Topics

Latest

AI

Amazon

Image Credits:Defiance Capital

Apps

Biotech & Health

Climate

Image Credits:Defiance Capital

Cloud Computing

Commerce

Crypto

Enterprise

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

startup

TikTok

transport

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

newssheet

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

A raw study that zeros - in on the founders of so - called “ unicorns ” — company worth over a billion dollars — has found most have “ underdog ” beginner who are often drawn from the top 10 universities . There ’s also a rising distaff founder make - up , and no obvious monopoly at seed degree of funding for VCs .

The field of study ( “ Unicorn Founder DNA Report ” ) byDefiance Capitalof 845 unicorns and 2,018 unicorn laminitis set out to face at the “ DNA ” of unicorn founders , concentrating on the U.S. and U.K. ( no EU / European ) from 2013 to 2023 , to define the common traits of these kinds of founders .

The study found :

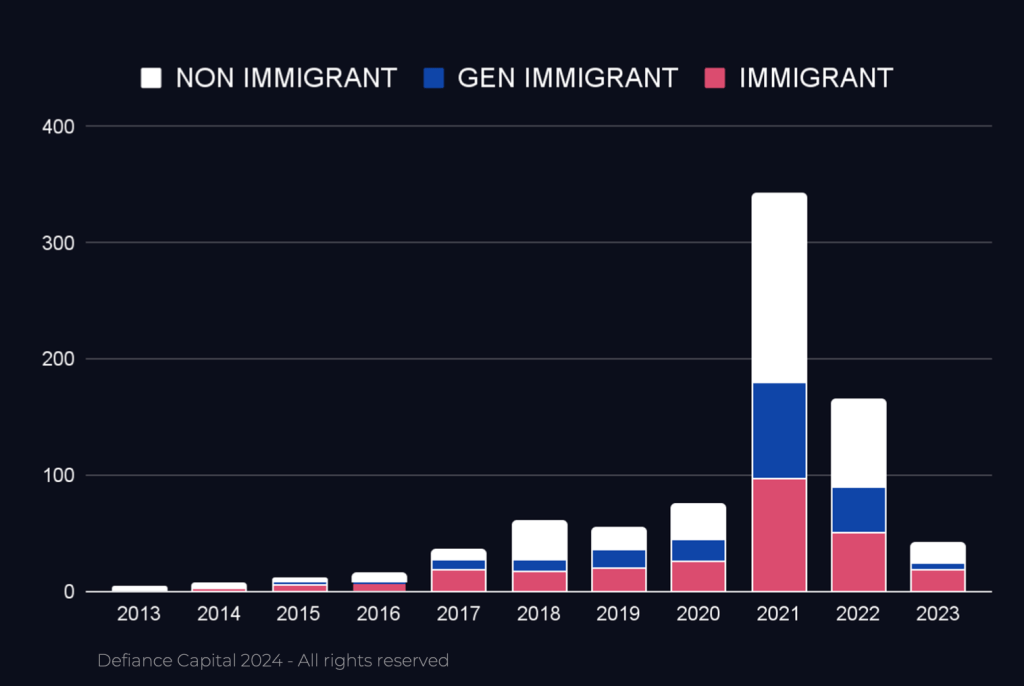

The study further found that unicorns were dominated by white father , but that every third unicorn had an Asian father . Indeed , 38 % of unicorn had at least one founder who was not white : 82 % had at least one livid laminitis , 62 % had first or 2d generation immigrant founders . Only 3 % of unicorn had a black founder .

And only 21 % of immigrant and distaff founders raised from top 10 VCs . Teams with female founder were two eld younger than all - manly teams when found their unicorn ( 32 versus 34 ) .

Serial founders ( 50 % ) were more likely to come after construction unicorns , but only one in five unicorn had solo beginner .

During the last decade , all top seed funds were generalist investment firm , and the market for seed stock is extremely fragmented . Only 28 % had raised capital from a top VC seed fund ( with more than 1 % market contribution ) .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Only 34 % of unicorn founding father had worked at an elect employer prior to founding a unicorn , suggesting a McKinsey or interchangeable ground is not a prerequisite to succeeder .

The written report also found three prevalent factors in the “ DNA ” of a unicorn founder .

1.No “ plan B ”

2.“A chip on the shoulder ”

3.Unlimited self belief

The study find that many unicorn founders were forced to develop a growth mindset , with values , work ethic and aspiration all established during puerility .

Most had a personal level of feel below the belt treated or feel special in their aboriginal environment .

The study observed these trait in communities left behind for generations , e.g. women founders , citizenry of people of colour , neurodivergent or founders with atypical backgrounds .

Many tend also to be “ challenging rebels , ” often motivated by a great suit they care deep about , have inviolable family role good example , a timbre peer web and no concern of bankruptcy .

A far greater phone number of first and 2d genesis immigrant chief operating officer had STEM degrees than local CEOs , suggesting a brain drainpipe from go forth or humble economy to develop ones . Significantly , more second generation immigrant attended an elect university than the rest of the sampling .

Other interesting datum compass point come out of the field . Solo father lean to start their unicorns three long time after than founder teams , and it took seven years on mediocre to hit unicorn status for all type of founder teams , but second generation immigrants took only six years .

And in fact , the all - white , virile , local , Ivy league archetype of founder was actually an infrequent occurrence , at 11 % , and only one - third of father native to a country where they founded the ship’s company graduated from a top 10 university .

In addition , the top 20 U.S. VC monetary fund tended to favor male , immigrant founders with STEM degrees from elect university at seed , but appear to be missing a trick by mostly discount female founders , a get demographic in the unicorn blank space .

comment , Defiance Capital father Christian Dorffer tell me : “ I believe this is the most comprehensive cogitation ever done on the background of unicorn founders in the U.S. and U.K. We cover all new unicorns from 2013 - 2023 , covering over 2,000 founders and over 800 unicorns . ”

“ VCs famously say that ‘ it ’s all about the people ’ , but with only 10 % of unicorn founders fitting the Mark Zuckerberg visibility , most of the thousands of seed funds are backing the wrong type of founders . One interesting finding in our study is that even the best funds , like Sequoia , only get into less than 3 % of unicorns — and only 30 funds have a unicorn marketplace share of 1 % or more , ” he said .

“ The hunger , ego - belief , ingenuity and resilience we found in the unicorn laminitis also make a lot of sense when you see that 62 % had immigrant founders ( typically from land where it ’s unsufferable to build unicorns ) and 17 % of raw unicorns last year had female founders . ”

He continued : “ Immigrants and other underrepresented founders are clearly able to produce these awe-inspiring results but I wanted to testify it to LPs . A lot of the immigrant founders are coming from the develop world , like India and Africa , even Eastern Europe . They do n’t really have that many options at home . They have to leave and pursue chance elsewhere . ”

“ There ’s only 30 funds that have more than 1 % portion of all these unicorns , which means that it ’s entirely fragmentise , ” he added .

“ If you combine this atomization with the fact that immigrant and women found it harder to fund raise , there ’s a huge chance for new stock to add up in and specifically localise out to look for these founding father . ”

I take him how a VC or a family role might change their scheme as a final result of seeing this research ?

“ Sequoia being the top investment firm in only 2.8 % of unicorns means that they miss a lot . Yes , for LPs , top monetary resource are a comparatively good investment funds . But kinsfolk offices are now looking at emerge director and especially early - stage funds as the potential Alpha . So if you ’re look to maximise return as a family agency , you need to be in a few novel funds , issue coach so as to get that outlier company that become into a unicorn , ” he suppose .

Dorffer , who intend now to make a podcast with many of the unicorn founders surveyed , said : “ The stories that are come out show crazy finding . As a female founder , you have to work twice as hard and take twice as many coming together to raise the money . The founders of Andela and three African founders that built unicorn … have stories that are just so inspirational . ”