Topics

Latest

AI

Amazon

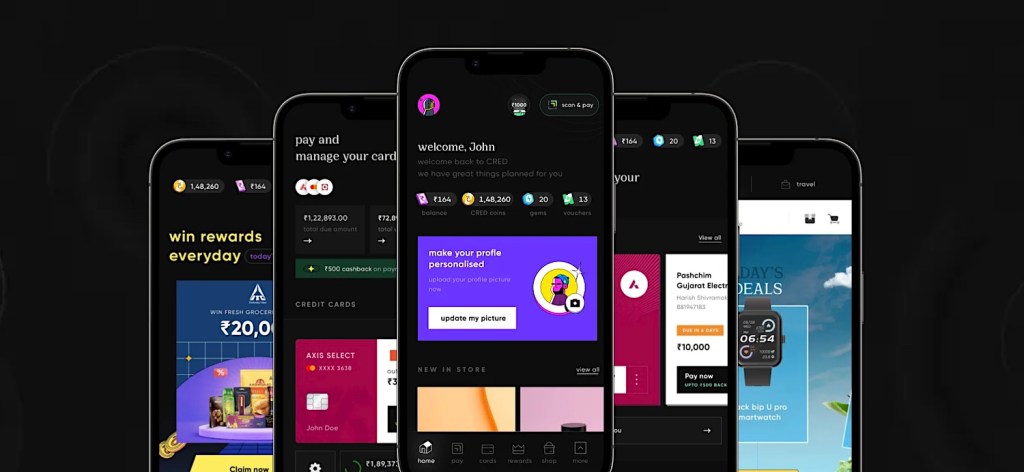

Image Credits:CRED

Apps

Biotech & Health

clime

Image Credits:CRED

Cloud Computing

Commerce

Crypto

Enterprise

EVs

Fintech

Fundraising

contrivance

stake

Government & Policy

computer hardware

Layoffs

Media & Entertainment

Meta

Microsoft

privateness

Robotics

security system

Social

infinite

Startups

TikTok

deportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

street cred has received the in - principle favourable reception for a payment collector permit in a boost to the Indian fintech startup that could aid it better answer its customer and launch new products and experiment with ideas quicker .

The Bengaluru - headquartered startup , valued at $ 6.4 billion , received the in - principle commendation from the Reserve Bank of India ( RBI ) for the payment aggregator license this week , according to two sources conversant with the thing .

CRED did n’t instantly answer to a request for remark .

The RBI has granted in - principle approval for payment aggregator licenses to several troupe , admit Reliance Payment and Pine Labs , over the retiring year . Typically , the central savings bank take nine months to a year to release full approving following the in - precept approval .

requital aggregators are essential in facilitating on-line transactions by play as intermediator between merchant and customers . The RBI ’s favorable reception enables fintech firm to expand their offerings and compete more effectively in the market .

Without a license , fintech startups must rely on third - political party defrayment processors to treat transaction , and these players may not prioritise such mandate . Obtaining a licence allows fintech companies to swear out payment straightaway , shorten costs , win greater controller over payment flow rate and onboard merchant directly . Additionally , defrayment aggregators with licenses can sink fund now with merchants .

A licence can also reserve CRED to make itself uncommitted to more merchants and “ generally be everywhere their client shop , ” an industriousness executive director said .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

The in - rule license approval to CRED watch the Native American central savings bank crack down on many fintech occupation practices in recent quarters and loosely uprise cautious of award licenses of any variety to businesses . In a stunning move , the Reserve Bank of India ordered Paytm Payments Bank in the first place this year tohalt most of its businesses .

CRED — which counts Tiger Global , Coatue , Peak XV , Sofina , Ribbit Capital and Dragoneer among its backer — serves a large chunk of India ’s affluent client . It originally launched six years ago with the feature article to help members pay their credit card bill on time , but has since expanded its oblation with loan and several other products . In February , it announced it had reached an understanding tobuy reciprocal fund and stock certificate investment funds platform Kuvera .