Topics

Latest

AI

Amazon

Image Credits:Kapital

Apps

Biotech & Health

Climate

Image Credits:Kapital

Cloud Computing

DoC

Crypto

Enterprise

EVs

Fintech

fundraise

contraption

Gaming

Government & Policy

computer hardware

layoff

Media & Entertainment

Meta

Microsoft

concealment

Robotics

security system

societal

blank space

Startups

TikTok

transport

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

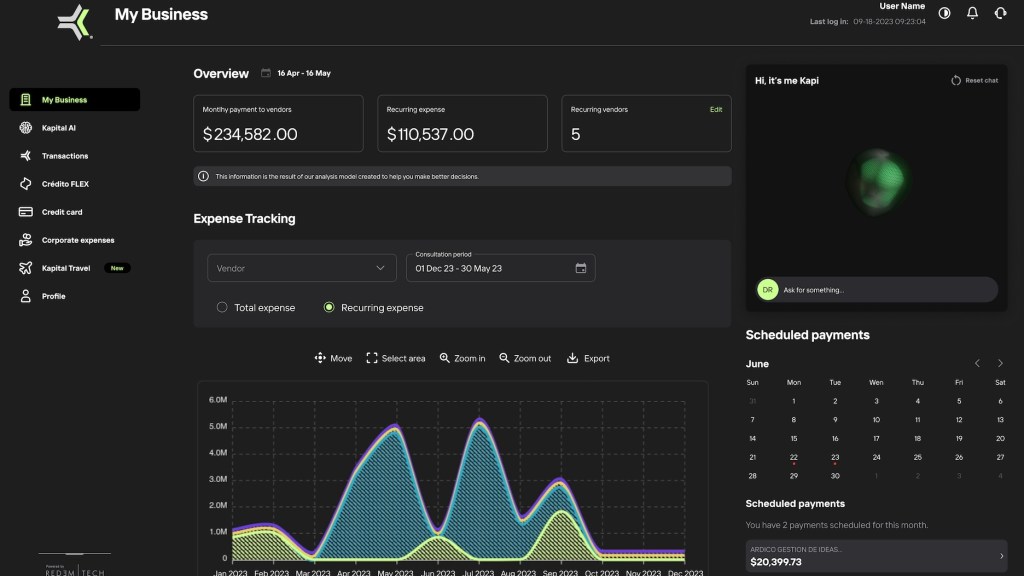

Bank and technology platformKapitalcontinues to run down in venture capital , grabbing another $ 40 million in Series B dollar bill and $ 125 million in debt funding . Tribe Capital led the Series B and was bring together by backers , including Cervin Ventures , Tru Arrow , MS&AD Ventures and Alumni Ventures .

This marks the second investment for the Mexico City – based company this year . We previously coveredKapital ’s $ 20 million Series Ain May that included $ 45 million in debt .

Rene Saul and Fernando Sandoval co - ground Kapital in 2020 to provide standardized fiscal visibility to small line , using data and hokey news , that great initiative have . This enables customers to get at and manage their clientele operations and cash flow in real time . The company also uses AI to underwrite small business loan .

“ Small businesses represent 90 % of the world ’s business sector ; however , in Mexico , only 10.5 % of those small businesses have access to full banking company credit , ” Saul enjoin . “ That ’s what we ’re pay off — we give them visibility of their finances . ”

In 2023 , Kapital ’s customer base grew to 80,000 small businesses in Mexico , Colombia and Peru . It also take on Banco Autofin Mexico S.A. in September , which already had 65,000 customer , CEO Saul told TechCrunch . Kapital is profitable and produce revenue 6x in the past year .

Saul intends to deploy the new financial backing into R&D and technology growing , particularly to pad its fussy - border offer and get its Cartesian product rooms to bring home the bacon insights for its customers . One of the areas Kapital would like to accelerate is predictive analytics technology so that business customers have it off how to improve margins by selecting dissimilar seller .

“ Now we have a money box and we can create embedded finance alternative , ” Saul say . “ We also moderate the payment and can connect to everything around customers seamlessly . Having surgical process in three different countries in Latin America also entail our customers can move the money faster . Our goal is to work up a global depository financial institution to eventually connect everybody in the world . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

All that fintech investiture had a veridical impact on banking incursion in Latin America