Topics

Latest

AI

Amazon

Image Credits:panchanok premsrirut / Getty Images

Apps

Biotech & Health

Climate

Image Credits:panchanok premsrirut / Getty Images

Cloud Computing

Commerce

Crypto

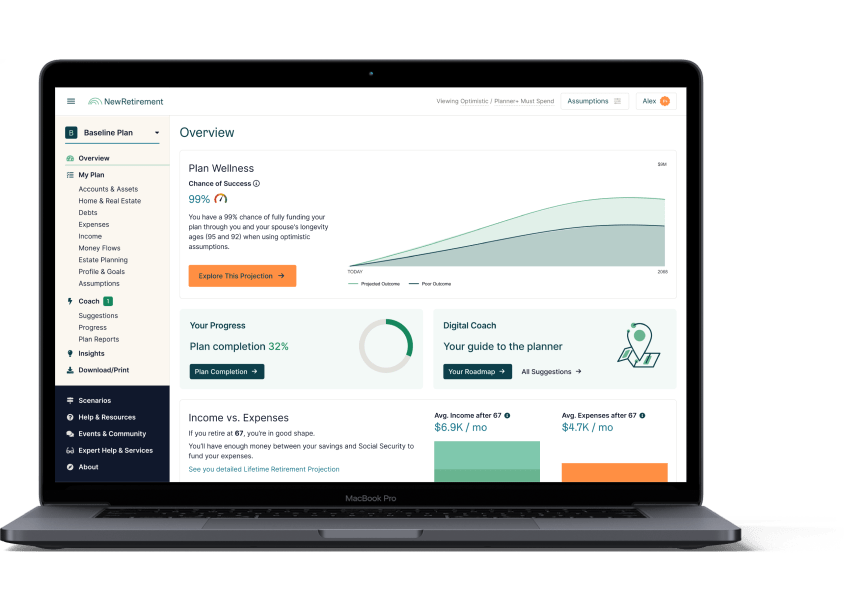

NewRetirement’s platform uses predictive modeling and data analytics to help users suss out the right savings approaches.Image Credits:NewRetirement

endeavour

EVs

Fintech

fund raise

Gadgets

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

blank

Startups

TikTok

Department of Transportation

Venture

More from TechCrunch

effect

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

meet Us

When enterpriser Stephen Chen ’s mom begin approach retreat eld , she was forced to adopt money from Chen — and Chen ’s blood brother — to make end encounter . They wanted to help , but the sibling also require to figure out a more sustainable , long - condition solution that ’d help their mom retire without get to concern about finances .

Chen tried to get guidance from a financial adviser , but no one would take his mother as a client because her nett worth was n’t considered high enough . So Chen started building spreadsheets and fiscal models himself , doing his best to figure out how his mom could live the retirement modus vivendi that she need .

“ mass like my mammy lack the tools to appear at their money holistically and strategically so they can make informed decisions , monitor their financial situation , understand which levers to pull and when and make the connection between the option they make today and the prospicient - term ramifications to their plan , ” Chen told TechCrunch . “ There ’s a confluence of factors that may change the future tense of financial preparation and advise . ”

It was after Chen helped his mama lower her expense , figure out when to claim Social Security , resolve when to downsize and take other steps to become financially independent that Chen realized oodles of other elderly Americans were facing the same challenge .

So Chen foundedNewRetirement , a Mill Valley - based ship’s company building software to help hoi polloi create financial retirement architectural plan . Today , NewRetirement ’s verbatim - to - consumer product power fiscal planning for 70,000 users managing close to $ 100 billion in their own financial plans , according to Chen .

“ Our models go beyond nest egg and investments , taking into business relationship all of the other factors in a somebody ’s life , from home equity , healthcare costs and taxes to Medicare and Social Security , ” Chen said . “ Every time a user makes a variety , we fly the coop thousands of simulations for serve them optimise their architectural plan … We account for thousands of unlike scenarios , enabling user to confidently represent out accumulation and decumulation projection with digital guidance . ”

NewRetirement is Chen ’s second inauguration after Embark , an online college lookup and admissions tool he launch in 1995 . And , like Embark , Chen sees NewRetirement as a digital solution to a modulation face by millions of Americans .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ 120 million Americans over age 50 hold 80 % of the wealth in this country , ” Chen pronounce , “ But running out of money remains a top 10 fear , with virtually half of Americans saying they are worried about it . ”

Indeed , the legal age of Americans — as many as 65 % , perCharles Schwab ’s Modern Wealth Survey 2023 — have no formal financial architectural plan . And while 37 % of respondents say that they work with a financial advisor , two - thirds of Americans trust that their fiscal preparation call for improvement , accord toNorthwestern Mutual ’s Planning and Progress Study 2023 .

NewRetirement , which began as a consumer offering and in 2021 expanded to the endeavour , charge $ 120 per year for access to a suite of tools , calculators , recommendation and scenario comparisons and ~$1,500 per twelvemonth for check - IN with a certified financial planner . In addition , NewRetirement sells a subscription - based private recording label variation of its tools place at fiscal consultant .

Now , you might wonder , what makes NewRetirement unlike from startups likeRetirable , which likewise provides an array of retirement planning tool and access to plus managers ? Chen asserts that NewRetirement is one of the few — and perhaps only — financial planning platform that serves consumer as well as adviser and workplace .

“ Our core innovation is allow anyone to produce a programme with industrial - strength tool , enable advisers to join forces with the end user and pass water this uncommitted at weighing machine through enterprise pardner who impart it to their customers , ” Chen order . “ As more financial services companies see their offerings like investment direction become commoditized , there ’s vast value in helping client and prospect recollect about their money holistically . By offering self - directed digital planning to clients versus lead off with a human adviser , they can scale and attend any number of users , learn about them , help them make estimable decisions and place their product and services more effectively . ”

That impulse no doubt helped NewRetirement to cinch its Series A funding around this calendar month .

The company raised $ 20 million in a tranche that land its sum lift to $ 20.8 million , led by Allegis Capital with engagement from Nationwide Ventures , Northwestern Mutual Future Ventures , Plug and Play Ventures , Motley Fool Ventures and others . Chen enjoin that the cash extract will be used to inflate 50 - employee NewRetirement ’s endeavor production , descale up onboarding , accelerate R&D efforts and build electrical capacity to meet future requirement .

“ With this new Das Kapital , we will have three to four age of runway , ” Chen said . “ That give us sentence to carry on to scale our enterprise partnerships and enhance our product . What ’s more , the current downturn is enabling us to convey in unbelievable talent . We have a strong squad in place and will expand headcount further this twelvemonth . ”