Topics

up-to-the-minute

AI

Amazon

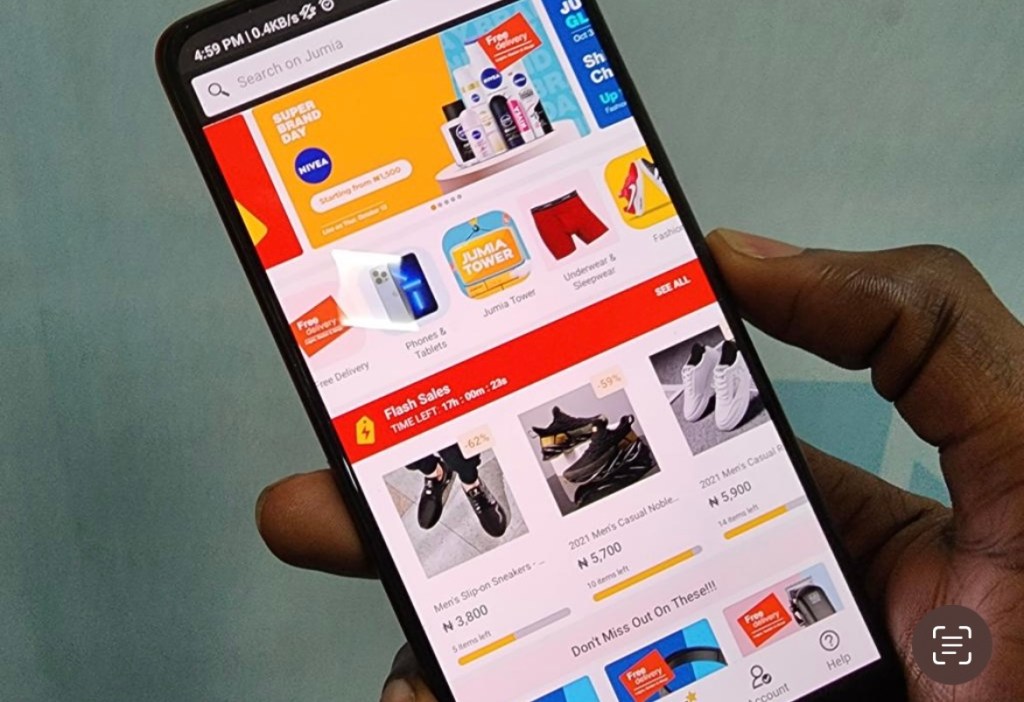

Image Credits:Jumia

Apps

Biotech & Health

Climate

Image Credits:Jumia

Cloud Computing

Commerce

Crypto

Enterprise

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

computer hardware

layoff

Media & Entertainment

Meta

Microsoft

privateness

Robotics

Security

Social

Space

startup

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

get hold of Us

In 2023 , Jumia revised its adjusted EBITDA loss direction thrice : $ 100 million to $ 120 million in Q1 ; $ 90 million to $ 100 million in Q2 ; and $ 80 million to $ 90 million in Q3 , aiming for a 57 % to 61 % year - over - year reduction if meet .

The company exceeded these expectations and significantly outperformed in that regard . It ended the year with $ 58.2 million in adjusted EBITDA loss , mark a 68 % decrease from 2022 , and Q4 concluded with less than $ 1 million in aline loss , a 99 % decrease . Jumia ’s operating red ink lessen by 90 % to $ 4 million that quartern and by 64 % to $ 73 million for the entire year , leading to an improved fluidity position , closing the year with $ 121 millionaccording to its Q4 2023 and full - year financials .

These losses were reduced primarily by decreased revenue enhancement provisions in specific countries , a nonrecurring issue that occurred in the last quarter of 2023 . Also , significant decreases in sales and advertising expense , down 63 % year - over - year , and ecumenical and administrative expenses , down 54 % year - over - class , contributed . For the latter , Jumia’snotable exit from the food delivery businessin Q4 led to layoffs and departmental restructuring , resulting in a 17 % drop-off in staff price within G&A expenses year - over - year .

“ We ’ll continue looking for more efficiency whether on a daily , monthly , or weekly basis . We keep on finding new opportunity to be a bit skimpy and to drop a spot less money not only on staff but also on dick , logistics , and so on . In some nation , we ’ve identified that we could be a bit leaner in some departments . It ’s an ongoing optimization and we ’re running adjustments , so it ’s business as usual for us , ” Jumia CEO Francis Dufay said on a call with TechCrunch .

Jumia stop food delivery across seven markets , shifts focus to expanding forcible goods business enterprise

In gain to macroeconomic status such as currency devaluations affect consumer ’ buying power , Jumia ’s strategic conclusion , admit exiting the food legal transfer sector and reducing client incentive , contributed to a 4 % step-down in orders to 6.6 million , a 16 % reduction in alive customers to 2.3 million , and an 8 % decline in GMV ( gross merchandise value ) twelvemonth - over - year to $ 233 million .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Nevertheless , the companionship remains affirmative that its focus on physical goods , such as electronics and way items , will drive improvements in these metric while maintain losses minimal . A slight indicator is the increase in quarterly fighting customers , ordering , and GMV by 16 % , 17 % , and 42 % , respectively , poop - over - twenty-five percent , in the first place fueled by successful Black Friday and Christmas sales military campaign . There ’s also the rise in the average fiat note value for forcible good , climbing from $ 40.6 in 2022 to $ 45.5 in 2023 , which likely cushioned the shock on the troupe ’s Q4 and full class gross experience a low 2 % and 8 % twelvemonth - over - year declination to $ 59.4 million and $ 186 million .

“ In 2024 , we await to better our economics further and cut Johnny Cash usage better than in 2023 and get back to growth on the orders and GMV excluding strange exchange impact , ” say Dufay . “ We will hold the same strategy on the merchandising side so that we will be very prudent and materialistic on all expenditures and the whole cost foundation , and with that , we believe that we have everything it takes to grow profitably . ”

Investors have show favorable reception for Jumia ’s cost - issue measure throughout the class , with its percentage cost rebound up 40 % at the clip of issue .

Meanwhile , JumiaPay ’s Total Payment Volume ( TPV ) stood at $ 59.3 million in Q4 2023 , mark a 10 % drop-off year - over - year . However , transactions surged , accomplish 3 million , a 41 % increment year - over - twelvemonth ; 45 % of orders on the Jumia weapons platform in Q4 2023 were complete using JumiaPay , up from 31 % in Q4 2022 .

Jumia give up food saving because of deep - pocketed ‘ aggressive ’ rivals , CEO says

Jumia reports GMV growth in physical goods across five countries and lowest losses since IPO