Topics

Latest

AI

Amazon

Image Credits:Christopher Pike / Bloomberg / Getty Images

Apps

Biotech & Health

clime

Image Credits:Christopher Pike / Bloomberg / Getty Images

Cloud Computing

Commerce

Crypto

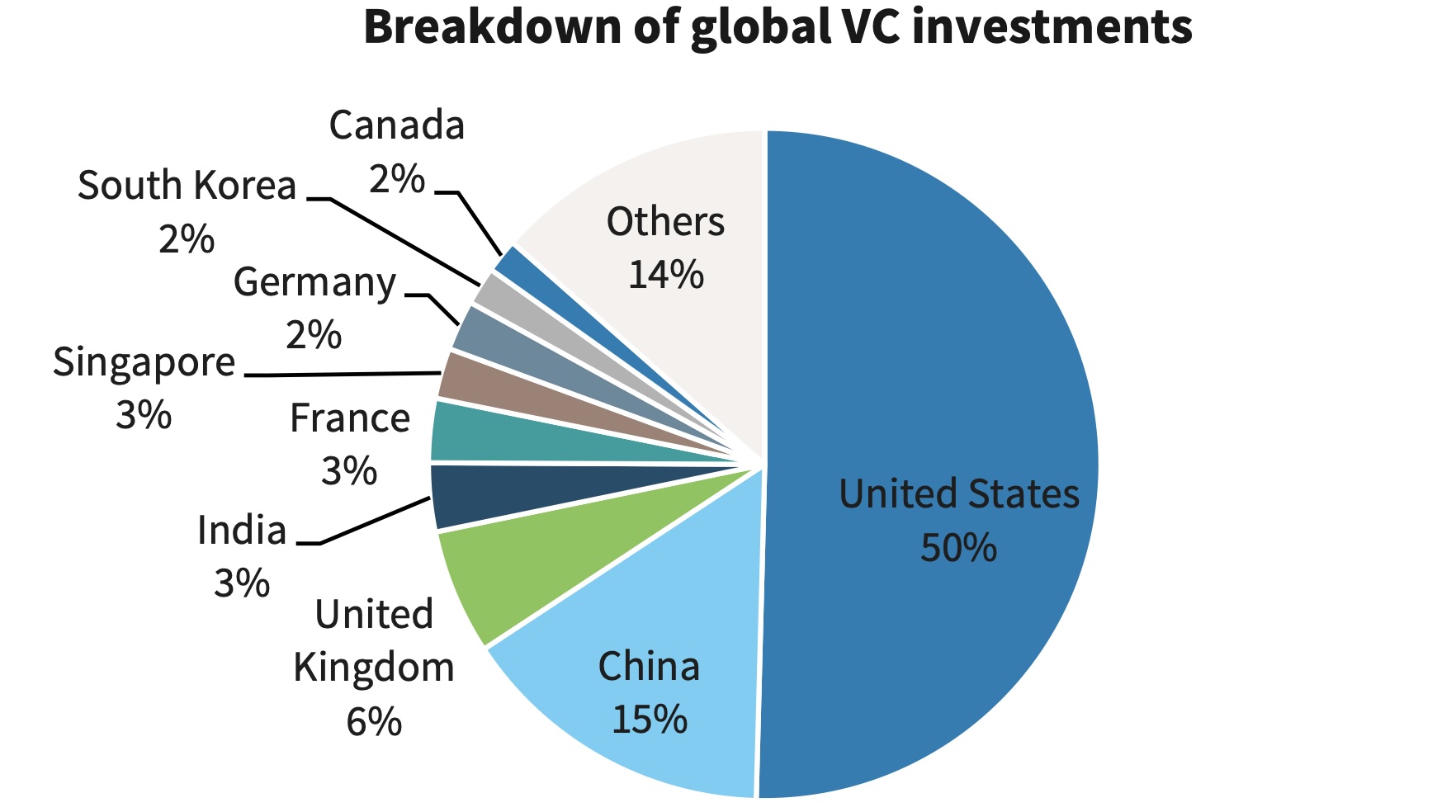

Top VC markets, by volume of investment in 2023.Data:PitchBook and Barclays

endeavor

EVs

Fintech

fund-raise

contraption

Gaming

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

blank

startup

TikTok

Transportation

speculation

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Indian startups have raised about $7 billion this year, according to market intelligence platform Tracxn, down from about $25 billion in 2022 and $37 billion in 2021

High - flying venture investor in India managing C of zillion of dollars are tempering expected value , making former - stage startup bets that in good - character scenarios they trust will yield 3 - 5x invested capital .

Several leading India investor , including Peak XV Partners , Elevation Capital , Lightspeed , Nexus and Accel , have raised $ 500 million - plus in the past two yr , hearten by earlier home run and immense mart potential difference .

However , the die hard humor has budge this year . Investors are increasingly cautioning that they are struggling to discern fund - returning opportunities — their latest headache in the earth ’s most thickly settled body politic . ( A VC with a latterly raised fund below $ 250 million asserted that investment firms wielding $ 500 million or more in capital reserve present corking difficulty deploy those assets productively . )

VC firms generally make between 20 to 30 investments per fund , wager on a choice few startups that can potentially generate oversize riposte to compensate for other going . These firms aim to have two - three of their portfolio companies drive the absolute majority of a fund ’s capital amplification . This strategy of pursuing in high spirits - risk , high - reinforcement deals is especially coarse among early - stage investor who allocate most of their fund capital into young startup in hopes of catch in early on the next self-aggrandising thing .

Theglut of capitalhas contribute India investors to turn abnormally conservative and choosy , founders and investor said . business firm are scrutinizing deals at Series A and vitamin B complex stages for up to six months now , said an investment banker , when such deals once took far less diligence . India ’s sovereign stock has been evaluating an investment in agritech startup WayCool for more than six months at this point , allot to two masses familiar with the issue . play inauguration Loco has also arrest talks with investors to raise about $ 80 million , but more than six months later no deal has materialized .

Bessemer Venture Partners ’ India squad has ink just one new nett quite a little this year , according to people conversant with the matter . One investor remarked that Bessemer is taking months and month in due industriousness and maintaining a high point of skepticism .

Anant Vidur Puri , a partner at Bessemer Venture Partner , confirmed the firm has only done one net new investment in India this twelvemonth , pronounce the fund is “ roadmap pore ” that looks to construct a concentrated portfolio of gamy - timbre investment and often wish to duplicate down on existing backings .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ We are also stage agnostic so can add up in at Seed , Series A , B or coulomb and look to retain to back our investment over stage , consistent with the saturated portfolio strategy . Some years we do 6 - 7 unexampled deals and some years we do 0 as well which could depend on when we see attractive and compelling investments in the market , but on an norm we do n’t do more than a handful of new investiture each yr , ” he told me in a text edition substance .

Mirroring the sluggish investment pace in startup ecosystem globally , Native American startups have secured just about $ 7 billion in cap in 2023 , fit in to market intelligence agency platform Tracxn , down from about $ 25 billion in 2022 and $ 37 billion in 2021 . In fact , it ’s the lowest infiveseven years , even as Tracxn said five . ( Only two Indian startups — Zepto — and InCred — enter the unicorn golf club this year . )

Late - stage financial support experienced the steepest decline , plummet over 73 % twelvemonth - over - yr . Moreover , the number of mega - rounds above $ 100 million totaled just 17 for the year , a 69 % drop-off compared to 2021 .

Some investors said they are taking more precautions because of the dwindling value of many of the top Indian startups , something they say has forced them to reconstruct their marketplace dissertation for India .

Prosus recently slashed the evaluation of Byju ’s tobelow $ 3 billion . ( Byju ’s , which has produce over $ 5 billion to date , was assess at $ 22 billion early last year . ) Pharmeasy , once appraise at $ 5.4 billion , recentlyraised working capital at a 90 % discount . Vanguard has trim down the rating of drive - herald hulk Ola by more than 60 % . Food delivery giant Swiggy , merchandiser payments platform Pine Labs , and SaaS Gupshup have all also face write - downs this twelvemonth . Reliance and Google - backed Dunzo , which has raised more than $ 500 million , isstruggling to make payroll department , and BNPL startup ZestMoney , which enhance over $ 130 million , isshutting down .

India - focused investor are also progressively growing bearish on Southeast Asia . In late years , firms like Peak XV and Lightspeed expanded into the part , backing many other - leg startups , some of which became freehanded winners .

However , some large investor now harbor apprehensions , saying too much capital chases too few practicable Southeast Asia deals , billow valuations and diminishing potential returns . ( In a late interview , Peak XV tell it remains very bullish on Southeast Asia . )

Investors also question whether they have overestimated India ’s SaaS chance . “ Everyone underwrote product risk , companies were able-bodied to build products . No one has been capable to sell / graduated table gross beyond a meaningful point , ” a U.S.-based early - stage India investor sound out , lend that very few companies have been able to founder into American web to trade to U.S. ship’s company .

Dev Khare of Lightspeed Venture Partners Indiasaidthere have been fewer than 100 transaction for Indian enterprise software program startups across seed through growth in 2023 . The securities industry continue very focussed on seed transaction , and the Series A round is the “ chokepoint . ”

“ one C of seed done in India in 2021/2022 are finding it strong to give away into enterprise budgets given muscle contraction in budgets and/or many are me - too’s / lightheaded features , ” he wrote .