Topics

Latest

AI

Amazon

Image Credits:Bryce Durbin/TechCrunch

Apps

Biotech & Health

clime

Image Credits:Bryce Durbin/TechCrunch

Cloud Computing

DoC

Crypto

Enterprise

EVs

Fintech

Fundraising

gizmo

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

infinite

startup

TikTok

Transportation

Venture

More from TechCrunch

issue

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

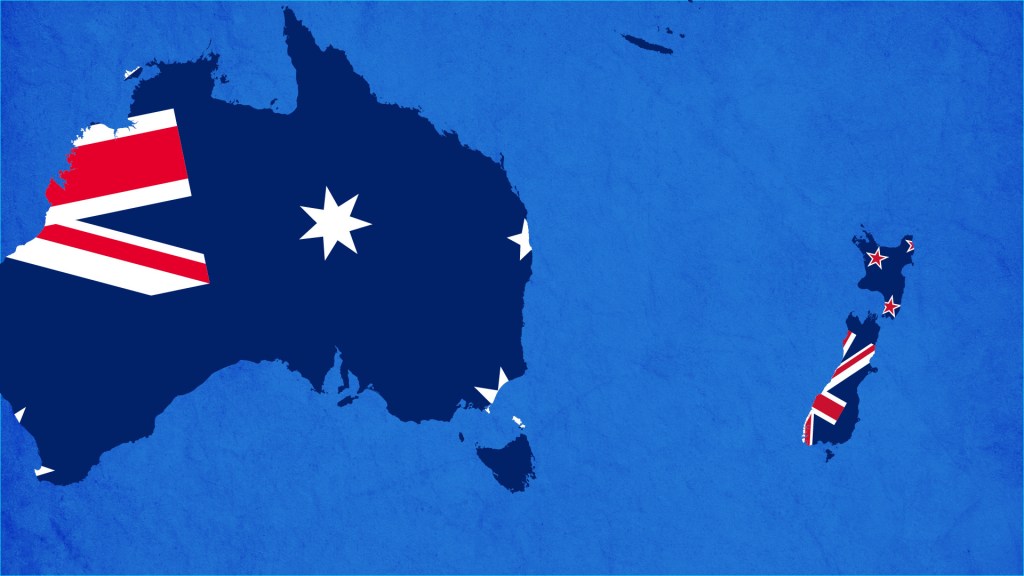

Australia and New Zealand are a far rallying cry from Silicon Valley , yet the problems and portion of their venture surround tend to be similar in nature .

Megadeals are rarer today , early - stage financial backing is up , rating have come back to earth , and investor are encourage their portfolio companies to exhibit a sustainable business with a clear path to taxation . The difference of opinion is that the geographic isolation of Australia andNew Zealandcreates a sense of hustle , if not urgency , around raising pecuniary resource and building a global production .

The Aussie and Kiwi inauguration ecosystem are new and less robust , and their markets are generally smaller than their U.S. , Asian and European counterparts . As such , startup here have a greater need to access not only outside mart , but also foreign funds , particularly if they ’re operating in uppercase - intensive industriousness like recondite technical school , and for later - stage round .

“ For the orotund legal age of Aussie and Kiwi business , their principal markets are typically offshore , ” Dan Krasnostein , partner at Square Peg Capital , told TechCrunch+ . “ Having investor on the pileus table from these markets can be helpful for originate and build local teams in those marketplace , or for finding customers . ”

Rather than a helplessness , startup from these commonwealth have turned this solidification of destiny into a potency . They know how topunch above their weight , and they know that they have to progress aglobal productfrom Day 1 .

likewise , the recent slowing of funding in 2022 and 2023 could work to the Aussie and Kiwi advantage . After all , this is a universe that had its mettle tested in the midriff of the Pacific Ocean . Doing more with less is n’t a challenge — it ’s the average .

Investors say New Zealand has ‘ all the proper fixings ’ to be a startup nation

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Craig Blair , co - founder and partner at AirTree Ventures , says the stream of capital into later - stage society has changed , but that ’s been to his portco ’s benefit .

“ working capital efficiency is being rewarded now versus growth at all costs in the bull market , ” suppose Blair . “ The bright spot is that Aussie and Kiwi entrepreneur are among the most working capital - efficient producers of unicorn in the world , and there ’s plenitude of evidence to show them jerk the growth - stage tieback vogue . ”

Just look at the fellowship that survive and thrived after the Great Financial Crisis of 2008 , like Australia’sAtlassianandCanva , and New Zealand’sXeroandRocket Lab . industriousness players believe a newfangled clutch of inauguration today will rise from this pretty - depleted backing surround to become the next round of unicorns .

investor predict today ’s capital environment and more sober valuations will lead to an increase in mature startup acquisition , strategical mergers , and joint ventures across the neighborhood . They expect to see more companies fail , which will level the playing subject field and guide to more integration and reallotment of capital , with talent focused on the most disruptive ship’s company that continue to thrive .

Read on to find out more about whatAustralianandNew Zealandinvestors think about speculation majuscule in the area today , including the challenge of compete with U.S. remuneration for top talent , the promise of climate tech and more .

Australian investors say working capital limitations push founders to ‘ new superlative of creativity ’