Topics

Latest

AI

Amazon

Image Credits:N26

Apps

Biotech & Health

Climate

Image Credits:N26

Cloud Computing

Commerce

Crypto

Image Credits:N26

Enterprise

EVs

Fintech

fund-raise

Gadgets

Gaming

Government & Policy

ironware

layoff

Media & Entertainment

Meta

Microsoft

secrecy

Robotics

Security

societal

Space

startup

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

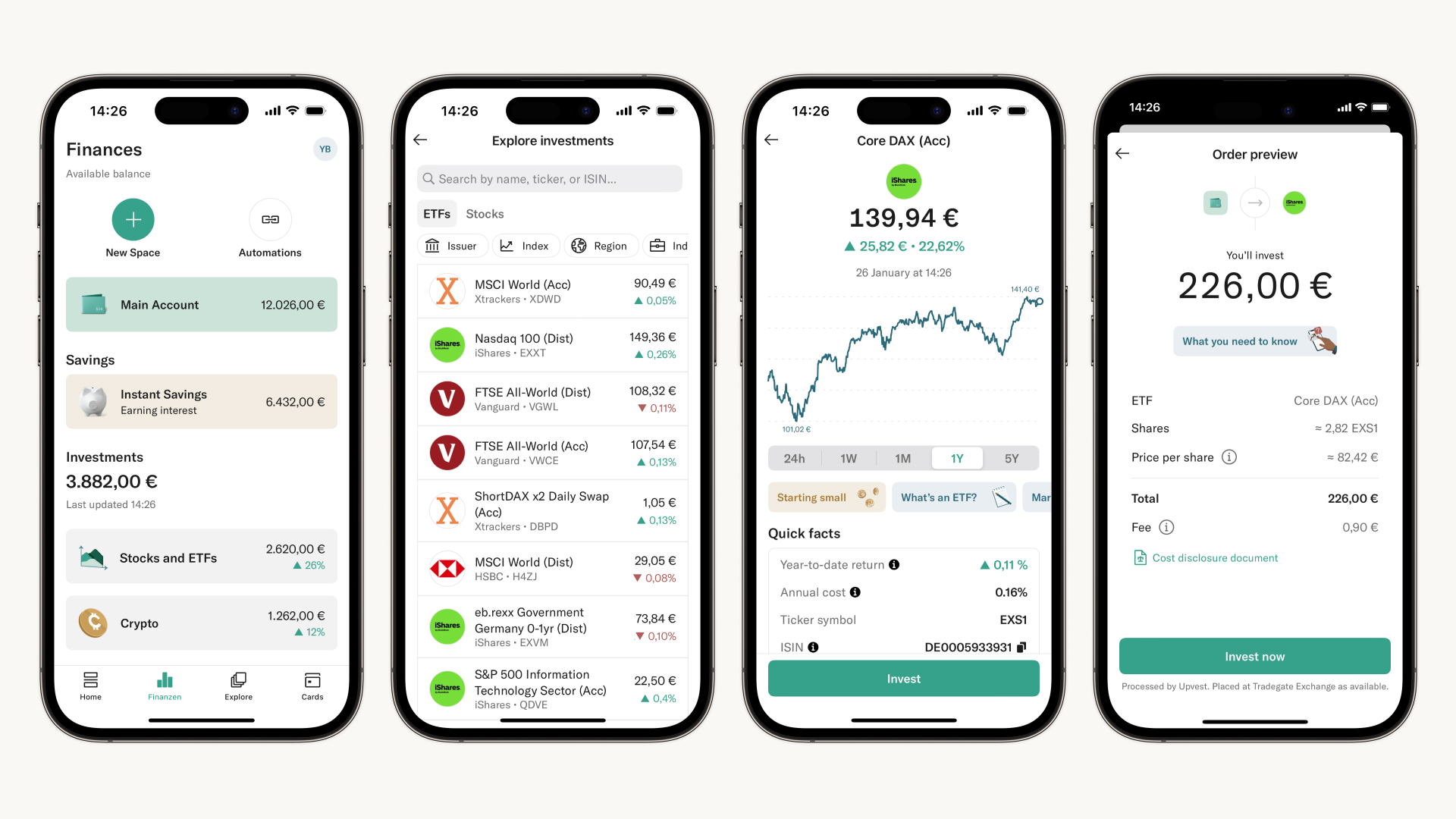

Berlin - based banking startupN26is wave out a novel blood line and ETF trading feature starting with Austria as the first market . This product launching mark a renewed focusing on the inauguration ’s core markets with a larger portfolio of banking products in those state .

Like many competition bank , N26 commence with a uncomplicated Cartesian product — an business relationship that you could apply to direct and incur money , and a poster that you could deal in real metre from a mobile app . And the company managed to win over billion of customers to open an business relationship as it only worked well than steady money box ( banking apps usually are n’t that great ) .

Over metre , the society expanded to more market and started sum more product . After several years ofhuge funding roundsand several hiring spree , and like many other tech companies , the company is shift its focus to efficiency and profitability .

After open office in the U.S. and Brazil , N26 decided to vacate course and pore entirely on Europe — and more specifically Germany , France , Spain and Italy .

There ’s another rationality why N26 does n’t desire to be spread too thin . Germany ’s financial governor BaFin bulge to look more nearly at N26 ’s operations back in 2021 . And BaFin still enforces a pileus on guest signups today . N26 can only accept 60,000 new clients a month .

“ I hope that we ’ll be getting out of any kind of restrictions in the next couple of tail , but it ’s very intemperate to predict , ” N26 co - founder and CEO Valentin Stalf told me .

As a issue , N26 has been ramping up its anti - money laundering controls to well comply with regulators . At the same prison term , the companionship has been trying to improve its margins and find new revenue sources for its existing client theme .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

After credit and savings, N26 adds stock trading

Adding lineage and ETF trading is part of this scheme of increasing the modal revenue per user . N26 is partnering with Upvest for this feature . Users will be able to drag out and drop money from their main N26 account to this new trading space .

After that , they can prefer how much money they require to induct in a particular ETF or stock . N26 supports fractional shares , meaning that user can corrupt a fraction of an Apple or Netflix share for as short as € 1 . And when it ’s meter to sell , user can either decide to reinvest what they arrest from that transaction or receive the money forthwith back in their main N26 account .

N26 charge € 0.90 per trade and premium client will soon get a handful of free trades per calendar month depending on their subscription plan . Ideally , stock certificate trading will boost agiotage subscription as margins are very good on these subscription .

This is going to be a slow rollout as trading will only be usable in Austria at first . It will also be limited to 100 ETFs with stocks coming later . But the society says that it will be available in Germany “ in the coming month . ” Other European countries will keep abreast cause .

N26 lately roll out saving accounts in Spain and Germany with an interest rate of 2.6 % presently . customer can also get a loan of up to € 25,000 from the app . In some mart , N26 also offerscrypto tradingdirectly in the app .

In other words , N26 is slowly turn into a full - fledge bank building with all the features you would expect from a bank . With store trading , N26 vie with trading apps likeTrade Republic . But N26 ’s chief vantage is that everything is bundled in one app .

The company presently has more than 8 million customers ( admit 4.2 million “ gross - relevant ” customer ) . It has € 8 billion in assets under management and wield more than € 110 billion in dealings volume per class .

The fellowship send me some ( unaudited ) fiscal data point about N26 ’s performance in 2023 . And the startup significantly increased its gross in 2023 with more than € 300 million coming from interchange fee , subscription revenue , credit product and interest group revenue from client deposits .

But the fellowship still had a € 100 million loss in 2023 . That ’s much better than 2022 as N26 reported a € 213 million loss that twelvemonth . But there ’s still some employment to do to reach profitability .

“ By the end of last twelvemonth , we were almost already break up even on a monthly foundation , ” Stalf said . “ So we continue this now . During the second half of the year , I think we ’ll be profitable on a monthly basis as a full company . ”