Topics

Latest

AI

Amazon

Image Credits:Grifin

Apps

Biotech & Health

Climate

Image Credits:Grifin

Cloud Computing

Commerce

Crypto

Image Credits:Grifin

endeavour

EVs

Fintech

Image Credits:Grifin

Fundraising

Gadgets

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

security system

societal

infinite

Startups

TikTok

DoT

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

get through Us

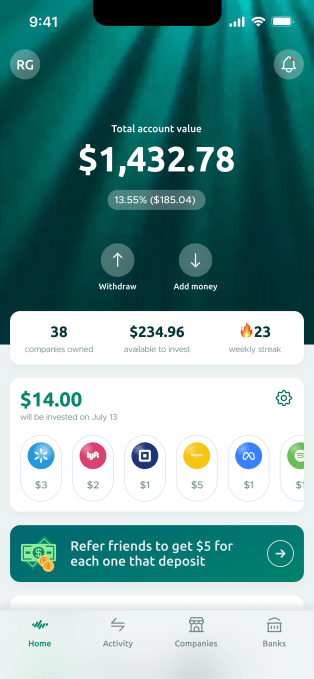

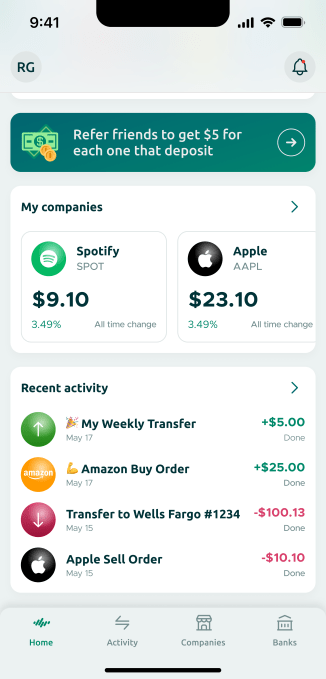

adorn appGrifintoday formally launched its awaited investment model called “ Adaptive Investing , ” which enables you to automatically enthrone in your favorite steel that you frequently shop from .

Grifin was founded in 2017 with the hope of making seat less daunting and renormalize it for people who are n’t that financially savvy . To engagement , Grifin has raised more than $ 11 million from a noted list of investor , including TTV Capital , Rise of the Rest , Gaingels , NevCaut Ventures , Mana Ventures , Sidecut Ventures , Miami Angels and Playtap Media Ventures , along with Witz Ventures carbon monoxide gas - father Austin Hankwitz and GGV Capital managing pardner Hans Tung . The ship’s company enounce it see about 20,000 unique Modern app installs per month .

Grifin ’s new patent - pending technology is an evolution of its original role model , which come the premiss of “ Stock Where You Shop , ” present you a chance to explore the intimidating world of investing by aligning your shopping habit with stock choices .

“ Investing , and even having a healthy positive family relationship with money , is an incredibly difficult thing to do and achieve , ” co - founder Aaron Froug state TechCrunch . “ The current system simply is n’t geared towards the individual , even with mobile access and 0 % delegation apps claiming to ‘ open up ’ investment to all . It still expect a passel of emotional energy , confidence and an understanding of how investing workplace . Most mass still do n’t finger like they have enough money to get started and even the most financially adept people I know do n’t be intimate what is inside most exchange traded fund [ exchange deal investment firm ] . All of it is cloudy and complicated . None of it is center around the individual . ”

The Adaptive Investing model direct to give exploiter more tractableness by integrating new functionality into the app , including the power to break robotic payments , increase / decrease how much you want to pass and manually invest more money in a companionship . It also introduces a “ Secret hard cash ” subroutine , let for non - public purchases and place more money off as cash for their future .

“ This letters patent - pending technology builds on the original premise by incorporate novel functionality to allow for a more intuitive and adaptive advance to investing , concentrate not just around people ’s day-to-day spending habits , but how much they want to invest , ” Froug add .

By nonremittal , Grifin automatically invests $ 1 per dealings . For instance , when you buy a cup of deep brown at Starbucks , the app withdraws $ 1 from your savings bank write up , and you get $ 1 of SBUX stock . you may also manually increase the investment amount to a maximum of $ 99 .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

However , just because you savour a sure trade name , it does n’t needfully mean it ’s a wise investment funds . Grifin now total a fresh “ Disable society ” feature article , allowing you to halt or annul invest in certain companies . There ’s also an pick to pause your investments for a week .

“ We are also keenly aware that just because a soul spend at a specific plaza , they might not want to clothe there … By investing in small amounts , as grim as $ 1 at a metre , the design is to facilitate masses to pick up to navigate the world of enthrone without incurring too many negative import if they do n’t get it correct , ” Froug says .

Plus , Froug indicate that Adaptive Investing dilute the impact of single - stock exposure since it encourage a diverse profile as consumers usually drop money across a wide grasp of companies — phone / internet bill , gasolene , monthly subscription service and so forth .

“ I ’ve been personally using our app for a small over two years and I ’ve invested in 115 unique fellowship , ” he notes .

Additionally , Grifin is contrive a redesign of its app , which will include a premium reading as well as an AI chatbot to help oneself people read how to invest .