Topics

Latest

AI

Amazon

Image Credits:Jagmeet Singh / TechCrunch

Apps

Biotech & Health

Climate

Image Credits:Jagmeet Singh / TechCrunch

Cloud Computing

Department of Commerce

Crypto

Apple Watch Ultra lookalike available online in India at about $9.Image Credits:Flipkart

endeavour

EVs

Fintech

Image Credits:TechCrunch / IDC

Fundraising

gizmo

bet on

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

startup

TikTok

transferral

Venture

More from TechCrunch

case

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

The world’s biggest smartwatch market has seen a deluge of new devices in the past few months

India ’s smartwatch market has transformed , seemingly overnight . For year , it has been dominated by its homegrown actor , while global giants like Apple and Samsung have struggled for bearing , amid the C of millions of one-year shipment . dead , however , the family has been glut with unknown brands , which have no prior and meaning creation . These have start pull in customer focus and are expect to eventually push the marketplace toward a consolidation stage .

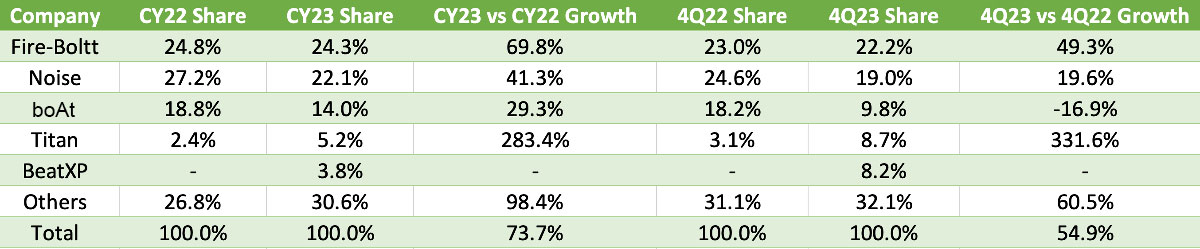

domesticated brands like Fire - Boltt , Noise and boAt have dominated the category , making up more than 60 % of the total market . Apple and Samsung , on the other hand , vanish from 4.5 % to a little over 2 % share combined , with 1.1 million units shipped in 2023,according tomarket intelligence firm IDC .

Meanwhile , new entrants have determine a surge in their market share from three to 3 - 5 % in 2020 to 15 - 20 % last year . Vikas Sharma , senior market analyst for wearable devices , IDC , told TechCrunch that the category now accounts for 134.2 million unit annually .

These brands sometimes carry an unrecognized name or are clone of plant products . Many are direct copies of self-aggrandising ball-shaped brands like Apple and Samsung , priced at less than $ 12 ( 1,000 Native American rupees ) . The Apple Watch price in India set about at $ 360 ( 29,900 Indian rupees ) for the Apple Watch SE , while the Samsung Galaxy Watch 4 retails at $ 290 ( 23,999 Indian rupees ) . The Indian smartwatches from firebrand such as Fire - Boltt , gravy boat and Noise start out from $ 12 .

Unlike the more expensive example , off - brand product generally have no guarantee . In some cases , the retail merchant offer customer a transposition warranty , but that is , too , not provided by the manufacturer and given merely on a musical composition of paper or even verbally . Fitness trailing metrics are often inaccurate due to deficient selection of sensors to save costs , while the ironware / software jazz group leaves much to be hope . Nevertheless , the accuracy — even on the smartwatches offered by established Amerind players — sometimes does not equalize that of the Apple Watch or Samsung Galaxy Watch , as these seller compromise on sensor quality to maintain affordability .

“ The accuracy of the sensing element is not proficient enough [ across most low-priced smartwatches ] to provide the same level of user experience , which users get in a premium model , ” Counterpoint ’s senior research psychoanalyst Anshika Jain narrate TechCrunch .

Sharma pointed out the aesthetics , which make these strange branded model resemble the Apple Watch and Apple Watch Ultra or some high - end rounded smartwatches , as well as affordability , help them gain customer tending .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Hong Kong - based market psychoanalyst firm Counterpoint Research has observed the identification number of unknown brands in the Indian smartwatch market has grow from 78 in 2021 to 128 in 2023 .

“ There has been almost 80 - 90 % growth in the telephone number of unknown steel , ” said Jain . “ This clearly indicates how the market has become more crowded now . ”

She noted the figure the analyst firm has observed for the last duo of years : Most unknown make go forth during the third quarter — around the time of the festive time of year in the land — and remain active for one or two stern before disappearing completely . Additionally , these are likely lily-white - label products imported from China at dirt - meretricious prices or assembled by an Indian electronics manufacture services partner , she said .

Declining prices

The maturation of unknown brand in the Indian smartwatch market has not yet importantly impact all the local firms dominating the market . However , the be player are conservative . Some established local brands have part feeling the warmth . to boot , the growing market place share of unknown brands has reduced the middling selling price ( ASP ) .

Sameer Mehta , co - father and CEO of Warburg Pincus - backed boAt , say TechCrunch the decline in ASPs is as high as 90 % .

“ Overall volumes have started go down , ” he said . “ ASPs have declined by , say , 90 % , which fundamentally does not get along well for any industry . differentiate me one industry where the price erosion strive 90 % in just one year . ”

Market analyst have also observed a massive fall in the ASP , though not as solid a drop as Mehta mentioned .

Jain of Counterpoint , meanwhile , enounce the ASP dropped by around 39 % to $ 36 in 2023 from $ 59 in 2022 . “ There ’s a hatful of froth at the bottom , which is just work in devices and putting it out in the market . Once that drop dead away , there will be some sanctity . Everybody will stop investing in the business if nobody is making money in the business . ”

boAt , India ’s third - precede smartwatch stigma , go steady a 17 % declination in twelvemonth - on - class growth in the fourth quarter , per IDC . The smartwatch business lead about 20 % of the startup ’s revenues .

Mehta say despite date some wallop from the unrecognized make , gravy holder would continue to generate 15 - 20 % of revenues from smartwatches in the next couple of years .

Unlike boAt , Fire - Boltt and Noise ( the top two mark ) , see year - on - year growth in the same quarter .

Gaurav Khatri , atomic number 27 - founding father of Bose - gage Noise , tell TechCrunch the startup did not see any notable impact from the “ constant inflow of fresh entrants and blade . ”

Moves to retain the market

Market expert consider the on-going shift with obscure brand blow up their bearing will pretend all key actor — unless the dominants change their scheme and add up more value to their future smartwatches .

Currently , market officeholder primarily target first - time buyers — exchangeable to strange brands . alternatively , psychoanalyst believe that give brands should target existing customers .

“ the great unwashed are not opting for these [ established Indian branded ] smartwatches for their next purchase with the same level of exuberance for the first leverage … the main reasonableness is plain the customer experience and user user interface of these machine , which is not that smooth , ” say Counterpoint ’s Jain .

Most established Amerindic players do not focus on institute distinctive worthful feature to smartwatches , unlike their big - tech counterparts admit Apple and Samsung . Smartwatch makers in the country also sometimes use the same Taiwanese original design producer [ ODMs ] , limiting product specialisation . Many of these models even yield an preternatural resemblance to Apple and Samsung . However , Indian brands claim to uprise printed circuit boards topically , and figure package experiences in - household , distinguishing themselves from spherical players . Local assembling essentially avail manufacturers avert import duties that are 20 % .

Last year , smartwatch brand name boAt and Noiseentered the saucy ring marketin India to branch out their product catalogue . However , the wise anchor ring market in India , which saw more than 100,000 cargo in 2023 , is led by Ultrahuman , with a percentage of 43.1 % in Q4 , per IDC .

Mehta of gravy holder told TechCrunch the inauguration is look to focus on creating different class in the smartwatch marketplace , such as new models aimed at kids and the elderly , sports and health , to keep on its presence . likewise , it is looking to project its new smartwatches for second- or third - time emptor , who are more cognizant of their health and wellness and look for good - quality devices . Nonetheless , these modification will increase the pricing of boAt smartwatches .

That order , market analysts like IDC ’s Sharma predicts the Indian smartwatch market will see only individual - digit ontogeny this year due to stiff challenger from unknown brand and dropping ASPs . The market used tosee over 150 % twelvemonth - on - year growthin the former years .

Sharma also believes that the smartwatch market place may consolidate in the coming duet of years , and fewer players would be left .

“ There will be a flatline coming in the next two years … it all pick up after COVID , and now it ’s gone to a sky stage … we ’ll before long see a intensity detail , ” he said .