Topics

Latest

AI

Amazon

Image Credits:Eugene Mymrin / Getty Images

Apps

Biotech & Health

clime

Image Credits:Eugene Mymrin / Getty Images

Cloud Computing

mercantilism

Crypto

Image Credits:Loops

Enterprise

EVs

Fintech

Fundraising

Gadgets

gage

Government & Policy

ironware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

inauguration

TikTok

DoT

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

newssheet

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Pitching investors is a gravid part of running your inauguration , but no matter the termination of the merging , the chance does not end there . You should not only belogging your heavily - earned touch into a CRM , but also keeping these relationship strong through investor updates .

But what exactly is an investor update ?

It ’s a even e-mail a startup sends to its investors to inform them about the troupe ’s late progress , key metric unit , challenges and succeeding plan .

These update demonstrate to investors your commitment to come along and learn through trial and erroneous belief . Over time , this builds trust while allow you to leverage investor expertness and their networks . With enough combine , these investors may participate in your next stave and refer you to unexampled potential investor too .

Although it may vocalise like a simple e-mail , there really is an art to writing an effectual investor update . The follow is everything you need to know about how to craft and transport an update that keeps investor engaged , communicates impulse , and granary support on your journeying .

The role of tone and transparency

Investor updates make a critical tool for nurturing relationship , so you ’ll want it to come across as genuine and relatable . strain for transparence rather than salesy or unrealistically affirmative . Your update should feel like an insider write up that ’s almost impartial , letting the fact and figure verbalise for themselves .

It ’s also perfectly okay to acknowledge areas where you did n’t quite gather your goals . I ’ve seen founding father turn these type of situations into pure gold by only reel them into lessons learned .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Format considerations

For startup at the come or Series A stage , update should be about 250 to 750 row , while quarterly and annual update should be up to 1,500 words to account for more region of the business . Your investor update should be concise and straight to the point , because investor are often bombarded with emails . Plus , information overload can overcast your main takeaway .

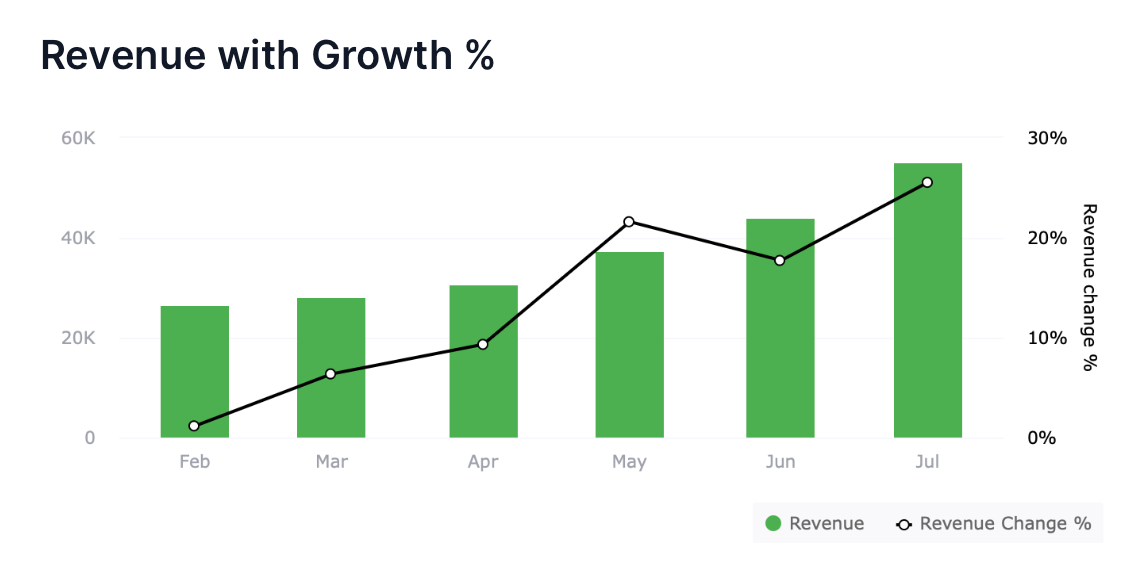

away from chart and graphical record , your updates should be primarily text . employment heater and subhead to break up the text for ease of legibility .

Tools for writing, sending and tracking

you may use a number of tools to muster in and direct along your update , but do n’t let the frame-up process declare you up if you postulate to get it out the room access . A lot of founders get by just draft their update with a simple email and BCC - ing everyone .

When you ’re ready to explore more advanced option , tools like Paperstreet , Cabal and HubSpot simplify the process of send off the update . in person , I likeLoops — it ’s like Notion but for building electronic mail , so I notice the interface intuitive and easy to use .

The two main advantages of using a dedicated sending tool over received electronic mail are near deliverability and the power to survey post - sending analytics . Tracking open and snap rates is especially valuable for understanding which prospective investors are most engaged with your content .

Timing and consistency

It ’s a good idea to bulge out acquire content ready about one to two week ahead of time . If you have a squad , work with them early to gather the latest information . For seed or Series A startups , monthly and annual update are the way to go . As your concern grows and matures , however , the norm transformation toward quarterly and annual updates .

One thing is true across the board when it comes to frequence : Stay reproducible . Sticking to your update schedule build trustingness with investors , which is fundamental to getting them involved in your startup .

Components of the investor update

Example investor update

dependent Line : FakeCo Update | July ’ 24

Hi all — I ’m pleased to report on a jolly massive last month here at FakeCo . Team esprit de corps sense high , and our customers ca n’t seem to get enough . get ’s dig in !

TL;DR :

Asks

FakeCo specializes in AI - drive analytics for healthcare providers , focusing on ameliorate patient termination through datum perceptiveness . For more selective information , please visit < radio link > .

July Performance Review

Future Outlook : August

unspoiled Things

It ’s been another great month here at FakeCo . Thank you for all of your ongoing living as we uphold this wild ride ! Looking forward to discuss these updates and our succeeding programme in more detail .

Please feel free to schedule a catch - up call with me here : < link >

Until next time !

Tim Johnson

Founder & CEO , FakeCo

When sharing this update or any selective information from this email , I enquire that you please do so with deliberate consideration .

Think of your investor update as a chance to show investors what you ’re made of . It ’s not just about the number and milepost — it ’s about giving them a peek into how you think , how cautiously you ’re pay attention to the details , and just how far you may take your startup . Embrace this peter , and I guarantee that you ’ll quickly see its impact .