Topics

recent

AI

Amazon

Image Credits:Get Moving / Shivam Bharuka, co-founder and CEO of Get Moving, developing the Finvest app

Apps

Biotech & Health

Climate

Image Credits:Get Moving / Shivam Bharuka, co-founder and CEO of Get Moving, developing the Finvest app

Cloud Computing

Commerce

Crypto

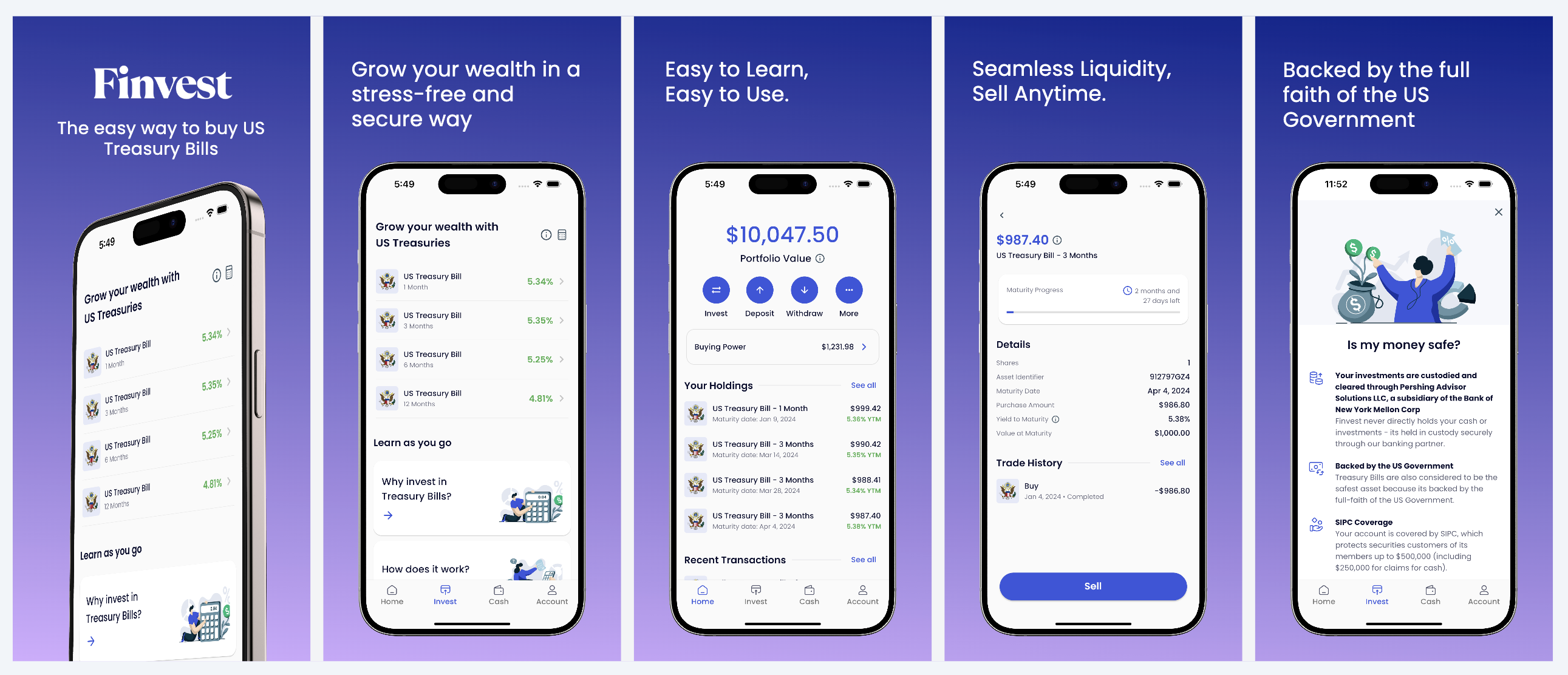

Finvest’s investment app features.Image Credits:Get Moving

initiative

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

computer hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

distance

inauguration

TikTok

deportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

picture

Partner Content

TechCrunch Brand Studio

Crunchboard

get through Us

Apps like Robinhood made investing in stocks easier , andFinvestwants to do the same matter for place in U.S. Treasury Bills .

Shivam Bharuka , Centennial State - father and CEO of Get Moving , started solve on Finvest in 2023 . With interest group rates at such high levels , Bharuka require to take advantage of the surround — however , banks were giving penny on the dollar , he told TechCrunch .

“ With the high interest rates , you essentially earn loose money on loose cash through U.S. Treasury Bills . But , there is no easy direction to buy Treasury Bills today , ” Bharuka state . “ you may buy them through the government website , Treasury Direct , which is an experience from the 1990s , or utilize the legacy securities firm like Fidelity or Charles Schwab . Those experiences are often opaque , and come with a clunky drug user experience . Most modern fintech apps also do n’t enable you to invest in underlying define - income plus . ”

He was part of the Winter 2023 Y Combinator cohort , however , Bharuka initially went in with a logistics - focused party for India . He ended up pivoting when he acknowledge the pain detail associated with buying Treasury Bills .

He and his team are modernise Finvest to make the purchase , management and selling of U.S. Treasury Bills unlined . The company partner with a securities firm firm to carry out the trades .

Here ’s how it shape : After downloading either the iOS or Android app , users create an account , lend a bank report and initiate a bank deposit . Typically , there is a one - day substantiation process for create a brokerage house write up . However , Finvest enables the sedimentation to be tee up so that once the account is approved , the trade will start going through .

Finvest charges a flat management fee of 0.03 % per calendar month on the average daily food market value of your Treasury assets and monthly direction fee .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Bharuka is not alone in need to make this outgrowth easier . Zamp Finance , back by Sequoia , provides a treasury management political program for better admittance to U.S. Treasury Bills . Finvest sweetens its offering with a high - yield cash management account that gives you a 4.4 % output , in high spirits than most savings accounts .

The caller is in its earliest stages , with Bharuka go down to say how many customers have downloaded the app , but did say that around $ 1 million in deposits were made since launching in December .

It also already snaffle $ 2.7 million in funding from an investor group that let in Bayhouse Capital , Unpopular Ventures , Y Combinator , Olive Tree Capital , Pioneer Fund , Fractal Ventures and a group of angel investor , including former Airbnb executive director Oliver Jung .

Bharuka plan to use the financing to flourish Get Moving ’s engineering team and eventually add other asset classes to the Finvest app , for example , corporate bonds and municipal bonds .

“ We ’re also planning to set up this internationally as well , ” he sound out . “ We have been explore this angle because there is a destiny of interest group to invest into treasury , especially in Romance countries , like Argentina or Brazil , because their economic economy have not been that strong . They want to seat in a stronger economy , but there is no direct means to do it today . ”

Robinhood ’s decision to limit crypto trading makes practiced sense