Topics

late

AI

Amazon

Image Credits:EarlyBird

Apps

Biotech & Health

clime

Image Credits:EarlyBird

Cloud Computing

Commerce Department

Crypto

Image Credits:EarlyBird

Enterprise

EVs

Fintech

Image Credits:EarlyBird

Fundraising

gismo

back

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

transportation system

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

newssheet

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

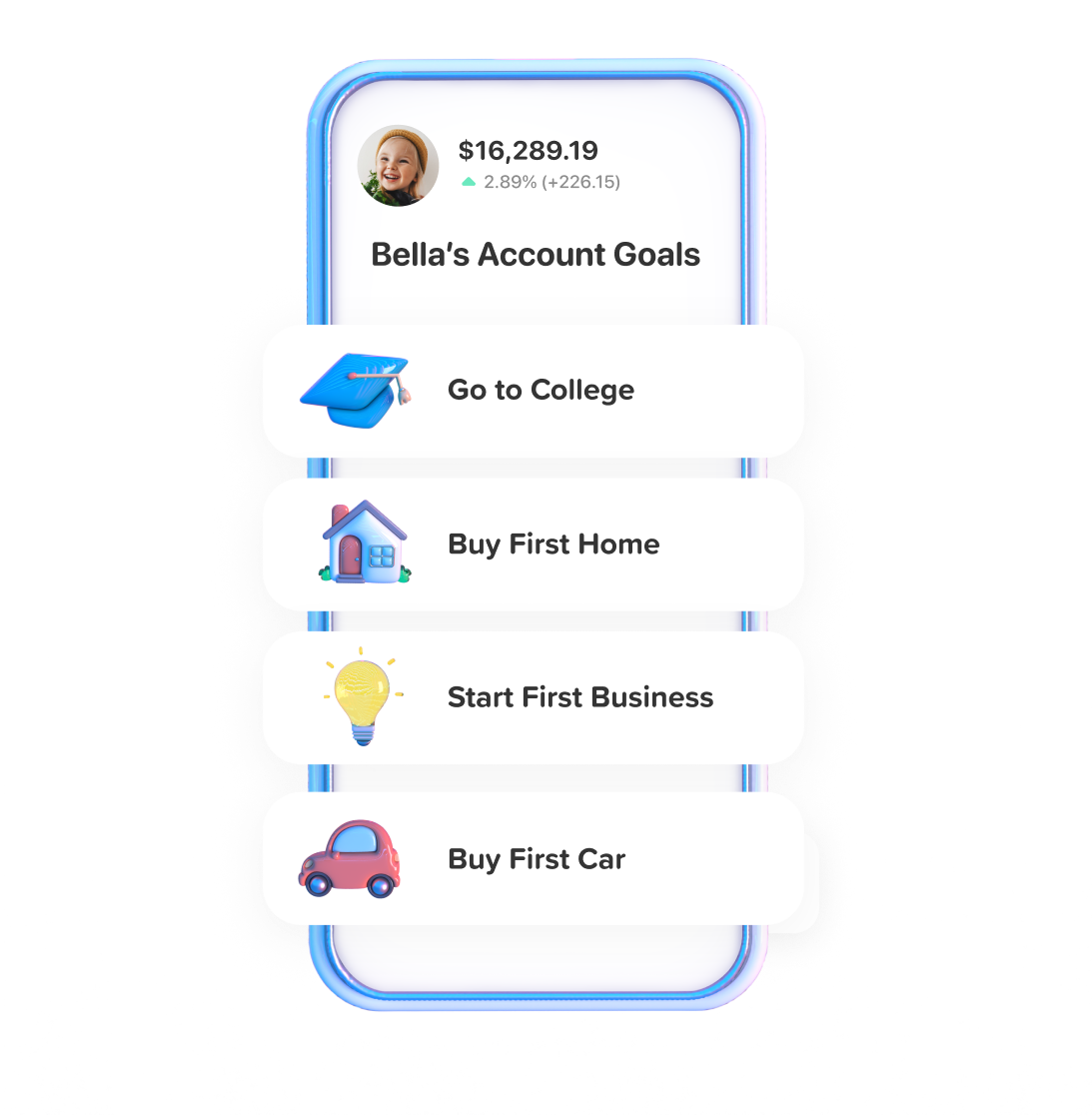

EarlyBird , an app that lets families and protagonist gift investments to children , has elevate $ 4.5 million in a seed extension round that was part funded by its substance abuser groundwork . The app let parent make a tutelary accounting , also known as a UGMA ( Uniform Gifts to Minors Act ) account , which allows them to invest in stock , bonds , mutual cash in hand and other securities on behalf of their shaver . Once the child turn 18 , the investing become theirs . In plus to saving for college , the funds can be used for thing like a down payment on a home , seeding your child ’s first line of work , jaunt the world , retreat and more .

The startup ’s founder and CEO Jordan Wexler told TechCrunch in an interview that because EarlyBird is a residential district - ground investment platform , the company believed it had an interesting chance to test its community outside of the traditional crowdfunding platform and see if they would want to enthrone in the round .

“ As this bout begin to make out together , we recognized that there could be a coolheaded way for us to give up a specific allocation for the existent parents that are investing in EarlyBird , so that the parent that are adorn in EarlyBird really invest in the platform that ’s investing in their kids , ” Wexler said . “ We send out a feeler email to our drug user base and it was by far the most booking we ’ve ever image on a study like that . ”

The startup then spread up the allocation , which was satiate within the first 48 hours . Wexler says that being originative pay off , noting that if you require to exist in today ’s startup securities industry , you have to persist in to get creative and tap into the community of interests around you .

The funding round was preempt by IDEO Ventures and included investment from all of EarlyBird ’s previous seed round of golf investors , including 776 Ventures , Fiat Ventures and RareBreed Ventures . The round also included investments from ResilienceVC , Sweater Ventures , Alumni Ventures , Goodwater Capital , Wintrust Bank , Lightspeed Scout Program and Parallel .

The latest funding round bring the company ’s total amount of backing raised to $ 10.9 million . EarlyBird close a $ 4 million seed funding round in November 2021 and a $ 2.4 million pre - seed beat in November 2020 .

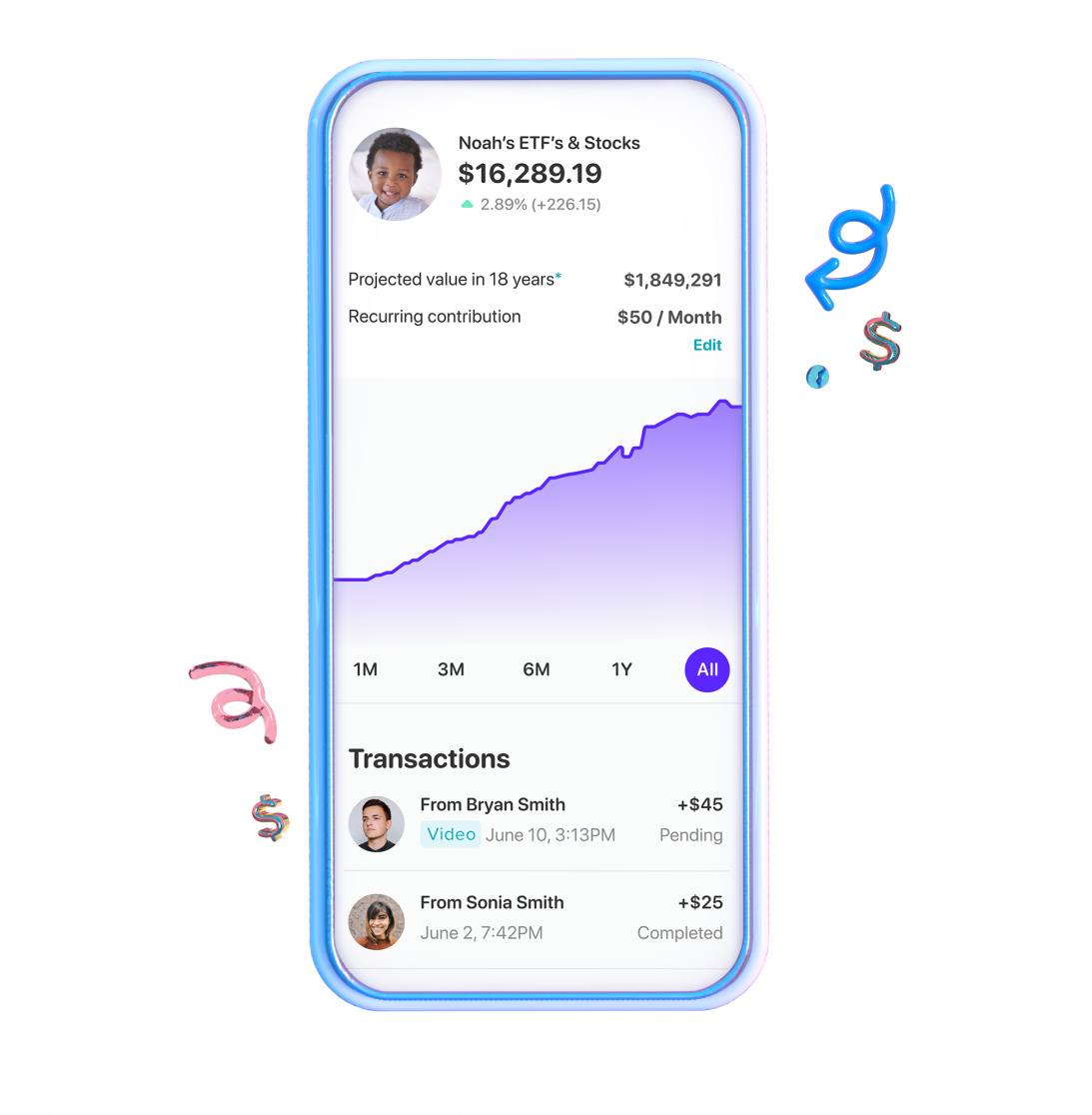

EarlyBird plans to use the funding to spread out on the startup ’s focus on residential area - based investing , as the platform is not just all about investment . Wexler say the startup has find that investing in a nestling is deeply emotional , which is why it has social features . For instance , every time you invest , you could create a video store that contextualizes the investment .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ What we ended up seeing over the last couple of year is that parents started to use this as a means to catalog all these special moments with their child , ” Wexler said . “ For instance , if a mom got a advancement and want to lionize , she could do a one - time investment and make a video memory tattle to her child about it . And so EarlyBird becomes this really unique centralized place where you are building this time capsule . ”

EarlyBird will also employ the financial support to focus on the next interaction of its investment services . The startup presently offers the ability for a parent to select one of five Managed Portfolios and invest . In the future , EarlyBird wants to be able to make multiple customized portfolio so that a parent can pick and choose parentage and do so with their child as they originate up . In addition , the startup is starting to explore way to fetch a college savings 529 plan into the EarlyBird experience .

The inauguration is presently focused on the 0 to 7 - year - old demographic , but EarlyBird plans to provide services for the entire lifecycle journeying from 0 to 18 + .

“ We desire to establish a dedicated experience for a teen to be able to take possession so that at 18 we become their primary brokerage firm account , and we take over the likes of any other larger financial institutions because we ’ve been their trusted financial solution from day one , ” Wexler said . “ And so you keep to invest with us , and then of form , your children , and then the whole cycle start again . ”

EarlyBird ’s new app lets syndicate and friends ‘ giving ’ investment funds to child