Topics

Latest

AI

Amazon

Image Credits:Dhiraj Singh / Bloomberg / Getty Images

Apps

Biotech & Health

clime

Image Credits:Dhiraj Singh / Bloomberg / Getty Images

Cloud Computing

mercantilism

Crypto

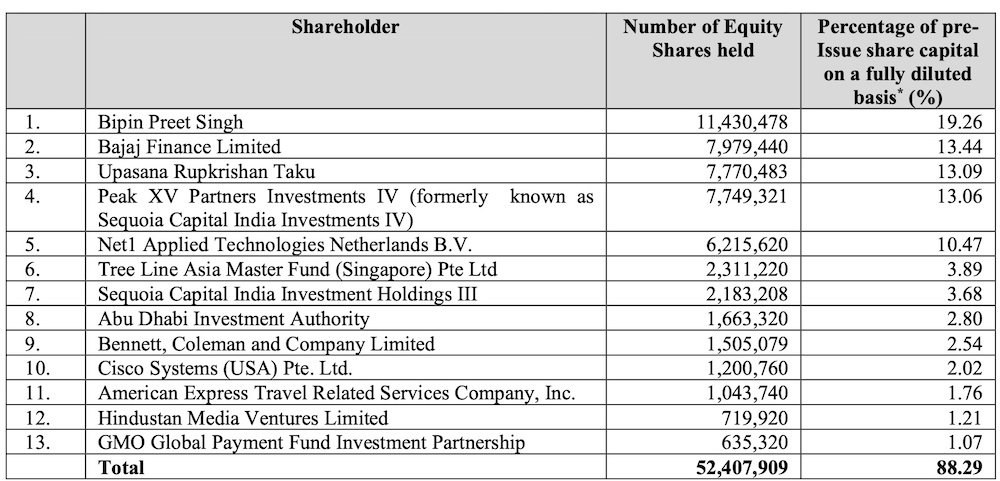

MobiKwik’s shareholding.Image Credits:MobiKwik DRHP

Enterprise

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

inauguration

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

reach Us

Amerindic financial services startup MobiKwik seeks to raise about $ 84.2 million through issue of new shares in an initial public oblation in the home grocery , it said in a gulp prospectus charge with the local markets regulator Friday .

The 15 - year - old startup , found by hubby - wife duet Bipin Singh and Upasana Taku , does n’t plan to deal any existing shares in the IPO , according to the new prospectus . It does plan to leaven about $ 16 million in a pre - IPO rung , it say .

MobiKwik operates an online financial services political program proffer digital payments , credit , investment funds and indemnity products . The startup has seen strong ontogeny , amassing more than 146 million registered users and 3.8 million merchant partners . MobiKwik , which started its journeying as a mobile notecase provider , has since expanded into additional fiscal services , including “ buy - now - pay - later ” credit , personal loans , merchant cash advance , wealth management and insurance policy distribution .

Its Zip buy - now - pay - later product examine credit disbursal of $ 490 million in fiscal 2023 , up 21x from two age prior . MobiKwik ’s full dealing note value across its defrayal and recognition ware also more than doubled from $ 1.78 billion in financial 2021 to $ 3.15 billion in financial 2023 . MobiKwik seeks fresh backing to leverage its user base and merchant internet to cross - sell extra fiscal products .

SBI Capital and DAM Capital are the lead book - running managers for the IPO mental process , the prospectus state . MobiKwik , which was unprofitable in the fiscal year 2021 , 2022 and 2023 , turned profitable in the six months end September 30 , 2023 . It made a profit of $ 1.1 million during that six months on revenue of $ 29.3 million , the startup unwrap in the course catalogue .

MobiKwik is the latest Amerind startup that is looking to go public this year . Lossmaking startupsOla ElectricandFirstCryfiled their draft course catalogue for their initial public offerings last calendar month . As many as40 more tech - focussed or adjacent firmsare looking to go public in India in the next two yr .