Topics

late

AI

Amazon

Image Credits:Jonathan Hepner

Apps

Biotech & Health

clime

Image Credits:Jonathan Hepner

Cloud Computing

Department of Commerce

Crypto

go-ahead

EVs

Fintech

Fundraising

gadget

Gaming

Government & Policy

computer hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

startup

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

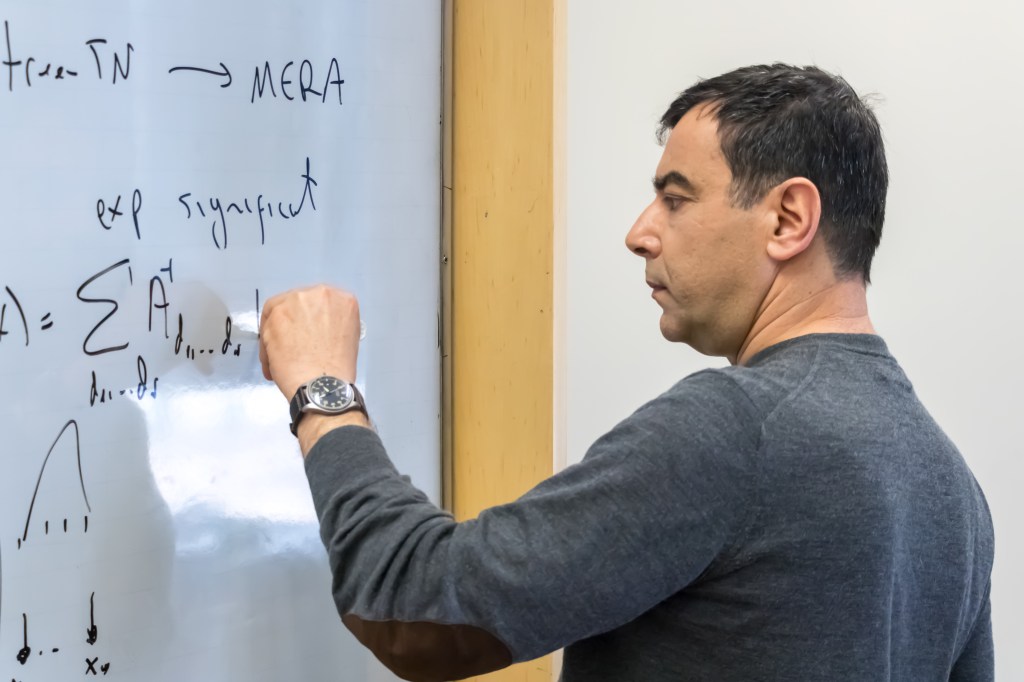

Amnon Shashua , the founder and CEO of Mobileye , has an centre for complicated problems that he believes can be resolve with AI , and that AI itself can be fixed to become more honest . On the by-line of building and extend his ego - driving railcar technology company — which he tookpublic , thensoldto Intel , thenspun outagain — he ’s been hatching a number of other ideas .

Now , one of these is raise money and gaining meaning momentum .

One Zero , a fintech aiming to use AI in retail banking services , is in the process of heighten at least $ 100 million , TechCrunch has learned .

Despite being co - establish by one of the most high - visibility and successful father in Israel , One Zero has had surprisingly small attending to date outside of its home plate market . But the party has raised around $ 242 million so far , and in 2023 it was valued at $ 320 million , per information inPitchBook . Our source say that the valuation will be importantly higher in the next round . One local report ( publishedthe day after this story was release ) estimated the pre - money rating at between $ 400 million and $ 450 million .

It is unclear who the investors are , but former backers of the fellowship include Tencent , OurCrowd , and SBI Ventures ( the now - self-governing firm that once was a part of SoftBank ) , as well as Shashua himself .

One Zero ’s current campaign to heighten money hail on the bounder ofreportsthat it stress to close a rung last class . That round never happened . Meanwhile , the warfare with Hamas has led to One Zero place off employees and curtailing international enlargement due to the war with Hamas , according toanother Israeli outlet .

On the other hand , One Zero ’s current growth and elbow grease to raise more money amount amid a frenetic pace of activeness for Shashua , who has a non - executive role at the company , with Gal Bar Dea as CEO . In the last mates of years , Shashua has establish or co - founded startups working on humanoid robotics ( Mentee ) and alternate approaches to enceinte speech models for generative AI ( AI21 ) , as well as , launched only a couple of weeks ago , AA - I Technologies(pronounced “ double AI ” ) , which Shashua draw as his endeavor to build an “ AI scientist . He is also a computer science prof at the Hebrew University in Jerusalem .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

One Zero ’s every bit ambitious mission is to “ fetch private banking to the masses , ” he said in an consultation . It propose to democratize the form of high - touch , advisory - type services that high - final - deserving mortal get when they swear , in a market where the mean person not only does n’t get that kind of serving today , but is staring at a future where there may be no forcible bank , and no human being to help , at all .

It ’s tackling that ambition by room of a double business focus . In Israel , where One Zero is based , the inauguration has acquire a banking license and has been building a full - flock retail bank . Alongside this , One Zero is using insights gained from that retail business — which Shashua described in an interview as a “ sandpile ” — to trail its models and hone its technology for certify that technical school to bank operating elsewhere .

The retail occupation now has around 110,000 customers , Shashua recount TechCrunch , and although it has yet to announce any licensing deals so far , the company says it ’s receive a number of inward petition from major banks to do so .

The company ’s cornerstone so far — and the direction of where it plan to enthrone its funding — is a chatbot called Ella , which aims to be estimable than current chatbots while put up services that human bankers could not .

As Shashua sees it , while there have been a identification number of efforts to build up AI into retail banking services , for example around functions like manage disbursal , they ’re limited in what they can do .

“ You do n’t see bank deploying artificial intelligence to a level in which you are actually replacing a banker , ” he said .

As an example , he said , take automated communicating . you could need a banking chatbot very introductory questions , such as “ how much money is in my bill ? , ” or information about recent transactions , and it can commonly do . But it ’s a dissimilar story if you ask anything with calculations , such as “ how much money will I have in my deposit report at the end of the year based on body process so far ? ” , or “ what is the best fashion for me to purchase a car based on my fiscal visibility ? ” Not only are chatbots incapable of answering such questions , most personal bankers ca n’t either .

“ There is an opportunity here , where generative AI can , apparently , do this , ” he said . “ It goes right smart beyond spending tracking . ”

One Zero ’s glide slope to build such an AI , as Shashua identify it , is very ambitious and feels as tricky as self - driving . It focus on using multiple big language models . Some models may be optimize for different tasks , he said , but run tasks through several Master of Laws can also provide a diversity of responses , which then are run through a verification outgrowth to understand when answer are shoddy or incorrect .

And if those answers are not verify to be helpful or correct , the AI does n’t attempt to say something anyway , he said . “ It ’s okay [ for it to ] say , I can not solve your job . I can not serve your question , ” he said . “ Humans also can not answer every enquiry , right-hand ? So it ’s all right . It ’s not ok to say , here ’s an answer to your question , and the response is totally phony , completely assumed . ”

The system is starting with more basic job like expend direction and the architectural plan is to tally in more functionality over meter to serve apprize customers on finance big purchases or saving money more sagely .

Updated with further details on valuation and fundraising .