Topics

in style

AI

Amazon

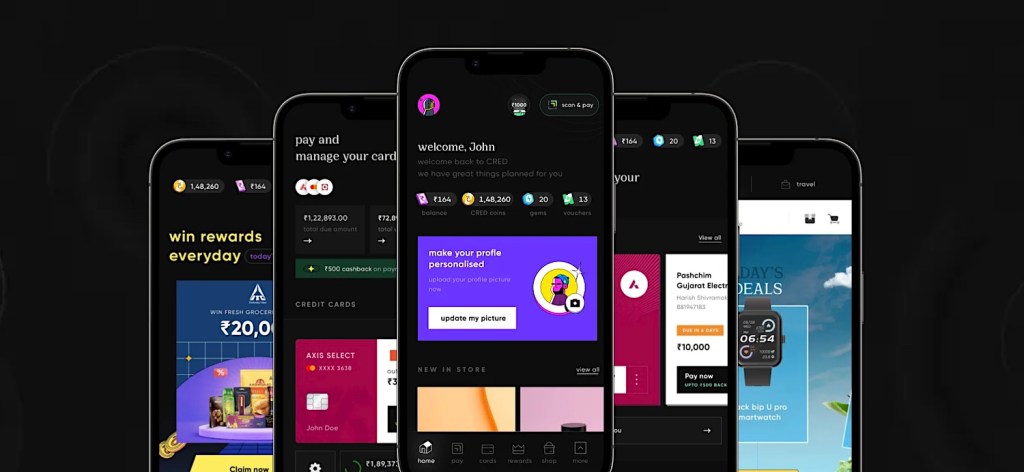

Image Credits:CRED

Apps

Biotech & Health

mood

Image Credits:CRED

Cloud Computing

DoC

Crypto

endeavour

EVs

Fintech

fund raise

gismo

gage

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

privateness

Robotics

Security

Social

Space

Startups

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

newssheet

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

meet Us

Indian fintech startup CRED has hit an agreement to buy mutual fund and neckcloth investing platform Kuvera as part of an expansion into wealthiness direction .

The $ 6.4 billion Bengaluru - headquartered startup articulate it was pull in by Kuvera ’s experienced team and expertise in enabling customers to invest straight in reciprocal fund and livestock with advisory and tracking tools .

Kuvera , which handle plus of over $ 1.4 billion for its 300,000 strong user base , has emerged as a platform of choice for many of India ’s moneyed investor . The average monthly SIP contribution on the program digest at 5,000 Amerind rupees ( $ 60 ) , more than twice the industry norm , while full mutual investment amounts over $ 14,450 are over 5x higher than the norm .

Kuvera will continue to operate as a stand - alone app following the attainment , CRED order , adding that it will research desegregation in the future . Kuvera ’s 50 - person team will join CRED as part of the learning .

“ Through our mesh with CRED we realise that our core time value of transparency , drug user value and simmpleness align beautifully with each other , ” say Kuvera co - beginner Gaurav Rastogi in a program line . “ Together with CRED we see an exciting chance to fast - track build up new products and feature for our community while also bring a trusted wealth management answer to millions more . ”

TechCrunch reported last year that CRED was intalks to adopt Kuvera . The deal involves both John Cash and stock , the business firm say . They declined to partake the precise economic value of the stack . Kuvera had raise about $ 10 million in private rounds prior to the accomplishment . The U.S. asset manager giant Fidelity will become a shareowner of CRED follow the acquisition .

“ emotional to receive Kuvera and their team into the gamey - trust street credibility ecosystem , ” CRED laminitis Kunal Shah said in a program line .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ Kuvera is super popular among financially savvy Indians ; their products and visual modality are aligned with CRED ’s principle of investing for long - condition note value creation rather than unretentive - full term entertainment . Look fore to working and sharing learnings with the Kuvera team in our mutual aim to enable financial progress . ”

CRED ’s interest in Kuvera hail at a time when the Indian fintech behemoth , which serves some of the state ’s most wealthy customers , is exposit its offerings . The eponymic app originally launched six year ago with the feature to help members pay their credit card bill on meter . It has since tot scores of features that incentivize good fiscal behavior and expand to e - commerce and lending .

The inauguration has been eyeball broadening its wealthiness management offering for some clock time . Itheld talks with Bengaluru - headquartered Smallcase in 2022 , but the talks did n’t materialize into a trade . ( CRED has made a series of investments in the past three eld , acquiring wager in LiquiLoans and CredAvenue , and buying Happay . )

Mutual funds can be a lucrative category for CRED , which process a third of all citation card payments in India by volume .

The Indian mutual fund market is one of the largest and fastest mature in the world . According to the Association of Mutual Funds in India ( AMFI ) , the assets under management ( AUM ) of the Amerindic reciprocal fund manufacture bear at more than $ 575 billion , up over 20 % from a yr ago . But the legal age of citizenry — about 90 % of the universe — still do n’t invest in mutual stock and stocks .

Native American fintech CRED ’s earnings surge 3.5x to $ 168 M