Topics

late

AI

Amazon

Image Credits:Nasir Kachroo / NurPhoto / Getty Images

Apps

Biotech & Health

clime

Image Credits:Nasir Kachroo / NurPhoto / Getty Images

Cloud Computing

Commerce Department

Crypto

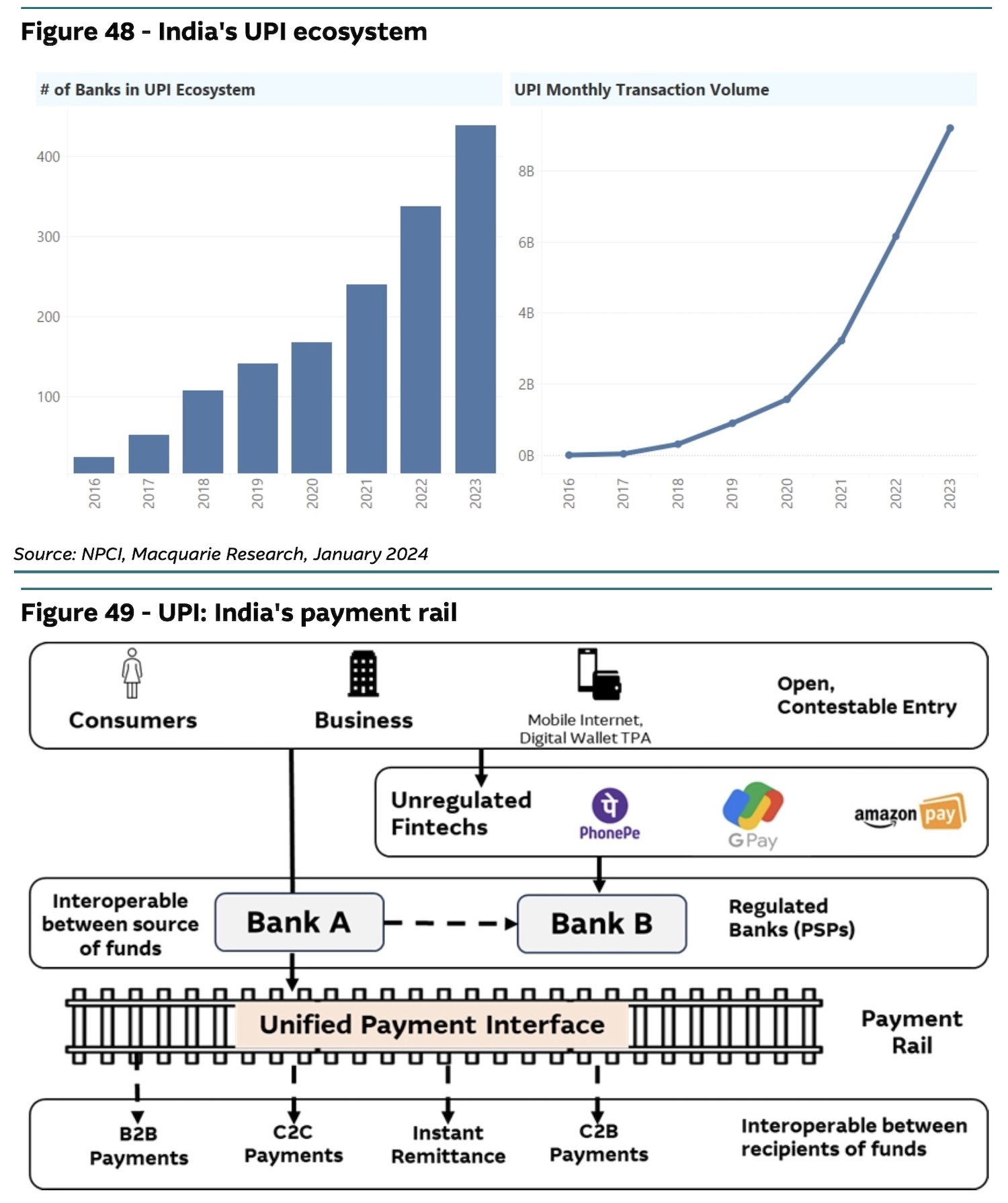

An overview of India’s UPI ecosystem.Image Credits:Macquarie Research

Enterprise

EVs

Fintech

fundraise

gismo

game

Government & Policy

computer hardware

Layoffs

Media & Entertainment

Meta

Microsoft

privateness

Robotics

Security

societal

Space

Startups

TikTok

transport

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video recording

Partner Content

TechCrunch Brand Studio

Crunchboard

meet Us

The National Payments Corporation of India ( NPCI ) , the body overseeing the country ’s widely used Unified Payments Interface ( UPI ) mobile payment system , is going to meet various fintech startup this calendar month to develop a strategy to address the rise market potency of PhonePe and Google Pay in the UPI ecosystem , source familiar with the matter told TechCrunch .

NPCI executive project to forgather with spokesperson from CRED , Flipkart , FamPay and Amazon , among other players , to discuss primal initiatives aimed at boost UPI proceedings on their respective apps , and to realise the assistance they require , the beginning said .

UPI , built by a concretion of Indian banks , has become the most popular elbow room Indians transact online , and the system is tell to serve more than 10 billion transactions a month .

These new meetings are part of a growing effort to address concern elevate by lawgiver and diligence instrumentalist about the market ascendency of Google Pay and PhonePe , which together describe for near 86 % of UPI transactions by volume ( that ’s up from 82.5 % at the end of December ) . Walmartowns more than three - fourths of PhonePe .

Paytm , the third - largest UPI player , had by March 31 ascertain its market share decline to 9.1 % from 13 % at the end of 2023 , followinga clampdown by the Reserve Bank of India(RBI ) .

The conversation comes after the cardinal bank carry its “ displeasure ” to the NPCI over the growing duopoly in the payment infinite , a individual familiar with the issue aver . An NPCI spokesperson declined to comment .

In February , a parliamentary panel recommend the Indian government tosupport the outgrowth of domesticated fintech playersthat can put up alternative to PhonePe and Google Pay .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

The NPCI has long search to limit the market place part of single UPI service provider to 30 % . However , the body recently last yearextended the deadlinefor firms to comply with this directive to the end of December 2024 . The organization faces a singular challenge in enforcing this directive : It believes that itcurrently lack the technical mechanics to do so .

India ’s central camber is also weigh an bonus plan aimed at creating a more prosperous private-enterprise arena for issue UPI player , another person familiar with the matter told TechCrunch . The Economic Times separatelyreportedon Wednesday that the NPCI is encouraging fintech companionship to offer incentives to substance abuser for making UPI transactions on their respective apps .