Topics

a la mode

AI

Amazon

Image Credits:T. Narayan/Bloomberg / Getty Images

Apps

Biotech & Health

Climate

Image Credits:T. Narayan/Bloomberg / Getty Images

Cloud Computing

Commerce

Crypto

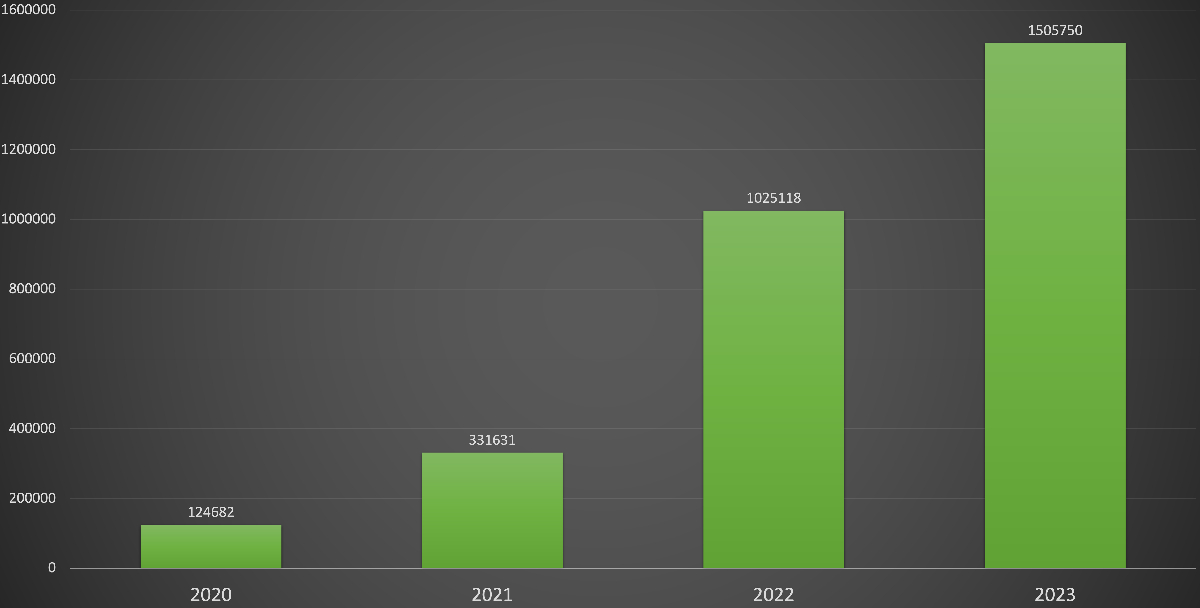

India’s EV sales grew from nearly 125,000 in 2020 to over 1.5 million in 2023, per the data provided by Vahan.Image Credits:Jagmeet Singh / TechCrunch

Enterprise

EVs

Fintech

Commercial electric vehicles consume a large percentage of energy in India.Image Credits:Sanchit Khanna/Hindustan Times

fundraise

contraption

Gaming

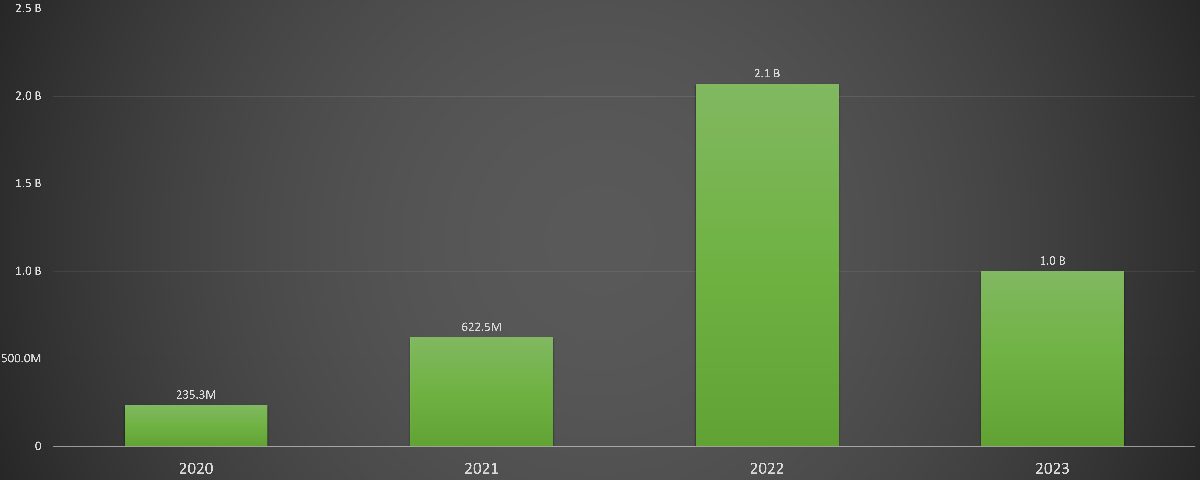

India’s EV funding declined to $1.5 billion in 2023, per the data provided by Tracxn.Image Credits:Jagmeet Singh / TechCrunch

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

secrecy

Robotics

Security

Social

Space

inauguration

TikTok

transport

speculation

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

EV sales in India grew by nearly 47% to 1.5 million in 2023

India , a major player in the worldwide automotive industry , has embark on center on transition to alternative fuels to curb pollution after expanding its consumer and fomite bases and adding local fabrication readiness over the retiring two decades . On this journeying , 2024 will be a all important yr , as the country — the third - big self-propelling grocery — front challenges to pop the question accessible growth capitalto tardy - phase startup while trying to lureTeslaand other extraneous EV manufacturers to enter its domestic market .

How EVs fared in 2023

In 2023 , India , the world ’s largest two- and three - wheeler manufacturer , sell almost 24 million vehicles , including commercial and personal four- , three- and two - wheelers , according to the latest data on the government ’s Vahan portal . Of the total number of vehicles registered , more than 1.5 million were EVs , capturing 6.35 % of the total base , including 813,000 galvanizing two - wheelwright . While the overall growth was nigh 10 % from about 22 million vehicle betray in 2022 , EV sale grew by closely to 47 % from 1.03 million EVs sold last twelvemonth .

This fetch the total number of electrical fomite sales in the land to nearly 3.5 million . Two - Sir Mortimer Wheeler accounted for more than 47 % of sales , four - Wheeler symbolize about 8 % and the rest descend from eastward - rickshaw and three - wheelers .

India ’s annual growth in EV sale in 2023 is significant ; however , it ’s not as high-pitched as in the late two years , which were over 209 % in 2022 and 166 % in 2021 . One of the reason for the dip in the sales of EVs is the baseball swing in subsidies given to two - wheeler customers through the $ 1.38 billion incentive dodge call Faster Adoption and Manufacturing of ( Hybrid and ) Electric Vehicles , commonly called FAME - II , that came into effect in June anddropped the monthly sales of electric two - wheelers in the country over 56%in that calendar month alone . The sudden drop in electric two - wheeler sales has arguably impacted the nation ’s overall EV mart , as India is preponderantly a two - wheeler food market and has trammel producer in the electric car segment .

Ravneet S. Phokela , principal business officer of electric two - cyclist startup Ather Energy , told TechCrunch the market take a hit for about three months due to the FAME - II update , though it has resile to pre - subsidy change degree as of October .

“ From the bound back , how the rapid development is going to be stiff to be seen , but we expect it to be more gradual than exponential . However , the days of 100 % quarter - on - quarter growth are gone , ” he said over a call , sum that the variety would help in the medium - terminal figure perspective .

“ In a style , while the subsidy impacted us in the short term financially , if I just take a macro position , there has actually been a good outcome because now , the market pricing is near to non - subsidy levels , which means the market has gotten used to price level that we can explore broadly when subsidy pass over , ” Phokela mark .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

The subsidy update has also cause integration and sudden expiration of many belittled - scale electrical two - wheeler brands , admit the I selling rebranded Chinese vehicle . Phokela said that the top four musician , namely Ola , TVS Motor , Ather Energy and Bajaj , which combined had around 26 % to 27 % plowshare about nine months ago ( before the government updated FAME - II in May ) , currently capture about 80 % of the entire electric two - bicyclist market .

Ather Energy sell an average of about 80,000 to 85,000 unit of measurement this twelvemonth and expects a alike sales figure of speech for 2024 , Phokela said .

Apart from electric two - wheelers , the FAME - II dodge apply to three- and four - wheeler sales to further EV usance in the country .

New Delhi has throw more than $ 628 million in subsidy through December 1 under FAME - II on the sale of 1.15 million vehicles , according to the political science datasharedin the sevens .

EV manufacturers have demanded that the political science continue propose subsidy to get the market support its ontogeny and dilate further to see the country ’s electrification prey to have 30 % EV penetration by 2030 .

“ Given that the costs are still not optimise yet for the provision range , it is crucial for the politics to extend the subsidy for two to three years and point it down , ” Phokela said .

Industry reservoir told TechCrunch that market players have requested the government ply predictability in its policies and keep off bringing abrupt change , such as the pillow slip of FAME - II update , to let them make Assumption and base financial and stage business provision accordingly .

“ A lack of predictability is the biggest killer point for the industry , ” an executive at an electric two - Sir Mortimer Wheeler company stated on the shape namelessness . “ Even if you are saying six month , please tell us that it will be for six months and then turnaround , but do n’t say two years and finish in one yr . ”

In addition to FAME - II , the Native American government has offered a $ 3.11 billion production - link bonus scheme to attract investments and promote domesticated fabrication of motorcar and auto components in the country . Indian railroad car manufacturers Tata Motors and Mahindra & Mahindra have emerged as the early donee of the incentive dodging . The regime reported more than $ 1.43 billion of investment came until the second fourth part of the financial twelvemonth 2023 - 24 as a result of the scheme .

Tata Motors saw a growth of 63 % in EVs and increased EV incursion in its portfolio to 12 % this yr , a company interpreter tell in a argument to TechCrunch .

machine manufacturers , include Ather Energy and Tata Motors , introduced their young EV models in the country to expand their presence and draw newfangled customer .

Phokela underlined that “ premiumization ” emerge as a noted consumer trend this year , particularly in the Indian galvanising two - wheeler market . The trend of premium model coming to the grocery store will continue in 2024 , he promise .

All four top galvanic two - wheeler brands have vehicles between the cost compass of $ 1,400 to $ 1,800 , while the traditional internal combustion engine two - wheelers are useable at an average price of $ 1,000 .

In the last 12 to 18 months , the galvanic two - wheeler market also saw growing sales from the tier up two and tier three Ithiel Town . For Ather Energy , Phokela said only 43 % of its sale came from tier one metropolis , while 57 % was from tier two and tier three towns — despite its circumscribed statistical distribution in those region . The startup is now expanding its distribution to get even higher sales event .

Some market observers conceive that the growth of electric two - wheeler sales in the developing parts of India is due to hefty electricity subsidies . However , Phokela contend that if that were the reasonableness , there would be a significant increase in the need for low - end vehicles , not the premium model . People in non - metro city regard EVs as status validation and a way to show off , he articulate .

Commercial use cases as a major investor attraction

Although top galvanizing two - wheeler manufacturers have so far targeted the personal mobility segment in the Indian market , investors are bullish on the growth of commercial-grade use typesetter’s case .

“ In the next two to three yr , the majority of the traction will come from B2B role cases — whether it is three - wheeler consignment , three - wheeler rider , eco - mobility , food delivery , hyperlocal deliverance , fast / quick commerce , the use of EVs there is the one that ’s speed up much faster , ” Kunal Khattar , founder and worldwide mate at Indian VC fund AdvantEdge Founders , evidence TechCrunch .

He said while the percentage of commercial-grade vehicle is about 30 million , or 10 % of the full number of vehicles on the route in India , they consume almost 70 % of the energy of all the vehicle .

“ If you ’re in the business of vitality , whether it is battery fabrication or swapping , vitality storage or building charge substructure , your total nidus should be on B2B , ” he observe .

Sandiip Bhammer , laminitis and co - managing partner at New York - base mood technical school VC fund Green Frontier Capital , differentiate TechCrunch the opportunity to make faster and more rapid growth in the commercial-grade section is importantly high than in the consumer section .

“ The economic viability of two - Sir Robert Eric Mortimer Wheeler and three - cyclist segment on the commercial-grade side is much clearer than on the passenger car segment , ” he sound out .

investor believe that compare to the consumer segment , the commercial section is less prostrate to be touch by subsidy changes . This is because businesses consider the entire cost of ownership rather than the face value of the vehicle they purchase .

Khattar said the B2B segment will be 100 % galvanizing in India in the next two to three old age , disregardless of whether subsidy and other incentive would be useable .

The countryplans to add thousandsof battery - operate on auto - ricksha and e - autobus to wire public transportation across states in the coming calendar month . also , itlooks to extend EV charging stationsat various local gas stations .

Capital flow in the market

fairness investments in India ’s galvanic vehicle ( EV ) market decrease by 52 % , from $ 2.1 billion in 2022 to $ 1 billion in 2023 , grant to the data point shared with TechCrunch by VC psychoanalyst firm Tracxn before this calendar month . The numeral of support round also dropped 62 % , from 135 in the previous year to 51 . However , EV financing was not as terrible as in some top - do sectors , such as technical school , SaaS , agritech and wellness tech , where fairness investments dropped by over 80 % .

Bhammer of Green Frontier Capital said the drop in EV funding this year was mainly due to valuation that were too in high spirits in many of the existing startup .

“ If you look at Modern companies that are lift Washington , they are really raising upper-case letter at a much more fair valuation than the older company doing denotation round , ” he say .

Investors are optimistic about the capital menstruum growth in 2024 but conservative about muted routine , particularly in the consumer segment , due to FAME - II change and lack of clarity on subsidy extension .

“ We need the support of the administration , in term of subsidies and taxes and all of that , because of the fact that we are not mainstream yet , ” Khattar of AdvantEdge Founders said .

One key rationality for being hopeful is India ’s growing global bearing and becoming a part of the China+1 scheme for most global companies .

“ China has now start de - growing . So , India is the beacon of promise in an otherwise pretty dull emerging markets scenario , ” Bhammer said .

What’s coming up next?

While India is still a nascent market for EVs , global EV troupe including Tesla and VinFast are also looking to enter the Indian market in the coming months to leverage the size of the world ’s most populous nation . The Indian government isdeveloping a new EV policyto attract foreign carmakers to reave into the market alongside supporting domestic player to inflate the country ’s electric cable car base . Incumbents including India ’s top carmaker Maruti Suzuki are also intimately observing the on-going moves by outside players to look for the correct time to enter the market .

“ Legacy car manufacturer are in no hurriedness . When they launch , they will pass around , and through their distribution , they will be able to start deal number as much as , if not more than , exist players , ” an EV investor tell TechCrunch .

Companies including Tata Motors , which are already in the EV market with their vehicles , are work to address the current adoption challenges .

“ Charging infrastructure growth remains the residuary roadblock for aggregated adoption of EVs . Tata Motors has initiated open collaboration with key bear down players to accelerate the development of chargers , which will pitch a better experience to the EV purchaser , ” the Tata Motors spokesperson said .

Ravi Pandit , co - father and group chairman of automobile technical school companionship KPIT Technologies , told TechCrunch that software and hardware have become the fomite ’s core and that movement will continue to grow over metre .

“ Now , the model is change where instead of there being a lot of computers in a car , there will be a computer and around which there will be a auto . That ’s a central shift , ” he say .

likewise , electric two - Sir Robert Eric Mortimer Wheeler manufacturers and infrastructure providers are work on standardized send solutions . Ather Energy has already collaborated with Hero to offer interoperability on charging .

“ We have about 1,400 loyal chargers , and Hero Vida has about 500 , and we are growing on a monthly footing , ” said Phokela . “ We are in conversation with many other OEMs , and these discussions are at different levels of matureness . ”

In accession to standardisation and interoperability on the charging side , some companies are exploring alternatives to lithium , including Na - ion - driven technologies and silicon anode .

“ What is clear is that you’re able to not drive rotation in any sector unless you have memory access to the natural stuff that power the manufacture . So , if China controls the refining capacity of lithium , how would India drive the EV revolution if it has to keep going to China for its stamp battery , ” Bhammer said .

He mentioned that other incoming updates in the market place admit vehicle - to - grid and clipping - on devices that will be useable on a subscription - based model to help oneself users convert an existing two - wheeler from a non - EV to an EV without charging the motor or battery permanently .

Why Gogoro pick India as its Modern go - to market