Topics

Latest

AI

Amazon

Image Credits:MoneyHash

Apps

Biotech & Health

Climate

Image Credits:MoneyHash

Cloud Computing

commercialism

Crypto

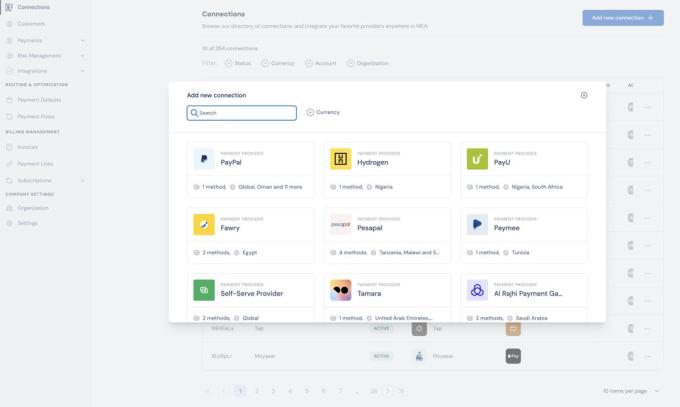

MoneyHash payment integration catalogue.Image Credits:MoneyHash

endeavor

EVs

Fintech

fundraise

contraption

gage

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

startup

TikTok

expatriation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

The payment landscape in the Middle East and Africa ( MEA ) region is marked by significant fragmentation , with numerous requital providers and methods in each area , evolving regularisation and various customer orientation . This complexness is further compounded by challenges such as defrayal fake , low checkout conversion rates and high transaction failure charge per unit .

Although the COVID-19 pandemic quicken the acceptation of digital payments in the neighborhood , infrastructure development remains inadequate . defrayal failure rates are three times high in the MEA region than the global norm , and fraud rate and cart desertion transcend those of other regions by more than 20 % . This present a challenge for merchant , who often comprehend payments as a price and risk center rather than a strategical enabler .

defrayal instrumentation platform streamline payment processes for merchants through integrated payment APIs . Egyptian fintechMoneyHash , one of such in Africa and the Middle East , has raised $ 4.5 million in seed investing , money it plans to use to further invest in its engineering and growth across the region . This comes two years after the startup batten $ 3.5 million in pre - seeded player .

Nader Abdelrazik , co - founder and CEO of MoneyHash , highlights that 10 % of all payments processed in the MEA region are digital , place MoneyHash unambiguously for a ontogeny phase that the region will inevitably experience over the next decade . However , navigating this burgeoning payments mart will demand forbearance and a commitment to continuous erudition .

As merchants or companies plunge their platform , they often start by collaborate with one or two payment processing providers . As their operations grow and spread out into multiple regions , they onboard additional payment providers to meet their evolving needs . However , integrate dissimilar payment stacks presents pregnant challenges . Besides the operational inefficiencies and technical complexities , in - house technical school teams may take several weeks to complete these integrations . In Africa and the Middle East , these challenge are hyperbolise by variations in defrayal methods , currencies and the isolation between commonwealth .

MoneyHash ’s ware includes a co-ordinated API to desegregate pay - in and pay - out rails , a to the full customizable check-out procedure experience , dealing rout out capability with hoax and nonstarter rate optimizers and a centralized transaction reporting hub . This is complement by tools enabling various use eccentric such as virtual wallet , subscription management and payment contact . Fintechs such as Revio , Stitch , Credrails and Recital are standardised instrumentalist in the defrayal instrumentation space .

In an e-mail audience with TechCrunch , Abdelrazik shared insights into MoneyHash ’s collaboration with merchant over the last four long time . For one , he claims that requital failure rates across the region vary significantly , and trust solely on average can be misleading . While the typical figure are around three out of 10 payments failing on fair , the reality differs wide among patronage , he said . For some , it may be as low as one out of 10 , while for others , it could be as high as five or six out of 10 . to boot , these figures do not let in client who abandon the checkout process voluntarily before make a payment . The CEO also noted that most of its customers do n’t know much about the complexness of payment and , many time , are not cognisant that most leak they have in payments are fixable .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

MoneyHash gets $ 3 M to build a super - API for payment operations in Africa , Mideast

Furthermore , merchandiser are expanding much faster than their partner requital service providers ( PSPs ) . These PSPs operate under rigorous regulations , reach the rollout of unexampled products and customizations slower than the merchandiser ’ maturation flight . As a effect , MoneyHash has compound its quislingism with PSPs , particularly those catering to go-ahead and prioritise client requirements .

“ Businesses appreciate the with child web of integration we have not just for reportage but for expertness . When they know that we execute all these integration in - house , they appreciate the squad ’s expertise and depth of cognition and leverage our squad to navigate unmanageable questions in payment . They know that working with us makes them future - proof , ” noted Abdelrazik , who launch MoneyHash withMustafa Eid .

“ That mean team expertness is key for us . Most of the meter , we hire entirely with payments and/or tech backgrounds , even in non - proficient positions . We saw massive effectiveness in make a team where client swear their cognition and expertise in something specialised and critical like payments . ”

At present , MoneyHash boasts 50 active paying customers . It does not pop the question gratuitous tiers ; most customers accessing its sandbox without payment are potential client in the assessment leg , add up over 100 . The payment instrumentation platform levies a combination of SaaS and dealing fees , commence at $ 500 + 0.4 % . SaaS fees increase while dealings fees decrease significantly for large enterprises due to volume , Abdelrazik explained .

MoneyHash ’s cum rhythm was co - direct by COTU Ventures and Sukna Ventures , with involvement from RZM Investment , Dubai Future District Fund , VentureFriends , Tom Preston - Werner ( GitHub ’s father and former Stripe investor)and a chemical group of strategical investor and hustler .

mouth on the investment , Amir Farha , general partner at COTU , said his firm believes that the full potency of digital payments in MEA is yet to be realized and MoneyHash ’s platform can catalyse the growth of digital payment across the region , enabling both global and local merchants to beg into novel revenue watercourse . “ We are thrilled to renew our support to a squad that has systematically demonstrated superior implementation , not just in batten top mid - food market and enterprise client , but also in expanding value across the total chain , even under challenge grocery conditions , ” he bestow .

COTU Ventures launches $ 54 M stock for pre - germ and seed startups in MENA