Topics

tardy

AI

Amazon

Image Credits:South_agency / Getty Images

Apps

Biotech & Health

Climate

Image Credits:South_agency / Getty Images

Cloud Computing

commercialism

Crypto

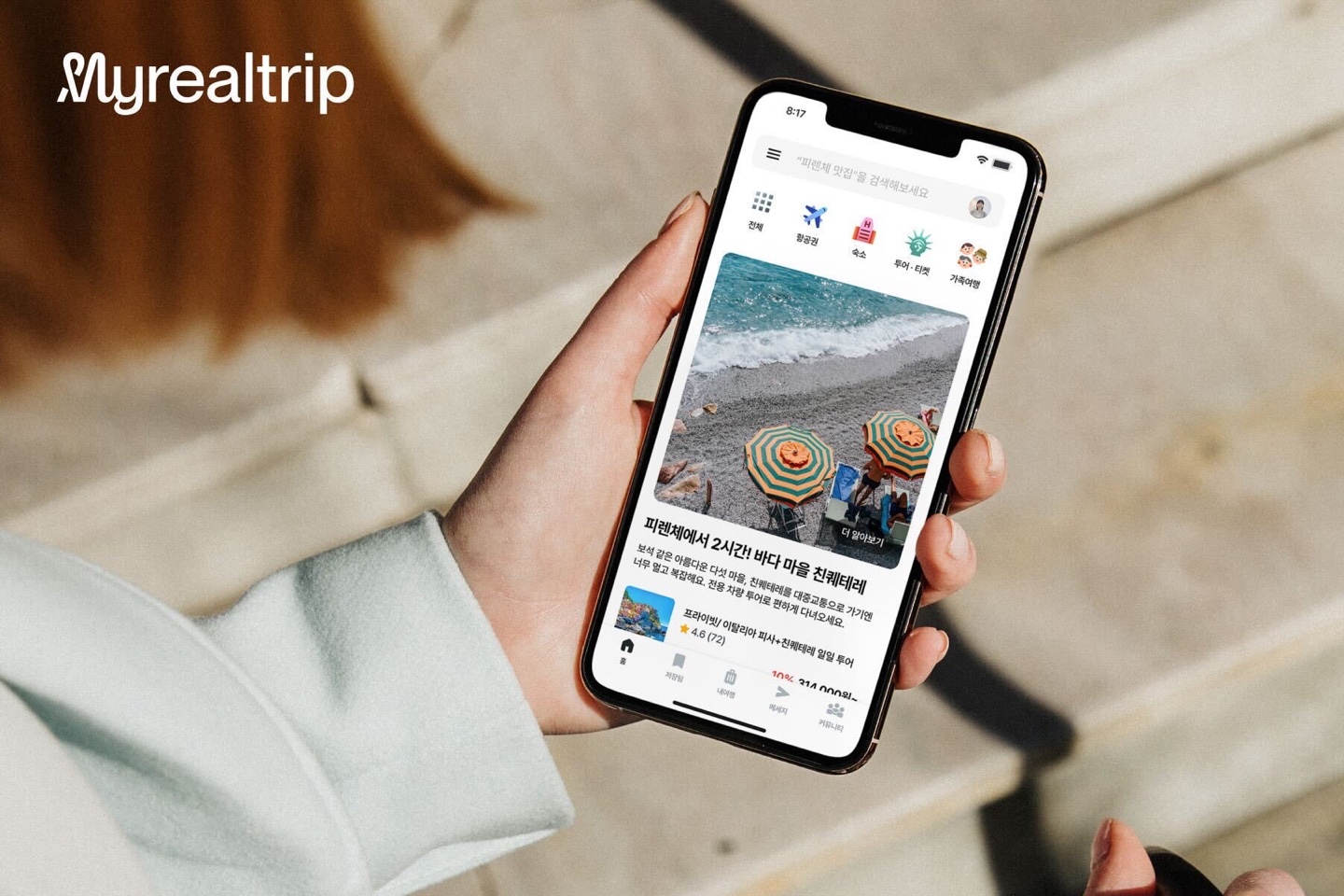

Image Credits:Myrealtrip

Enterprise

EVs

Fintech

Fundraising

gismo

Gaming

Government & Policy

ironware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

surety

societal

Space

Startups

TikTok

exile

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Myrealtripis the latest travel tech company to twit a growing post - pandemic tourism diligence . The Seoul - base startup tell today it has raised $ 56.7 million ( 75.6 billion KRW ) in a Series F equity unit of ammunition of financial backing to accelerate its byplay and product innovation and wild leek up its hiring .

Global tourism has rebounded to pre - pandemic level in the third poop of 2023 , according toa late UN World Tourism Organizationreport . travelling tech company again prepare to hie up their business enlargement .

“ The travel manufacture was fragmented 12 years ago in South Korea , and there was no political platform that allow for travel information , ” chief operating officer of Myrealtrip Donggun Lee said in an sole interview with TechCrunch . Now the 12 - year - old company , which has 7.9 million users in South Korea , purpose to be a super app in the locomotion diligence , offer travelling engagement services , from flights , accommodation , activities , to local transportation .

The company partnered with around 2,000 traveling agency , hotel platforms , and airfare comparison service providers like Expedia , Agoda , and Viator to enable traveler to book services tours , activities , restaurants , local transportation , hotels and Airbnb - like accommodations globally .

Its valuation increased by 3x since its last equity financial backing , Series D , in 2020 , Lee severalize TechCrunch , without provide an exact trope . The company valuation was estimated at more than 200 billion KRW in 2020 , per old media outlets .

Lee also state that Myrealtrip had seen its receipts rush by three clip since 2022 . The outfit posted a gross ware loudness ( GMV ) of $ 746 million ( 1 trillion KRW ) in 2023 . It direct to repeat its GMV and get an EBITDA of $ 12 million this year , Lee note .

Like most locomotion company , the Korean startup faced challenges during the pandemic lockdown . The company says it could survive with the capital it had assure in 2020 and debt financing in 2022 in preparation for post - pandemic .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ Myrealtrip prioritise domesticated touristry and launch new features like a group head trip or business travel to survive for the last two challenging years , ” Lee said .

The company did not just enlarge its domestic tourism but also made several acquisitions and strategic investment . Myrealtrip acquiredStartripin 2022 to capture the number of foreign holidaymaker chit-chat South Korea post - pandemic . This travel platform lets users discover and book Korean - pop ( kB - pop ) themed blot , let in popular boy ring BTS music video cinematography locations . Lee said it plan to operate Startrip as a separate entity to improve its service with advance technology .

Myrealtrip also invest in IwaTrip , a Korean travel weapons platform that helps users find available spots to trip with kids , and O - Peace , a carbon monoxide - work and co - surviving space political platform designed for digital nomads workers .

Technology will be key to the foresightful - term success of draw its inward and outward-bound change of location substance abuser as well as foreign holidaymaker to take on its competitor like SoftBank - punt Klook , which conjure up $ 210 million last calendar month ; Yanolja ; Agoda ; and Airbnb .

Lee say the party , which practice AI chatbots for customer armed service , will invest more in technology , including AI capability , before its plotted initial public offering in 2026 .

pass investors BlueRun Ventures Korea and IMM Investment co - lead the round , which brings its amount lift to around $ 113 million ( 150 billion KRW ) in fairness and $ 39 million in debt since its origin in 2012 . newfangled investor Korelya Capital , cross out its first investment in South Korea , and Vanderbilt University ’s endowment store and previous backers , including Altos Ventures , Partech Partners , Smilegate and SV Investment , also bring together the Series F.

The company has 300 employees as of today .