Topics

modish

AI

Amazon

Image Credits:David Garb Photography

Apps

Biotech & Health

Climate

Image Credits:David Garb Photography

Cloud Computing

Department of Commerce

Crypto

Image Credits:Panax

Enterprise

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

concealment

Robotics

Security

Social

Space

Startups

TikTok

Transportation

Venture

More from TechCrunch

outcome

Startup Battlefield

StrictlyVC

newssheet

Podcasts

telecasting

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

High interest rates and fiscal pressures make it more important than ever for finance team to have a better handle on their immediate payment flow , and several startups are hoping to help .

Two - class - old Israeli startupPanaxis one , and it just bring up a $ 10 million Series A round of financing leave byTeam8 , with participation fromTLV Partners .

inauguration have had some lot going after theCFO stackby streamlining processes and freeing up time to shape on strategical tasks . SVB ’s collapsecreated tailwind for the cash management category , which includes players such asEmbat , Kyriba , StatementandVesto .

Unlike some of these , Panax is focused on midsize and heavy companies in traditional industries such as manufacturing , logistics and real estate . While they take more than startups do , they do n’t always have the character of large treasury department that legacy solutions provide to .

Target apart , Panax also hop to differentiate itself in its offering , and not just by including investment accounts and citation lines in its view .

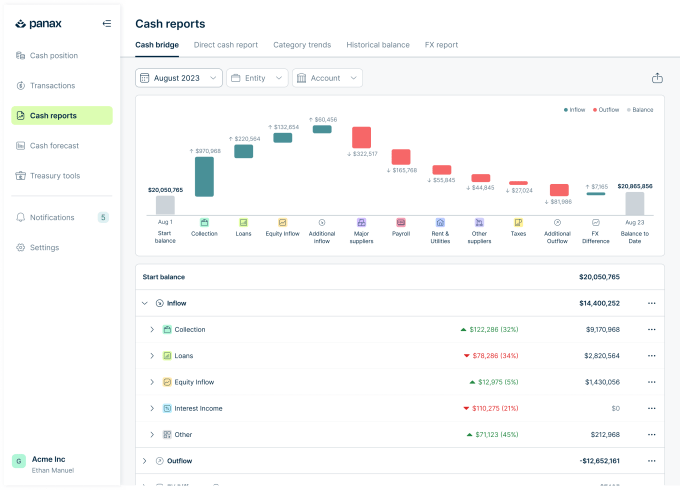

While visualise hard currency flow is helpful , Panax wants to go further than cater a splashboard , Panax CEO Noam Mills told TechCrunch . She thinks helping their client requires “ using data to empathise what ’s really important , influencing those decisions and facilitate them manage [ their treasury ] . ”

This time value suggestion seems to resonate with Panax ’s other adopters , which let in companies such as public beauty - focused companyOddity , and for which John Cash management mechanization is a sentence and money recoverer .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Bringing its entire funding to $ 15.5 million follow a $ 5.5 million seed rung head by TLV Partners , this new round will avail Panax scale its go - to - marketplace glide path and build a more rich AI and data squad now that it has enough datum for this , Mills said .

AI already act an crucial role at Panax : It helps the inauguration make sense of all the fiscal information it puts together , but also name insights and forecast cash current . For Mills , coat action items is where AI can really help . “ Oftentimes there ’s no schematic treasury section [ … ] so we see AI as a great enabler to be proactive and raise the right flags for the guest . ”

The node Panax is going after are ship’s company with complex treasury management needs ; typically , they manoeuvre in several position in currencies . Foreign exchange is one aspect Panax can help optimize , and this could drive additional for the company besides its SaaS model , which is priced based on the complexness of each client ’s operations .

There are many stakeholder hoping to get a share from help companies optimize their cash flow . For instance , they could apply for loans and request sour capital or credit billet from their banking app or from their accounting software interface . But Panax has a card to play as a one - stop treasury management dashboard that integrates good word and projection .

Panax ’s finish , Mills aver , is that finance squad wo n’t have to go anywhere else to execute decision they should make . “ [ That ] if we bring them the insights , they can move more cash into pastime bear accounting . imbed that functionality within our chopine is something that we see as really tightly attached to our note value proposal , and those are also things that we ’re developing across many unlike usage fount with money bowel movement . ”

grind ’ understanding of these needs number from her experience in private equity , which she share with chief commercial enterprise officer and co - founder Niv Yaar . But her personal background is quite unique : Before her roles in PE and incorporated finance , she was anOlympic fencer for Israel , and win several titles in her home country .

Asked what her jock past and CEO part have in common , she spotlight similar psychological requirements , such as perseverance and the ability to make do with uncertainty . But fencing is an single athletics , when running a ship’s company “ is more like a squad summercater . ”

“ There is competitor for talent everywhere [ but ] the mysterious roots we have in the R&D community in Israel through our CTO and the founding team gives us somewhat of an reward competing for talent , ” Mills said .

mill carry that mesh outcome will also play a role in New York City , where Team8 has an office . But she and her atomic number 27 - founder also pick the metropolis because of the additional overlap with Israel ’s time geographical zone compare to the Bay Area , and because of its relevance for fintech . “ The heart for that is more in New York and the East Coast , ” Mills said .