Topics

Latest

AI

Amazon

Image Credits:Juanmonino(opens in a new window)/ Getty Images

Apps

Biotech & Health

mood

Image Credits:Juanmonino(opens in a new window)/ Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:Atomico(opens in a new window)(opens in a new w

go-ahead

EVs

Fintech

Image Credits:Atomico(opens in a new window)

Fundraising

appliance

game

Image Credits:Atomico(opens in a new window)

Government & Policy

computer hardware

Image Credits:Atomico(opens in a new window)

Layoffs

Media & Entertainment

Image Credits:Atomico(opens in a new window)

Meta

Microsoft

secrecy

Robotics

Security

Social

Space

inauguration

TikTok

Transportation

speculation

More from TechCrunch

upshot

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

The downswing in the technology sector — dragged by inflation , higher interest group rate and geopolitical events — continue to stay , and one of the most acutely impacted area has been VC funding for startups , peculiarly those outside the U.S. consort to VC firm Atomico , company in Europe are on track to raise just $ 45 billion this yr — around half the$85 billionthat startup in the region raised in 2022 .

The digit amount from Atomico ’s big study on thestate of European technical school , which it issue annually .

It also found that startups in the region are bring up less at each stage of funding from Seed through to Series C ( and beyond ) , with former stage and larger companies feel a particular pinch : just 7 “ unicorns ” ( inauguration with a valuation of more than $ 1 billion ) are set to emerge this year in Europe , compare to 48 in 2022 and 108 in 2021 .

But there is a Ag liner in the account . While overall investment amount are by all odds down on the last two long time , Atomico ’s possibility is that 2021 and 2022 were outlier in terms of activity — a consequence of low interestingness rates , a surge of technology usage during the superlative of the Covid-19 pandemic , and a pen - up amount of funding among investor — raising ever - larger from LPs keen to harvest openhanded returns from a floaty industry — that needed to be deployed .

In other countersign , taking those two years out of the mix , it looks like figure are following a dumb , and perhaps healthier , growth curve ball upwards .

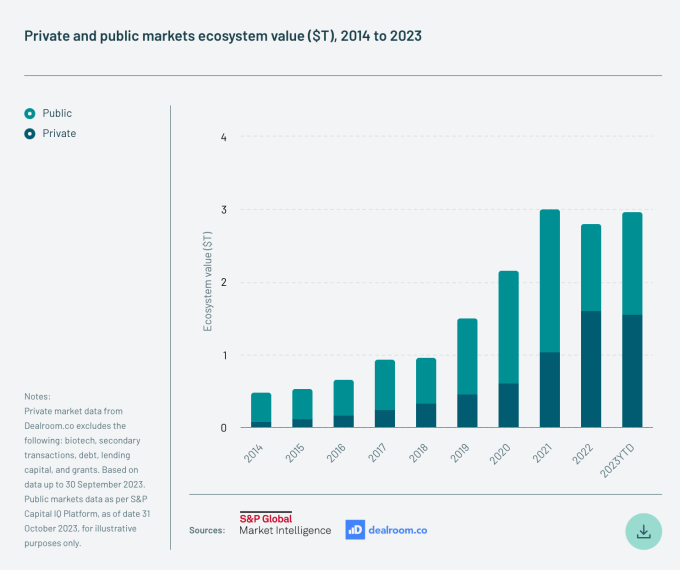

Another positive sign is that the overall full economic value of the European technical school ecosystem — that is , the combined equity note value of all public and secret tech companies in Europe — has returned to its 2021 record of $ 3 trillion after dropping $ 400 billion in value in 2022 . That ’s thanks to a steady stream of new startups raising money offsetting down rounds , with the absolute majority of fundraises made as flat unit of ammunition or up rounds .

“ This recoil in ecosystem economic value has also been supported by the continual influx of raw companies starting and raising individual capital for the first time , as well as the fact that , despite a magnanimous increase in the number of down circle , the overpowering majority of follow - on capital deployed into the ecosystem has been through flat rounds or up round of golf , ” the authors of the account write .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Atomico bases its figures on sketch it runs with startups and investors , and complement that with data from third party source like Dealroom , CrunchBase and others .

Some of the other noted points from the account :

“ crossing investors ” have frustrate out Europe . Atomico notes that so - called crossover investors — those who invest both in individual and public technical school companies ( Tiger Global is one well known example ) — have all but disappeared after driving some of the biggest deals of former years . In 2021 , there were near 100 mega - rounds where these investors led or participated in Europe . 2022 started to see a slowdown of that tread . This year , spook by the poor performance of both public and secret technical school companies , these crossover role player made just four investment in the region .

Their absence seizure has also impact the overall delineation for nine - form turn . Atomico notes that the first nine month of 2023 saw just 36 bout of $ 100 million or more , compare to hundreds in the predate two years . Notably these roundsdo notfollow the same upward curve as some other digit : there were 55 $ 100 + round in 2020 .

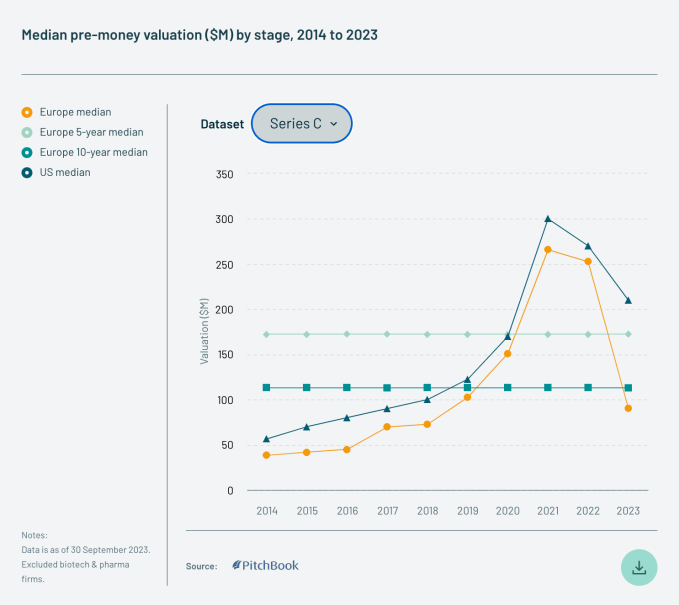

found the Seed . startup at almost every point are upraise on medium at down round , Atomico ’s data shows . Generally , the later the stage , the starker the valuation drop . Here is the picture for Series C rounds :

Overall , the median valuations for European inauguration persist considerably lower than those of their U.S. counterpart — specifically between 30 % and 60 % low-spirited .

“ This shift back toward long - term average in Europe mirrors what is happening in the U.S. , ” Atomico write . In fact , between the U.S. and Europe , funding has dropped in nearly every stage of investing between Seed and Series C. The only exception is Seed stage in the U.S. , which continued to rise , albeit at a slower pace . ( Median Seed rounds in the U.S. this class , Atomico say , was $ 11.5 million , while the European median trope was essentially half that amount : $ 5.7 million . )

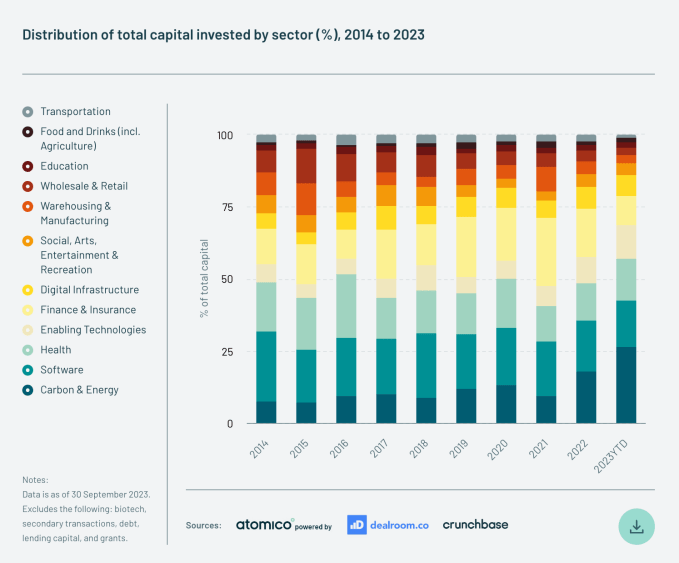

It ’s not AI that is dominating investment in Europe . Although the centering in the technical school zeitgeist right now certainly seems to be on unreal intelligence , when it comes to what segments are repel existent funding monies decently now , if you leap on that bandwagon , you might miss the real show . Atomico says that its numbers point that climate tech — and the wide area it ’s in , Carbon and Energy , account for a walloping 27 % of all capital empower in European tech in 2023 .

That is more than double what was vest in this surface area in 2023 , and it ’s even performing easily than some of the other segments of tech that have traditionally be huge in the area .

“ Carbon & Energy has soundly overpower Finance & Insurance and Software as the single large sector by capital raised , ” the report author mention . “ This not only represents a striking gain in the scale of working capital invested behind the green conversion , but also a cleared slowdown in fintech investiture volume since the peak of the grocery store . ”

update , set that the amount European startups are due to evoke in 2023 is $ 45 billion , not $ 42 billion .