Topics

up-to-the-minute

AI

Amazon

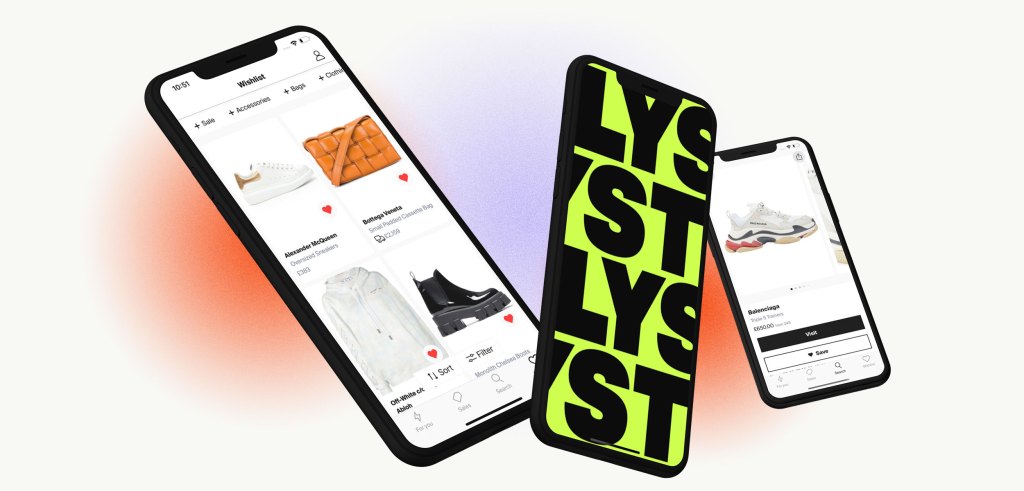

Image Credits:Lyst(opens in a new window)

Apps

Biotech & Health

clime

Image Credits:Lyst(opens in a new window)

Cloud Computing

DoC

Crypto

enterprisingness

EVs

Fintech

fund raise

contraption

punt

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

privateness

Robotics

security measure

societal

outer space

Startups

TikTok

expatriation

speculation

More from TechCrunch

case

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

style goes in and out of elan , and it turn out , so do way startups . Lyst , a high - end way marketplace that was once appreciate at $ 700 million , has been acquired for just $ 154 million in Johnny Cash byZozo , a Japan - base style and e - commerce business .

Zozo own a number of fashion brands that admit Wear by Zozo , Zozotown , and Zozosuit , among others . You might have hear of Zozo for another reason , though : Its father Yusaku Maezawa once had the “ most retweeted tweet , ” when he promised to give away 100 million yen in cash for retweeting it .

Zozo said it will proceed to operate U.K.-based Lyst as a stand - alone business , and its current chief operating officer Emma McFerran is remain with the company .

Lyst selling for a price tag massively lower than its last valuation is a star sign of the time . The world of e - Commerce Department is facing striking levels of uncertainty , with Lyst dealing with headwinds from three unlike directions .

First , U.S. duty rise are conjure questions around the future of global trade , admit the impingement on smaller companies across the world that sell goods to U.S. consumer . well-nigh a third of London - found Lyst ’s gross currently derive from sales in the U.S.

Second , even before those tariffs became an issue , Lyst was face monumental competition in on-line mode not just from other specialist outlets , but also behemoths like Amazon and Temu .

Third , engineering investors today have overindexed massively on anything to do with artificial intelligence operation . That has put a lot of pressure on companies that arenotin that space to show similar outgrowth trajectories , plus ontogenesis narrative that comprise AI in some way .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Lyst and Zozo seem to have gotten the memo . The pair will be “ Transforming the Future of Fashion Discovery through AI and Technology , ” the party prominently note in their declaration . That phrasal idiom is observe again in the waiver , but there are no specific details of what that will signify .

In addition to a beachhead in the U.K. , the heap also have Zozo an international business organization . Lyst said it has customers in 190 grocery , with 30 % of its stage business come from the U.S. , 24 % from the U.K. , and 34 % from Europe .

Lyst has lean into the long tail of fashion brand collection in a market model : It claims to offer product from 27,000 steel , including both designers and retail merchant . The inclination include Prada , Gucci , Bottega Veneta , Valentino , Miu Miu , Coach , Michael Kors , Hugo Boss , Selfridges , Harvey Nichols , and Harrods .

The company was one of the winners of the atomic number 99 - commerce boom during and just after the peak of the COVID-19 pandemic . When it raised$85 million in May 2021 , Lyst gained a valuation of around $ 700 million . Fidelity led that round , and other big - name investor in the company admit Accel , Balderton , and Molten ( formerly Draper Esprit ) . The company at the time even report the backing as a pre - IPO turn .

However , not only did the IPO window slam shut a few months later , but a heap of the increase e - commerce troupe saw during that period speedily puncture as consumers pass to their pre - pandemic spending habits . And then investors moved on to the next big thing , AI .

The fashion due east - Commerce Department market has remained unmanageable .

A spokesperson explicate that Lyst ’s 160 million user are “ yearly unique users , ” but that figure of speech includes participating shopper as well as those just windowpane - shopping . It ’s tough to know how successful the company ’s rebirth strategy ( important for e - commerce company ) has been . In 2022 , Lystlaid off 25 % of its staff . And it has not been alone . Farfetch , another big name in high - mode e - commerce , hasnosedivedsince the pandemic .

Lyst recorded receipts of £ 50.1 million ( $ 64 million ) in the year end March , 31 , 2024 , largely the same as its gross from the yr before ( £ 50 million ) , per its most recent Companies House filings in December 2024 .

Lyst continued to send a net loss in that clip , but it did carry off to narrow it drastically over that year to £ 510,000 from £ 23.7 million a class before . It also posted an run profit before revenue enhancement of £ 443,000 . A spokesperson noted that Lyst post $ 1 million in EBITDA in its last audited business relationship .

“ This is an exciting second for Lyst , and a win - win for our fashion ecosystem of shoppers and partner as we move forward as part of ZOZO Group , ” McFerran say in a statement .

Now the question will be whether getting better economies of scale with Zozo will give Lyst the lift it need to turn this around .