Topics

in vogue

AI

Amazon

Image Credits:Nigel Sussman(opens in a new window)

Apps

Biotech & Health

Climate

Image Credits:Nigel Sussman(opens in a new window)

Cloud Computing

Commerce

Crypto

Image Credits:Twilio

Enterprise

EVs

Fintech

Image Credits:Twilio

Fundraising

Gadgets

back

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

quad

inauguration

TikTok

transferral

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video recording

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Twilio ’s chief operating officer and co - founder , Jeff Lawson , is stepping down from his role and his seat on the society ’s board , following month of pressure from activistic investors and several quarters of slowing revenue growth . Khozema Shipchandler , Twilio ’s president and a former GE denizen , is taking over as CEO .

The Exchange explores startup , market place and money .

investor seem to be cheer the determination , with shares of Twilio up about 7 % this morning , though they could also be happy that the troupe articulate it would cover its quaternary - quarter tax income , adjusted income and full - year adjusted income above its old forecast .

While the timing of the move was a surprise , it ’s not a massive shock to see Lawson heading for the exits . investor havelong made exonerated their discontent with Twilio ’s late functioning , and at some point , either the final result meliorate or something change at the top . And while the companionship did enkindle its very pocket-sized forecast , this move may imply that its growth story did not better as much as the board or militant want during the 4th quarter .

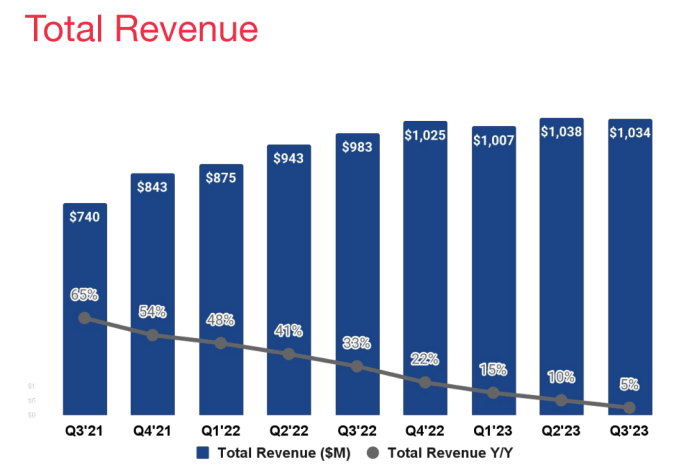

How is the company performing ? In itsthird quarter , Twilio ’s revenue increase 5 % to $ 1.03 billion from a year before , and at the time , Lawson give the results a electropositive hang-up in his official commentary , touting “ another record stern of non - GAAP income from operations and free immediate payment flow . ” Investors did not view the shape as favorably , though , and were seemingly more focused on the party ’s anaemic and slowing rate of revenue growth .

For the 4th quarter of 2023 , Twilio project that growth would slow even further , falling to 1 % to 2 % , though now with the company anticipate better results than expect , we ’ll have to wait and see what it really care as the year come to a close .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

What does Lawson’s exit tell us?

A few things . First , activistic press on companies is not something that can always be improve by a board shakeup or little changes to procedure . secondly , we instruct that while some technical school companies haverecently survived their meter in the activist barrelwith their CEO in position , that wo n’t always be the case .

I expect that the investors leaning on Twilio for change wo n’t take the leaders change , and the ensuing grocery reaction , as impetus to dolesssimilar work in the future . tardily - grow software companies that remain unprofitable on a generally accepted accounting principles basis , take banknote : Here there be activists .

The company ’s stock peaked at more than $ 345 back in early 2021 , but the downswing see it start last year at around $ 50 per part . Today , Twilio stock is worth about $ 74 per plowshare , accounting for the recent spindle .

part drive those declines was a firm angle of dip in revenue growth :

And that , in turn , was part predicated on the next trend :

We can see that Twilio ’s tax revenue maturation has slow down in line with its dollar - based net expanding upon charge per unit . In essence , Twilio ’s rapid increase was heavily predicated on its customer foot spending more on its products over time , but when that well ran juiceless — similar to how nearly every software fellowship has been dealing with customers tightening disbursal — the companionship ’s growth charge per unit fell .

brute .

Still , I do n’t recall that we should consider these termination to be Lawson ’s legacy . Sure , the company has had a problematic time lately , but that was just the final chapter of a very tenacious record . Twilio did what it set out to do : Build a immense business , make its investors a mint , and breed its worth after going public . That ’s a grand barb in the creation of startups .

I am also not convince that the strategic moves that some of its activist investors want to see — more on that here — make much sense . So when we debate Lawson ’s incumbency , I believe that the mass of what ’s happened is the real chronicle , and the last few years are more a result of a hot company suffering in a suddenly colder economy .

That ’s not to say that mistake were not made . The company overhired , which led tosuccessive staffing cutsthat were painful , regular reminder of its struggles . You could also brabble about its cost base more mostly , among other thing . Still , this company enjoys run - rate receipts of $ 4 billion and generates lots of cash . That ’s impressive , stop .

Perhaps the example here is that the adept a software business model is for client , the more variable result will prove as the economy evolves . When the market was hot , Twilio spring up like the proverbial weed and was handsomely rewarded by the stock market . But when the economic system slow up , that picture turned upside down . A business model that charges for what you need is keen when customers ask and require more , but when initiative clients are trying to find deliverance , your line will be less protected from those cost cuts than , say , a traditional SaaS fellowship .