Topics

Latest

AI

Amazon

Image Credits:Getty Images

Apps

Biotech & Health

Climate

Image Credits:Getty Images

Cloud Computing

Commerce

Crypto

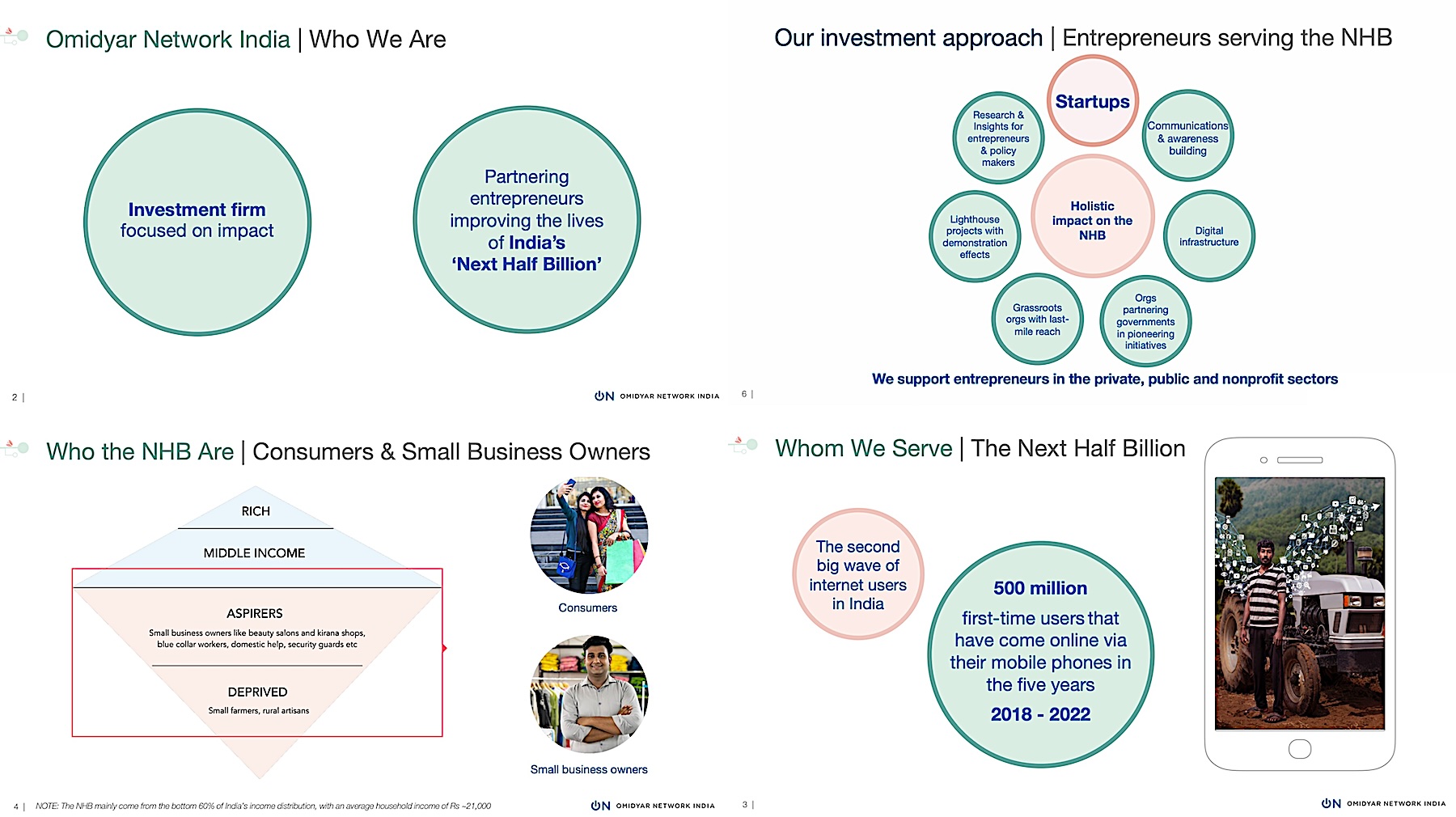

Slides from an Omidyar Network India’s presentation.Image Credits:Omidyar Network India (slide obtained by TechCrunch)

Enterprise

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

startup

TikTok

transit

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

meet Us

Omidyar internet , backed by eBay founder Pierre Omidyar , is exclude down its India functioning , two sources familiar with the matter told TechCrunch , in a stunning ontogenesis for the impact speculation firm that has back over 120 startups in the South Asian market over the last 13 years .

TechCrunch could n’t determine why Omidyar had determine to abruptly pull from the Indian market , a ontogenesis that was shared with the local squad Monday , a generator familiar with the thing said , quest anonymity as the thing is private .

The move comes a year after Omidyar web and nine other NGOs came under the radar of India ’s Central Bureau of Investigation , which serves standardized roles as the FBI in the U.S. , over aver misdemeanour of the Carry Nation ’s Foreign Contribution Regulation Act that superintend a business firm ’s power to receive abroad donation . Thousands of civil gild groups in India have had standardized licenses canceled in the past nine long time .

The house did n’t reply to a request for comment Monday but confirm the ontogenesis after the publication of this story . It say its decision to rip out of the Amerindic marked was “ to a great extent informed by the significant change in context and the growth in the economic landscape that the India - based team has experienced since first make investments there in 2010 . ”

It total : “ Today , there is more Indian led philanthropic and venture Washington than ever before , the res publica has a vibrant commence - up sector , and several investment trust now have a middle and lower - middle income focus as part of their investment scheme . From its outset , the Omidyar connection India team identified these system of rules fracture as critical to impact and work diligently to help catalyse this change . ”

The firm ’s add-in and leaders team will assess over the next two month how to best manage the portfolio inauguration go ahead , it said . The firm employed over three dozen citizenry in India .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Omidyar connection “ achieved our primary objective of catalysing impact , ” in India , the firm enounce , adding that it will no longer be make any more investment funds in India .

A separate individual conversant with the situation said that the India squad design to attempt to reunify and raise money outwardly and start a new fund , but cautioned that it ’s too too soon so the plans may switch and deliberation may give way .

Omidyar connection support startups in India that , at least on paper , were clear problem faced by half a billion hoi polloi in the country . Its portfolio startups include 1 mg , Bounce , Vedantu , Bijak , DealShare , Doubtnut , Entri , HealthKart , Indifi , M2P and Pratilipi .

As of July this year , Omidyar web India had about $ 673 million of accumulative asset under direction and its portfolio inauguration reached 735 million people , harmonise to an investor demonstration .

2023 has been a rough year for the Omidyar web India team . Doubtnut , a startup which advance more than $ 50 million , sell for $ 10 million this calendar month . AndZestMoney , once valued at closely $ 450 million , also announced that it was close down . Both of them count Omidyar web India among their backers .

India has come forth as a key market place for speculation and individual equity investors in the past decade as startup graduated table to serve the earth ’s most thickly settled marketplace . “ India is the raw China and the dissolute grow major saving in the come decade and beyond . We believe India offers the most attractive long - term investment funds appealingness in our universe , ” Baron Capital said in a quarterly report this year .

But it ’s also true that many speculation investors have struggled to make money in India .

Tiger Global ’s Scott Shleifer state early this year on a call with Amerindic entrepreneurs that he believe that the South Asian market will deliver the highest fairness returns globally in the time to come but admitted that the nation hadhistorically delivered below average returnsto the New York - headquarter giant .

“ Returns on chapiter in India have sucked historically . If you look at the market - leading internet company , whether it is Google , Facebook , Alibaba or Tencent , taxation for them got bigger than be more than a decennary ago . You had a great legacy of last 17 - 18 class of materially profitable net company . So returns on equity in the cyberspace got really high and the returns for investor have been really high . But that did not happen in India , ” he order .

Also breaking on TechCrunch : Tribe Capital eyes lead $ 75M - plus funding in India ’s Shiprocket .