Topics

Latest

AI

Amazon

Image Credits:Nazan Akpolat / Getty Images

Apps

Biotech & Health

Climate

Image Credits:Nazan Akpolat / Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:CB Insights

endeavor

EVs

Fintech

Fundraising

Gadgets

bet on

Government & Policy

ironware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

inauguration

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

reach Us

Cisco was the most active company

It ’s that metre of yr when we wait back at the twelvemonth ’s biggest tech M&A deals . Typically by this time , the usual acquisitive suspects like Microsoft , Salesforce , Adobe , SAP Oracle and Cisco have taken at least a few big swings . But this yr , only Cisco take a big morsel , ultimately annunciate 11 full deal .

SAP made a dyad smaller plenty , but Microsoft , Salesforce , Adobe and Oracle mostly stayed on the sidelines this class . The $ 61 billionBroadcom - VMware dealannounced in May 2022 finally closed last calendar month , andAdobe and Figmaagreed to terminate their $ 20 billion deal this month , which has beenstuck in regulatory limbosince it was announced in September 2022 .

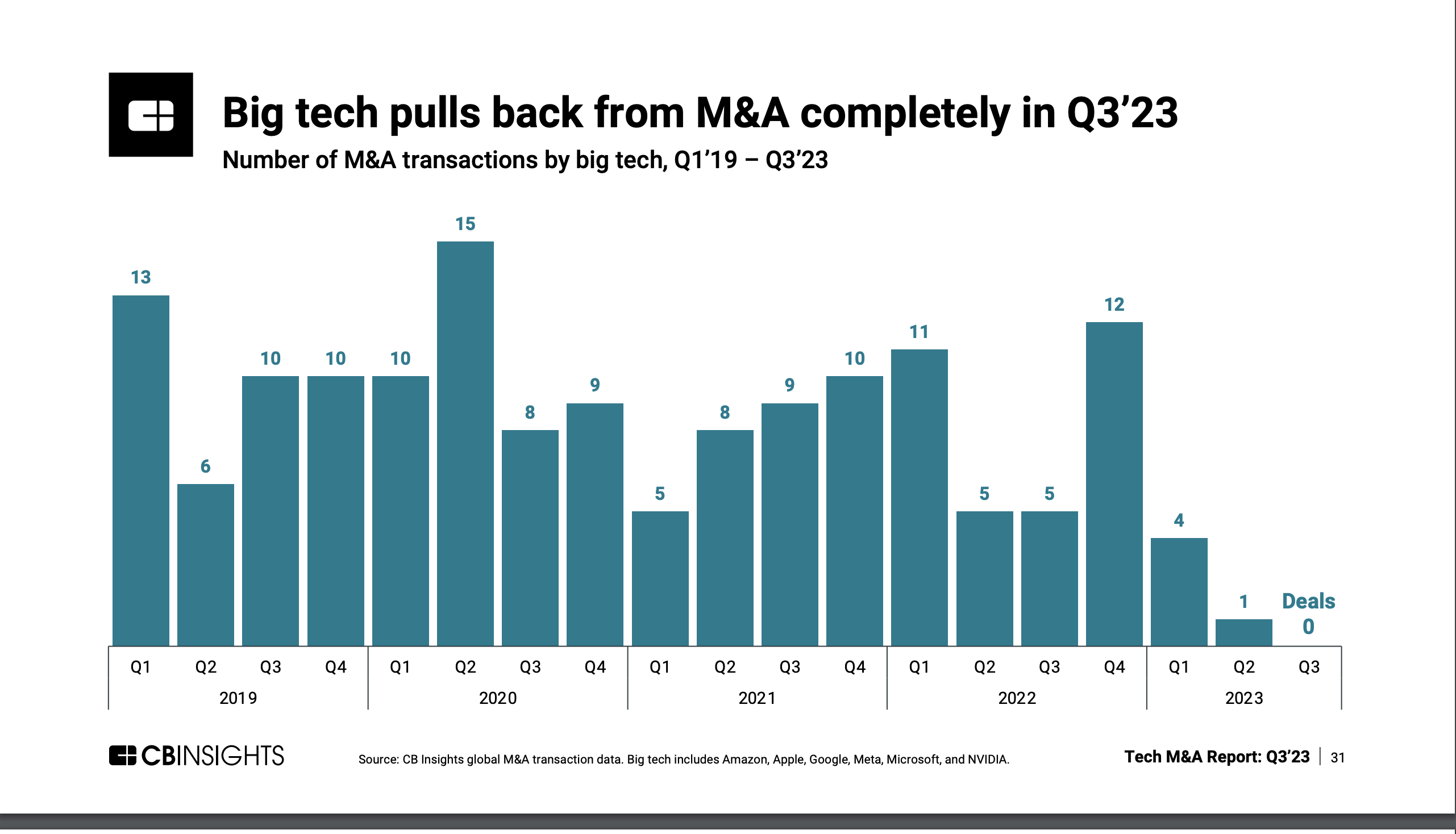

It ’s not our imagination that there are few pot from the biggest thespian . CB Insights reportedzero mess in Q3 this year from Big Tech . liken that with 2019 , when there were 10 such deals in Q3 , or with 2020 , when there were eight .

Perhaps the high cost of borrowing put a damper on the bargain we take care in 2023 . Long move are the Clarence Shepard Day Jr. of 2020 when the top dealstotaled $ 165 billion . This year it was just $ 67.7 billion , the scummy total we ’ve find since 2019 ’s all - meter low of $ 40 billion , the 2nd year we amass these top pile lists .

It ’s deserving noting that a skillful bit of the softwood this class involved private equity house either buying companies or selling them off at a skillful profits .

Maybe the smaller bargain involving AI weigh more , likeAtlassian corrupt Loomfor $ 975 million ; Salesforceacquiring Airkit.aifor an undisclosed amount , one of only two small acquisitions this yr ; orSnowflake nabbingAI hunt company Neeva , also for an undisclosed amount .

Regardless , here ’s what the top 10 go-ahead deals await like this class from cheapest to most costly :

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Databricks obtain MosaicML for $ 1.3B

This yr was about large language models and reproductive AI , and as Databricks look to focalize its datum chopine on AI , it acquire MosaicML , a gravid linguistic process manikin developer , for $ 1.3 billion .

IBM buys Software AG ’s StreamSets and webMethods for $ 2.3B

As the twelvemonth was close , IBM took another twinge at expanding its hybrid cloud support offerings when it bought a couple of pieces from Software AG , the German enterprisingness software system company owned by secret equity firm Silver Lake . Silver Lake got a substantive part ofits $ 2.6 billion investmentin Software AG back with this sale .

TPG buys Forcepoint Security for $ 2.4B

This might not have been the most exciting deal of the year , but it was still a multi - billion - buck transaction . Private equity firmTPG grease one’s palms Forcepoint Security’sgovernment surety division from Francisco Partners for $ 2.4 billion .

Vista Equity acquires Duck Creek for $ 2.6B

In another private equity play , Vista Equity Partners bought Duck Creek Technology , an insurance tech suite vendor , for $ 2.6 billion , giving the company a SaaS vendor with a solid indemnity industry niche . The party , which went public in 2020 , finally sold at a 45 % premium .

Thales Aerospace grabs Imperva for $ 3.6B

Gallic aerospace company Thales bought security measures companyImperva for $ 3.6 billionfrom private equity business firm Thoma Bravo . Thoma Bravo had purchased Imperva in 2018 in a $ 2.1 billion deal , meaning it held on to the firm for five geezerhood before turning it around for a $ 1.5 billion profit .

Clearlake Capital use up Alteryx private for $ 4.4B

Alteryx , a datum processing company that went public in 2017 after raising $ 1.4 billion ( per Crunchbase ) , was acquired by Clearlake Capital ina $ 4.4 billion dealat the final stage of the class , taking the society private .

IBM acquire Apptio for $ 4.6B

As IBM continues its chemise to a intercrossed cloud management marketer , the company bought Apptiofor $ 4.6 billion from Vista . Apptio help manage data in a intercrossed system where some is on prem and some in the swarm , which is becoming increasingly important in a world driven by AI . Vista bought Apptio in 2018 for 1.94 billion , typify a nifty $ 2.7 billion net income over the original price .

Francisco / TPG buys New Relic for $ 6.5B

New Relic once represented a Modern multiplication of program performance direction software company , but as SaaS has recede value in recent years , it became a target area for a pair of private equity firms . New Relic wassold off this yearto Francisco and TPG ( two names we ’ve already seen in separate flock on this list ) for $ 6.5 billion .

Silver Lake Partners and Canadian Pension Fund acquire Qualtrics for $ 12B

In the unusual taradiddle of Qualtrics , the company ( a once high - flying inauguration ) wassold to SAPin 2018 for $ 8 billion . The company was spin out just20 months laterandwent public in 2021before being taken individual again by a pool that included Silver Lake Partnersfor $ 12 billion in June . It ’s been quite a ride .

Cisco buys Splunk for $ 28B

The biggest mess by far this yr die to theever acquisitive Cisco . But while the society often realize small acquisitions , it has rarely , if ever , made a mega deal like the one announced in September , when it hold its purpose tobuy Splunk for $ 28 billion . It was a huge mickle , and in a class where prominent deals were miss , it was all alone at the top of the heap .