Topics

Latest

AI

Amazon

Image Credits:Aparna Jayakumar / Bloomberg / Getty Images

Apps

Biotech & Health

Climate

Image Credits:Macquarie

Cloud Computing

Commerce

Crypto

enterprisingness

EVs

Fintech

fundraise

Gadgets

Gaming

Government & Policy

ironware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

blank

Startups

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

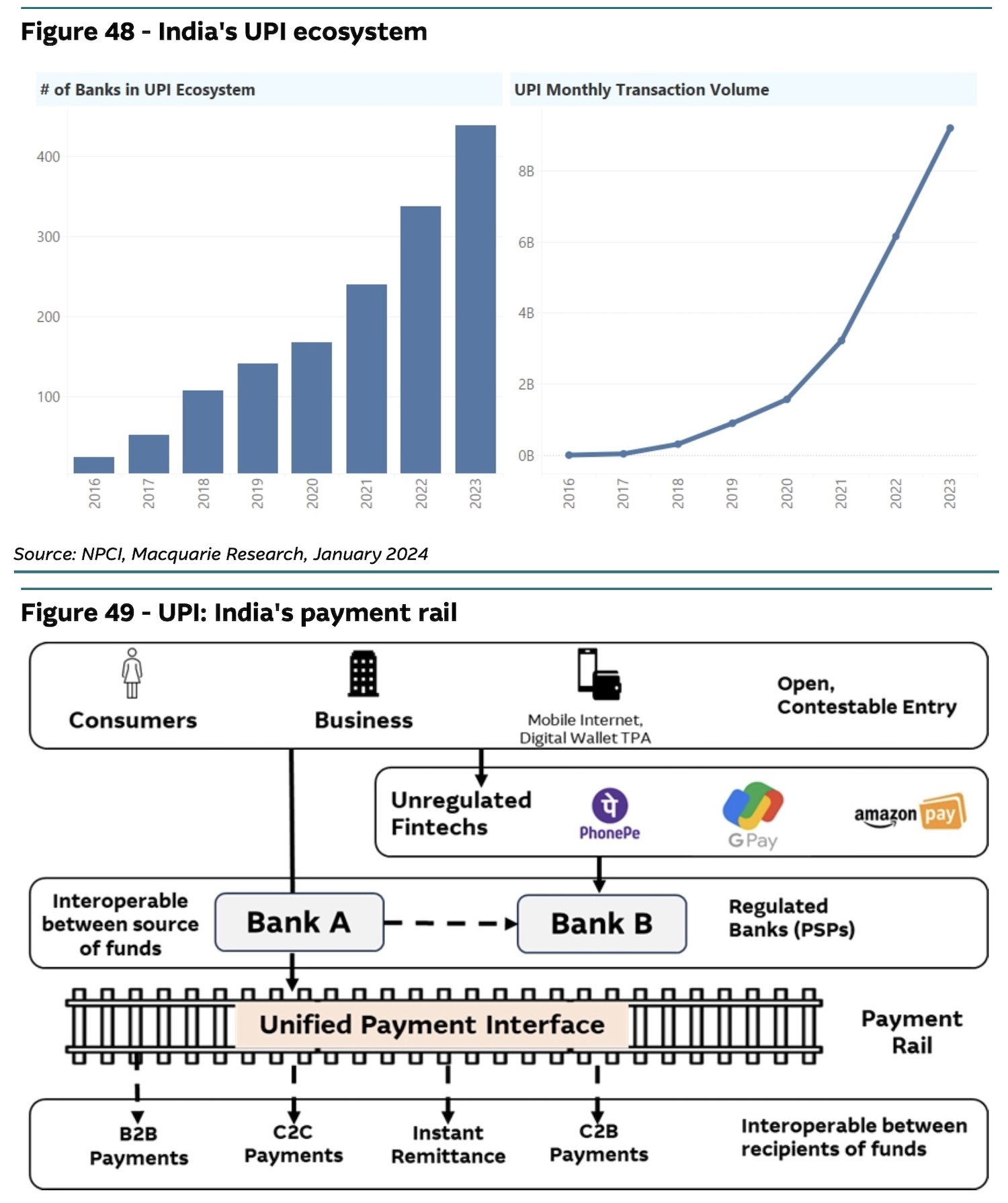

India is face a quandary in enforcing long - delay convention to cut back the dominance of PhonePe and Google Pay in the country ’s ubiquitous UPI payments internet , which processes over 10 billion transactions monthly .

The National Payments Corporation of India ( NPCI ) , a special unit of the Indian cardinal camber , wants to limit the securities industry share of case-by-case companies in the democratic Unified Payments Interface ( UPI ) system of rules to 30 % , a long - delayed effort to stamp down the dominance of Walmart - indorse PhonePe and Alphabet ’s Google Pay , which together control over 83 % of the maturate payments market . However , with rival Paytm nowstruggling after rigorous regulatory action , the NPCI face an knifelike challenge in bringing down the command share of the extend duopoly : It does n’t sleep with how to .

The NPCI officials think there is a proficient roadblock to achieving the goal and have sought manufacture actor in late quarters for ideas , two informant conversant with the office said . The NPCI , whichdelayed enforcing the ruler to 2024 , correct to comment Tuesday .

Its dilemma has come into focus again after a parliamentary venire asked New Delhi last week to support domestic fintech firms tocounter the dominance of PhonePe and Google Pay . The recommendation hail after the central bank place Paytm to stop several operation at Paytm Payments Bank , the associate entity that processes dealings for the financial services radical .

India ’s real - time digital payments system , UPI , has radically transform the country ’s payment landscape since its launching in 2016 . The UPI net feature about 500 bank building , 70 million merchants and a monthly transaction book surpass 10 billion .

The NPCI originallyproposed(PDF ) a stoppage on the mart share to palliate risks on the organization and to “ smoothen out all the proceedings in the UPI ecosystem . ” At the time of the proposal , PhonePe and Google Pay commanded under 80 % of the UPI market .

securities firm house Macquarie on Tuesdaydramatically cut its 12 - calendar month price target on Paytmover concerns that its lending partners and its customers may provide the political program . Macquarie , whose price objective inculpate a valuation of $ 2.1 billion for Paytm ( accept into account that Paytm has a $ 1 billion in cash equaliser ) , said the Noida - headquartered firm is “ fight for its survival . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Paytm ’s further loss of market share would benefit the top two , manufacture executive director caution . Citing official data , the parliamentary panel say PhonePe had 47 % and Google Pay 36 % securities industry share during October through November 2023 .

Industry executives say the only way for PhonePe and Google Pay to follow with the 30 % jacket is to stop adding raw users . In the meanwhile , PhonePe continues to spend on merchandising to take more portion .

India ’s primal money box , in the lag , is begin to suggest that perhaps a few thespian commanding the UPI marketplace plowshare is n’t really a trouble . The RBI Deputy Governor Rabi Shankar said at a press conference last week that the primal bank building has no care about UPI apps becoming too big , and how great someone becomes is for the “ securities industry to settle . ”

“ The market forces have to play out such that this percent is more evenly divide . We will not be interfere in the securities industry cognitive process to ensure the 30 % detonator that in any case is an NPCI essential . ”