Topics

in vogue

AI

Amazon

Image Credits:Orrick

Apps

Biotech & Health

Climate

Image Credits:Orrick

Cloud Computing

Commerce

Crypto

European 2023 tech investment deals.Image Credits:Orrick

Enterprise

EVs

Fintech

fund-raise

widget

stake

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

security system

Social

Space

startup

TikTok

Transportation

Venture

More from TechCrunch

case

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

reach Us

Europe is suffering from a big hangover after the technical school investment party of the 2020 - 2021 full stop . That say , compared to pre - pandemic levels , VC investing in European startups is up , historically speaking , and arrive at $ 60 billion , concord to a new report . However , the anomaly of the surge in investiture over the pandemic suffer in marked contrast to that growth and has make substantial headwind , even though there are signs of “ light-green shoots . ”

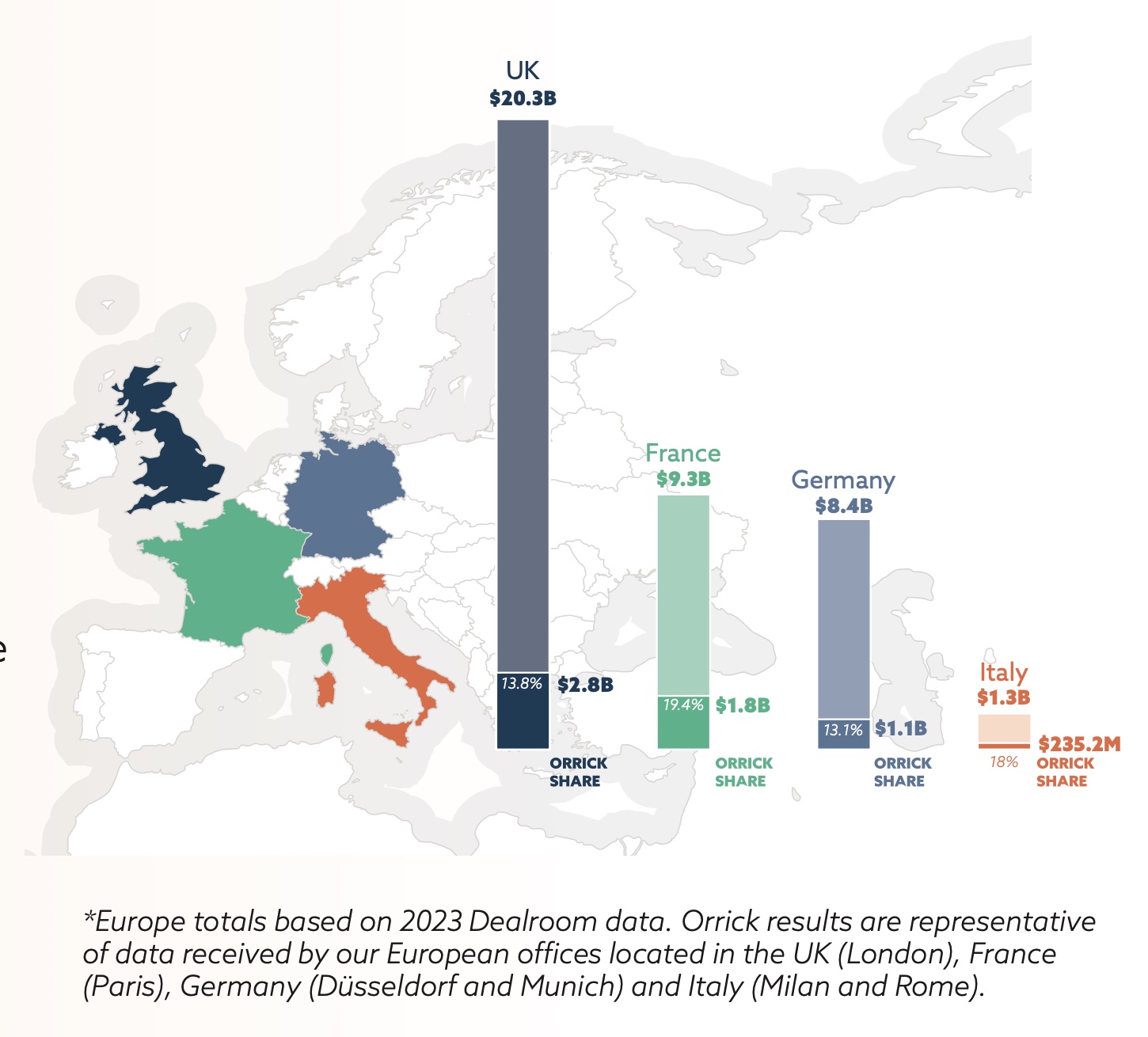

Global police firm Orrickanalyzedmore than 350 VC and growth equity investments its client completed in Europe last class .

The total capital raised in Europe was $ 61.8 billion . 2023 marked a reset and major rectification in investment levels globally . Of the top three ball-shaped area for VC — Europe , Asia and North America — Europe is the only one to top 2019 levels in 2023 .

agree to the story , although Europe is seat on “ book levels of ironical powder ” and “ producing more newfangled founder than the U.S. , ” financial support remains ho-hum .

Only 11 novel unicorn issue from Europe last year , the few in a decade , and a growing bit of unicorns lose their status .

mood tech overtook fintech as Europe ’s most pop sphere , and AI ’s share of total investment in Europe soared to a record book high of 17 % .

Orrick found that investor — recreate by the downturn in funding — are “ turning the turnkey , ” exercising greater control over investing , with father being want to stomach behind warrantee in 39 % of speculation deals .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

There was a cleared drop in later - stage financings , peck volume dropped and founders have been thrown toward other strategies such as alternative financing methods , or racing toward revenues and profits .

There was an “ unprecedented stiletto heel ” in the ability of new investor to enter technical school , as founders looked for newfangled lead investor , and an “ uptick ” in transmutable debt , rubber and ASAs , with convertible financing typify 23 % of rounds in 2023 .

Investors generally focused on managing their survive portfolios , lower-ranking transactions increase and SaaS and AI preserve to be popular . Interestingly , the number of fintech investments declined .

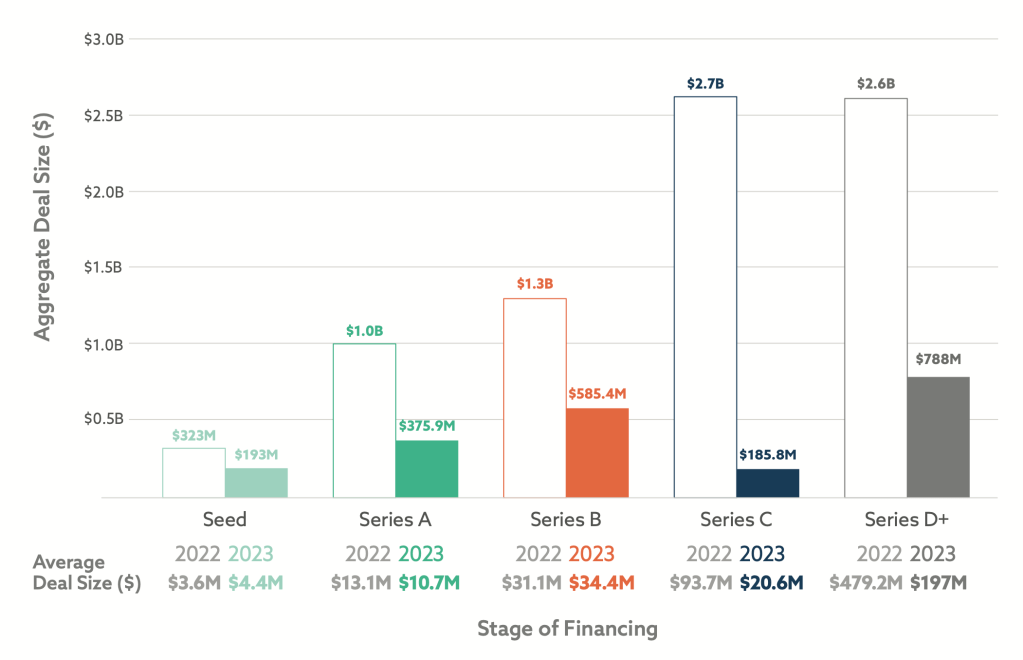

At each stage , sight value is down , with the most dramatic fall in later - stage deals .

Early - stage deal time value flatten by 40 % , even though other - stage investors are still the most active .

There was a decline in “ mega - rounds ” exceeding $ 100 million - plus+ . However , the IPO landscape exhibit “ polarity of life ” with ARM ’s $ 55 billion IPO , and M&A body process showed “ green shoot . ”

In the U.K. , VCs are under pressure level to hand over returns , which is likely to lead to increased requirement for secondaries , greater M&A activity and consolidation .

In France there ’s been a shift from “ founder - friendly ” condition toward more investor - well-disposed price , in mark contrast to the U.K. , where the opposite is true .

In Germany , a growing demand from LPs for liquidity is expect to “ energize the tech M&A pipeline . ”