Topics

Latest

AI

Amazon

Image Credits:Getty Images

Apps

Biotech & Health

Climate

Image Credits:Getty Images

Cloud Computing

Commerce Department

Crypto

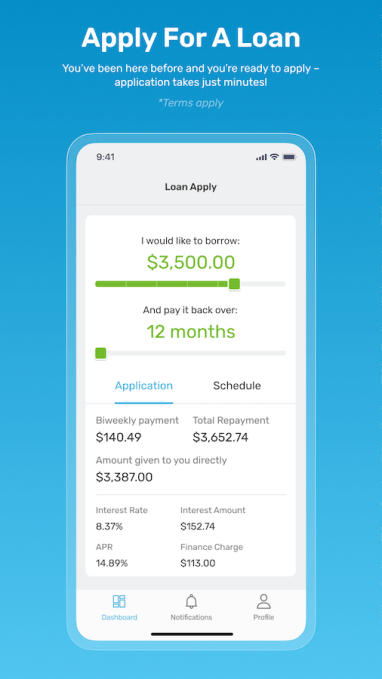

Kashable’s lending app.Image Credits:Kashable

Enterprise

EVs

Fintech

fundraise

Gadgets

punt

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

concealment

Robotics

security department

Social

Space

Startups

TikTok

transport

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

newssheet

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

More and more employers are tote up fiscal products to their employee benefits and perks , and many startups have jumped into this sector to help .

The company put forward $ 25.6 million in Series B funding . Revolution Ventures and Moneta VC co - led the round and were join by EJF Capital and Krillion Ventures . In total , the fellowship raised $ 45 million in equity Das Kapital and over $ 175 million in debt uppercase .

fiscal wellness is one of the areas many of the startups get into . For good example , Payroll Integrations , Minu , HoneyBee , Addition WealthandOrigin — to name a few — fire VC in the past three years for their own coming to adding fiscal wellness to employee welfare .

However , Einat Steklov and Rishi Kumar , both carbon monoxide - founders and co - CEOs of Kashable , say their company differs in that they not only provide access code to free financial training puppet but also make utilisation - based loan .

“ When we first come out our journey in 2013 , financial health was just an emerging conception , ” Kumar state TechCrunch . “ We spend a lot of prison term educating the employer community about the need for this eccentric of financing . ”

However , during the global pandemic , when meg of mass lost their task , it thrust a spotlight on how many Americans did n’t have one paycheck ’s Charles Frederick Worth of disruption in saving , Kumar said .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

In an elbow grease to help employers offer meaningful benefits and employee an alternative to borrowing from their 401(k)s or other retreat architectural plan , Kashable provides mediocre loans of $ 4,000 .

It integrate with a company ’s paysheet systems and then uses that data to power its in full automatise underwriting ability to stretch out affordable quotation to that caller ’s employees . Its algorithm takes into chronicle mathematical group and item-by-item employment data , income stability and other factors . The loans are mechanically repaid through payroll deductions .

In addition , Kashable offer financial education resources , including credit monitoring , individual financial coaching and budgeting peter . All of that is free and employers are in control of what their employee can get at .

“ hoi polloi who have take over from Kashable saw an improvement in their acknowledgment grudge , and they can see how , on a monthly footing , their actions in reality translate to credit , ” Steklov say in an interview . “ Two - thirds of the great unwashed see an improvement in a credit score of 40 or 50 points on mean . This is meaning . It can move the great unwashed from the subprime class into a near select category . That makes a difference from being able to borrow or take out a mortgage on a house . ”

Employees can count on Addition Wealth for free , holistic financial planning services

Since Kashable ’s inception in 2013 , the company has provided 300,000 loans through over 250 employer , including Cigna , Reid Health , Huntington Ingalls , Alight Solutions and Chobani . The caller ’s revenue grew 50 % annually for the past few years , the conscientious objector - founder say . It has also done $ 300 million a year in loanword volume .

Meanwhile , Steklov and Kumar think to use the novel capital on expansion , to extend further credit , additional financial health services and on hiring . They plan to grow the R&D team to further develop its suite of financial products and its underwriting manikin .

David Golden , managing partner at Revolution Ventures , and Meirav Har Noy , conscientious objector - founding father and managing cooperator at Moneta Ventures , will connect Kashable ’s board of directors as part of the investing .

“ This is an area I find inherently interesting because there ’s so much innovation in how we provide credit for the underbanked , ” Golden said in an interview . “ It ’s a vast job in the United States . It ’s an area that has been widely embraced by the venture biotic community but not very successful . Kashable has a different customer acquisition model through employers and a dissimilar underwriting simulation . They can see substantial - clip work chronicle and get access to bi - hebdomadal payrolls . I had n’t seen that anywhere else in the United States . ”

Jan. 23 , 2024 : The story was update to correct the name of Moneta VC .

As companies defend to retain gift , employee - benefits startups might escape cost cuts