Topics

Latest

AI

Amazon

Image Credits:Ting Shen / Bloomberg / Getty Images

Apps

Biotech & Health

mood

Image Credits:Ting Shen / Bloomberg / Getty Images

Cloud Computing

DoC

Crypto

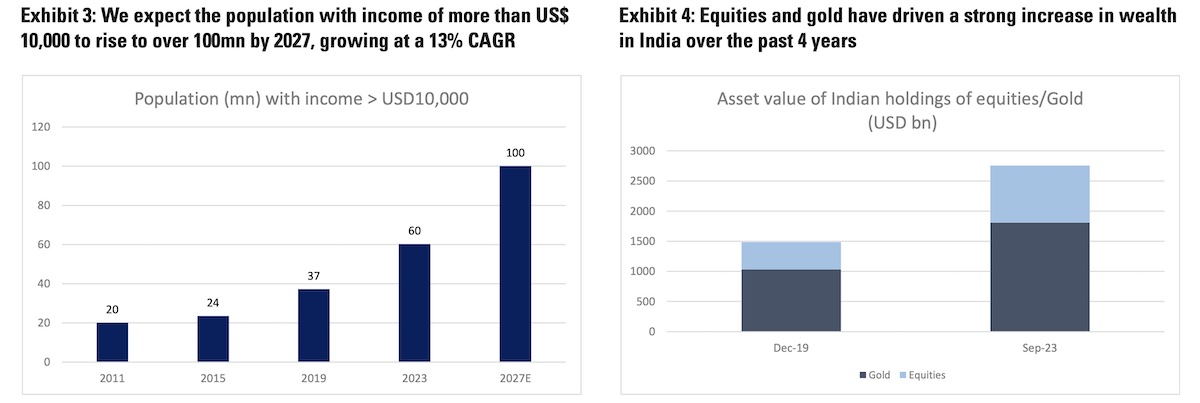

Goldman Sachs’ projection for India. (Image: Goldman Sachs)

Enterprise

EVs

Fintech

fund raise

appliance

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

General Catalyst has engaged with VC fund Venture Highway in recent months for the acquisition deal, sources said.

General Catalyst , one of the large U.S. speculation capital firms , is in talks to get an India - focalise VC as part of movement to flourish its presence in the fast - spring up South Asian inauguration securities industry , three source conversant with the matter told TechCrunch .

The deal would allow General Catalyst to tap deeply into India ’s vivacious engineering science scene that has lured over $ 100 billion in startup investment since 2010 . General Catalyst has betroth with Venture Highway in recent months for the deal , according to two sources conversant with the matter . The softwood with Venture Highway has n’t finalized , so matter include the objective fund could switch , the sources admonish , request anonymity as the deliberateness is private .

General Catalyst has back about a 12 and a half startups in India — including fintech giant CRED , used railcar mart Spinny , and healthtech Orange Health — but the venture firm has been looking to importantly expand its presence in the land for more than a twelvemonth , several people conversant with the affair said .

General Catalyst and Venture Highway did not respond to requests for remark Thursday .

The U.S. firm held conversations with many aged individuals in India last year looking to regain an India - based partner , many masses familiar with the issue said . At some point last year , it also began evaluate the possibility of acquiring an India - focused fund and use that itinerary to establish a full comportment in the country , the masses said .

It ’s not the first time a globose venture house has explore this route to exposit into India . Accel acquire Erasmic , which at the sentence had a principal sum of about $ 10 million , more than a X ago , creating Accel India .

General Catalyst , which has over $ 25 billion in assets under management , plans to seat more than $ 500 million in India over the next three to four age , another person familiar with the matter said . Its raw focus on India follows the house expand in Europe last class by fit in tomerge with La Famiglia , an investor in several high-pitched - profile early - phase startups include AI firm Mistral .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Venture Highway — co - plant by Neeraj Arora , who played an instrumental theatrical role in Meta acquiring WhatsApp — is a New Delhi - headquartered venture business firm that focuses on backing other - phase startups . The business firm , the size of whose last fund ( its 2nd ) wasabout $ 80 million , reckon Meesho , ShareChat , and Moglix among its portfolio startup . Samir Sood , one of its other partners , late stepped down . The firm also recentlysold some of its stake in Meesho , TechCrunch first reported .

India , one of the creation ’s with child inauguration ecosystems , has attracted several heavyweight include Sequoia , Lightspeed , Accel , Tiger Global , SoftBank , and Insight Partners in the past decade and a half . A number of other high - profile speculation firms including Coatue Management and QED and Andreessen Horowitz have also backed Indian startups in late days as they pick young firms attempting to serve the fast maturate net market place of over 700 million drug user .

enthrone in India has try uniquely thought-provoking to many globular speculation business firm that have entered the country or have explore such possible action , a partner at a India - ground venture house said . “ India has immense potential drop but we do n’t yet have the story of exits you see in the U.S. , nor do we have the size of return you might find elsewhere , ” the investor said , admonish that venture firms need to make serenity with the fact that the time horizon needed for bigger payday is much longer in India .

Yet , globally funds — including plus handler — are increasingly expanding focus on India , whose $ 4 trillion GDP is wait to double over by the destruction of the X , according to Morgan Stanley . Invesco , T. Rowe Price , BlackRock , Fidelity and UBS have backed several Indian startups through their mutual funds in the last five years .

“ Rather than thinking about mediocre GDP look at how many households in India will make more than $ 50,000 to $ 75,000 a twelvemonth by 2030 . Our plus is developers , ” Anu Hariharan , father of VC firm Avra and formerly the point of YC Continuity , post on Adam last week .

“ India will have ~15 million developer in the next decade making $ 50,000 to $ 75,000 a year . For every developer household , there is a fiscal services house and a health care household that will also make $ 50,000 to $ 75,000 a year . That equates to ~45 million households ( that will make more than $ 60,000 a year by 2030 . ) In comparison the UK today has 28 million house realise $ 45,000 a yr . ”