Topics

Latest

AI

Amazon

Image Credits:Finally

Apps

Biotech & Health

Climate

Image Credits:Finally

Cloud Computing

mercantilism

Crypto

endeavor

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

seclusion

Robotics

Security

Social

blank space

startup

TikTok

transport

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

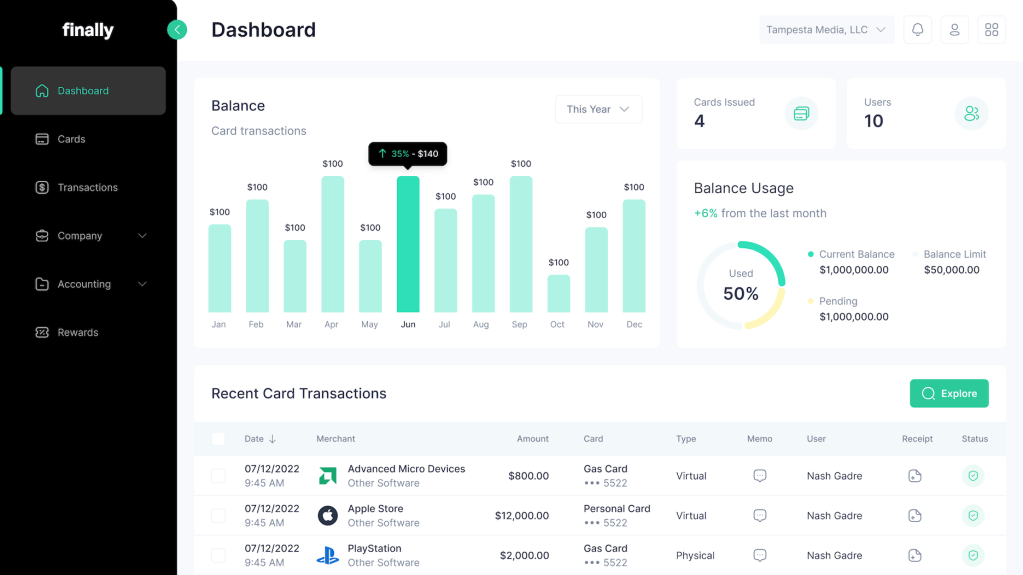

Finally , a fintech inauguration helping businesses automatise account and finance social occasion , fix another $ 10 million in venture capital .

TechCrunch antecedently reported on the company in 2022 when itraised $ 95 million in equity and debtto roll out minor business lending and bookkeeping capableness . Felix Rodriguez , his wife , Glennys Rodriguez and Edwin Mejia started the company in 2018 .

Since then , the Miami - based companionship has focalise more on bringing together business outgrowth , like bookkeeping , expense management , banker’s bill payment and paysheet , under one automated solvent for small business , Felix Rodriguez told TechCrunch .

That included the addition last yr of an artificial intelligence - powered account book , extend business banking functions and progress a young edition of its clerking app . The company also provides a corporate menu to aid small businesses with their cash period on top of commit them penetration into how they are doing .

eventually takes in $ 95 M in equity , debt to hustle out lending for small businesses

Small business responded : “ The last time we verbalise we were at a little bit over 1,000 customer , and now we ’re share with over 1,000 new business per month , ” Rodriguez enounce . He declined to reveal at last ’s valuation or receipts increase over the preceding year .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Meanwhile , the new capital , lead by PeakSpan Capital with engagement from Active Capital , will be invest in additional hiring , go - to - marketing and expansion of finally ’s technical school passel . That includes mobile reading of its bookkeeping , disbursement management and business banking apps .

“ The trick for us is really leveraging AI to give more insights and start spotlight what some of these data points think , ” Rodriguez said . “ Not every business possessor has that , so we feel like that ’s the next breakthrough . ”

Now with its three new products , Jack Freeman , partner at PeakSpan Capital , said in a affirmation that “ Finally enters 2024 as a fully - fledged fintech with a portfolio of products hold up minor businesses . We are psyched to see what the at last squad can do with more growth capital and resources this coming class . ”

Must - have tools modernistic chief financial officer ask in ontogenesis - leg inauguration