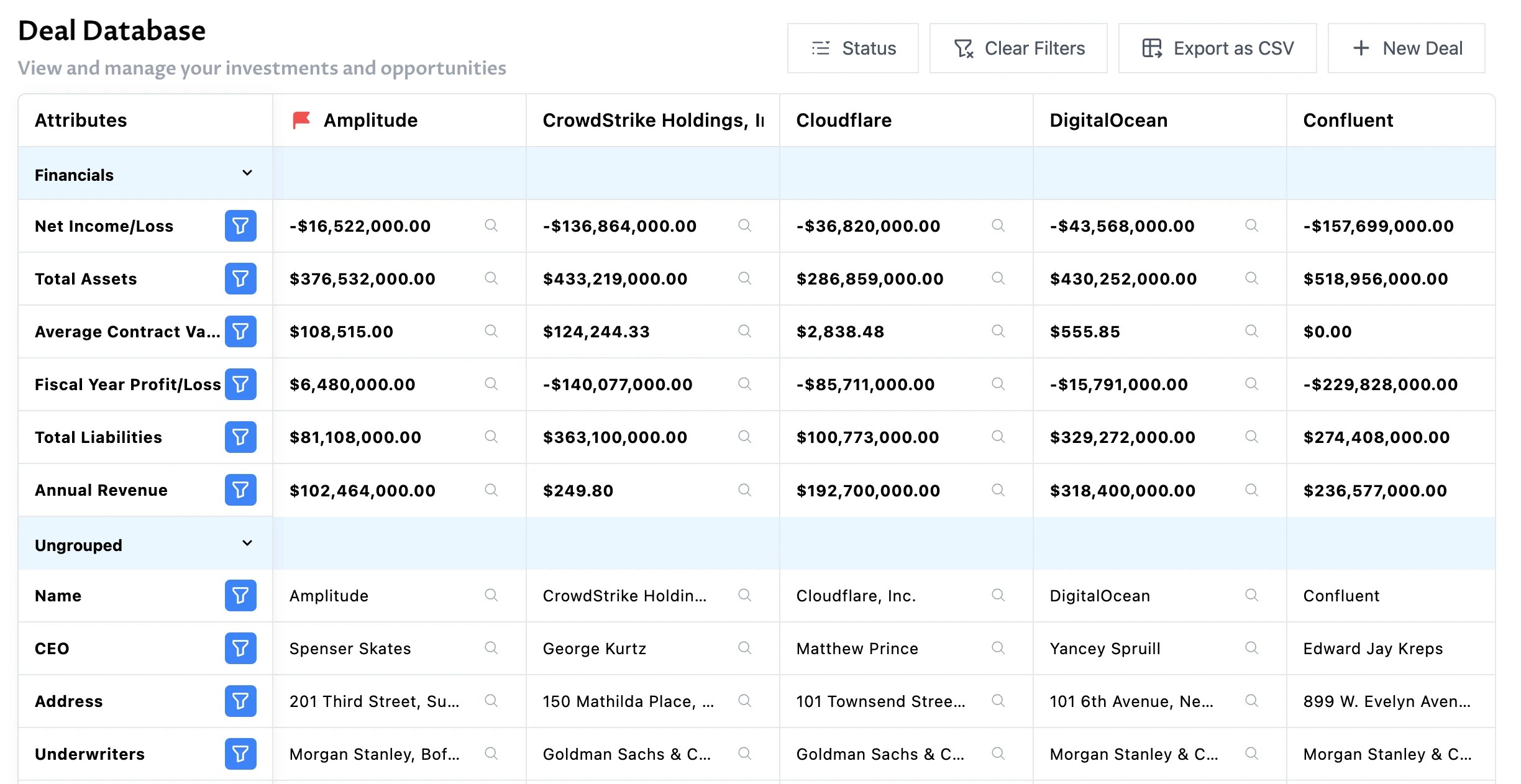

The platform first catalogs a fund ’s historical fiscal data and investment decision in a knowledge base and then applies the aforementioned poser to automatise tasks such as parse database of private company data , wield due diligence asking lists and digging for little - known figure of speech across the entanglement .

Dili recently added supporting for automatize comparable analytic thinking and industry benchmarking on a firm ’s stockpile of wad . Once funds upload their deal data , they can compare historical and current investment opportunities in one place .

“ envisage being able to get an email with a new investment chance or portfolio party update and instantaneously having a platform produce AI - generate business deal cherry flags , competitive analysis , industry benchmarking and a preliminary summary or memo leveraging your fund ’s historical investing patterns , ” Song say .

The question is , can Dili ’s AI — or any AI really — be believe when it comes to managing a portfolio ?

AI is n’t necessarily get it on for sticking to fact , after all . Fast CompanytestedChatGPT ’s ability to sum up up articles and found that the model had a tendency to get stuff amiss , pass on pieces out and outright invent details not mentioned in the article it summarise . It ’s not tough to imagine how this might become a real trouble in due industriousness work , where truth is paramount .

AI can also add prejudices into the decisioning process . In an experimentconductedby Harvard Business Review several years ago , an algorithm trained to make startup investment recommendations was found to break up white enterpriser rather than entrepreneurs of coloring material and preferred investment in startups with manlike founders . That ’s because the public data point the algorithm was trained on meditate the fact that fewer cleaning woman and founders from underrepresented groups incline to bedisadvantagedin the support physical process — and finally call forth less speculation Das Kapital .

Then there ’s the fact that some firms might not be easy running their private , tender data through a third - party model .

To attempt to allay all those fears , Song say that Dili is continuing to fine - tune its fashion model — many of which are loose source — to reduce instances ofhallucinationand improve overall accuracy . She also punctuate that individual client information is n’t used to train Dili ’s manakin and that Dili plans to offer a way for funds to create their own models trained on proprietary , offline investment company data .

Dili ran an initial pilot last year with 400 analysts and users across different case of funds and banks . But as the startup expands its squad and adds new capabilities , it ’s angling to expand into new app — ultimately toward becoming an “ destruction - to - end ” resolution for investor due industriousness and portfolio direction , Song tell .

“ Eventually we trust this core technology we ’re build up can be applied to all parts of the asset allocation process , ” she added .