Topics

in style

AI

Amazon

Image Credits:Astek Diagnostics

Apps

Biotech & Health

mood

Image Credits:Astek Diagnostics

Cloud Computing

Commerce

Crypto

[Slide 6] A great, comprehensive problem statement.Image Credits:Astek Diagnostics

Enterprise

EVs

Fintech

[Slide 15] The legal moat around Astek is off to a good start.Image Credits:Astek Diagnostics

Fundraising

contrivance

Gaming

[Slide 9] – How it works, part 1.Image Credits:Astek Diagnostics.

Government & Policy

ironware

[Slide 10] – How it works, part 2.Image Credits:Astek Diagnostics.

layoff

Media & Entertainment

[Slide 12] Teeming with team members.Image Credits:Astek Diagnostics

Meta

Microsoft

Privacy

[Slide 17] That’s a lot of redacted data.Image Credits:Astek Diagnostics

Robotics

security system

Social

Crunchbase “knows” about three rounds of funding.Image Credits:Crunchbase

Space

Startups

TikTok

PitchBook shows a huge amount of information about company financials in its database.Image Credits:PitchBook

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

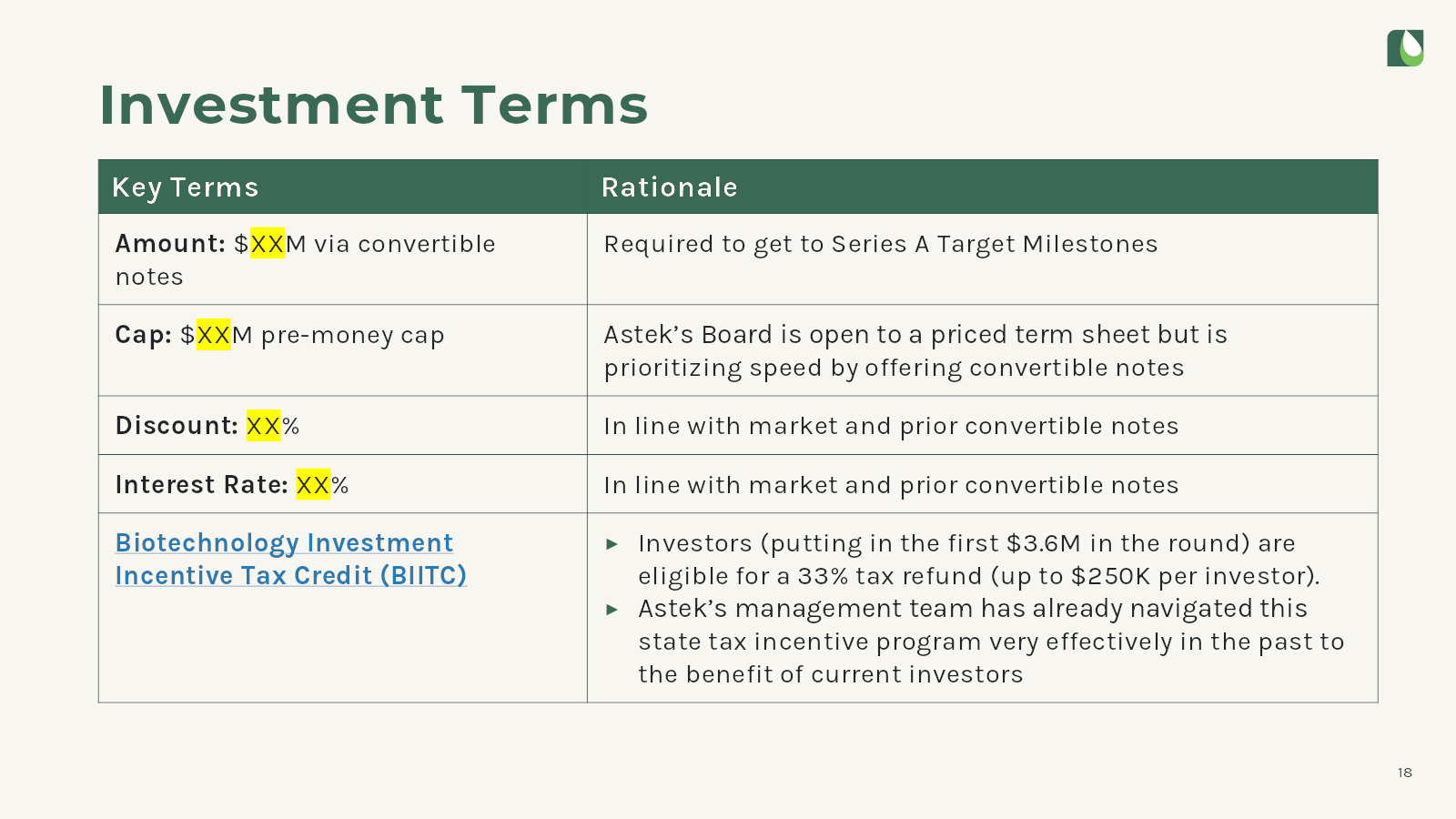

[Slide 18] This slide is not only superfluous, it’s potentially a red flag.Image Credits:Astek Diagnostics

newssheet

Podcasts

Videos

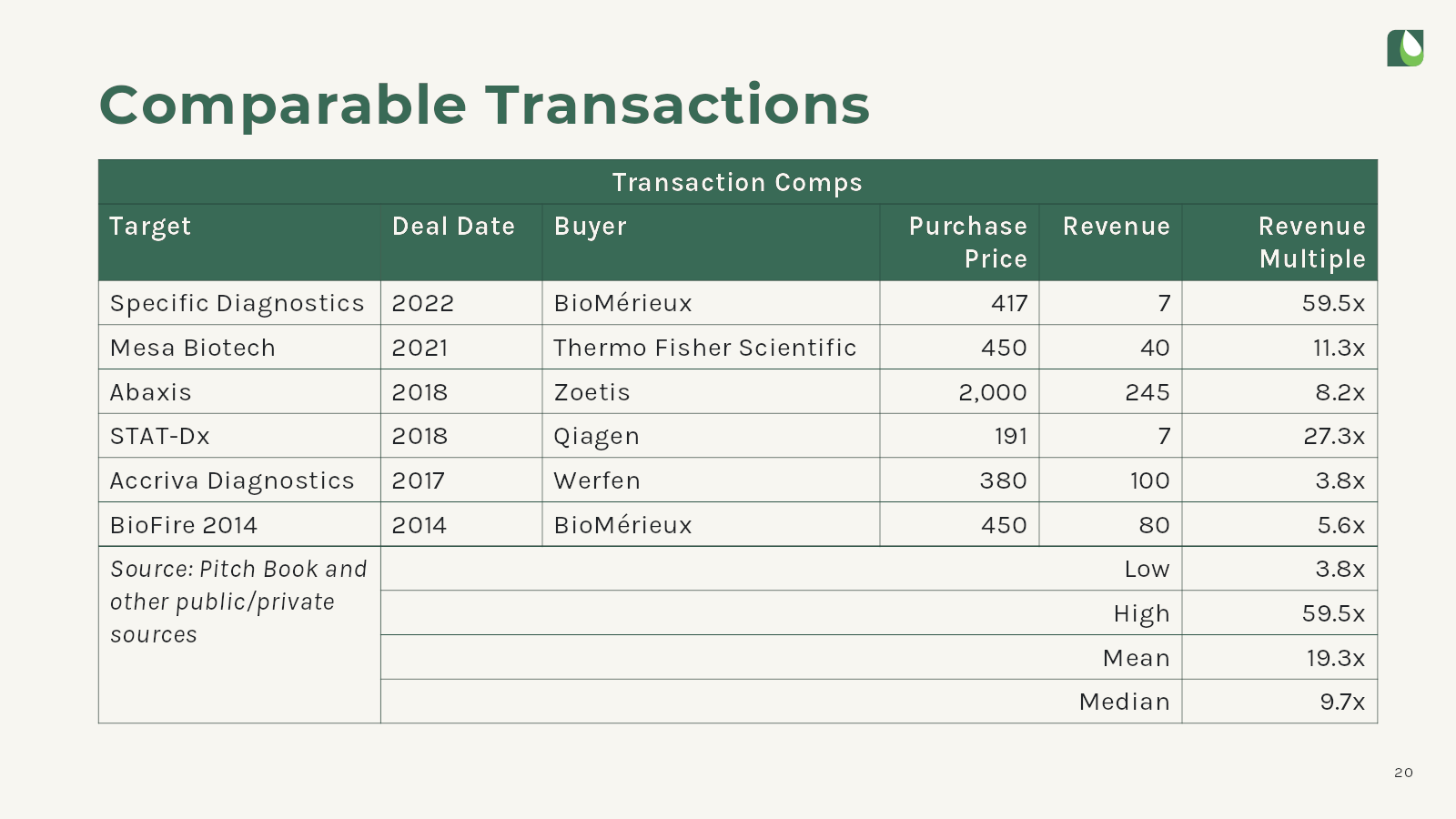

[Slide 19] Exit strategy, part 1.Image Credits:Astek Diagnostics

Partner Content

TechCrunch Brand Studio

Crunchboard

[Slide 20] Exit strategy, part 2.Image Credits:Astek Diagnostics

Contact Us

Astek Diagnostics closed a $ 2 million round for its piddle diagnostics organisation , despite the fact that raising money for medtech is n’t for the faint of center . The company ’s deck of cards has some good stuff in it and could be a mysterious source for thing we can learn from , too .

We ’re looking for more unique sales pitch decks to tear down , so if you want to submit your own , here ’s how you could do that .

Slides in this deck

Astek Diagnostics has a pretty beefy 22 - slide deck that break up a lot of the narrative over multiple slides . In some face , the deck of cards is comprehensive and impressive , but it also comes across as jolly defensive and slightly dated , even though this fundraising round close latterly . Some of the slides have been gently put .

Three things to love about Astek Diagnostics’ pitch deck

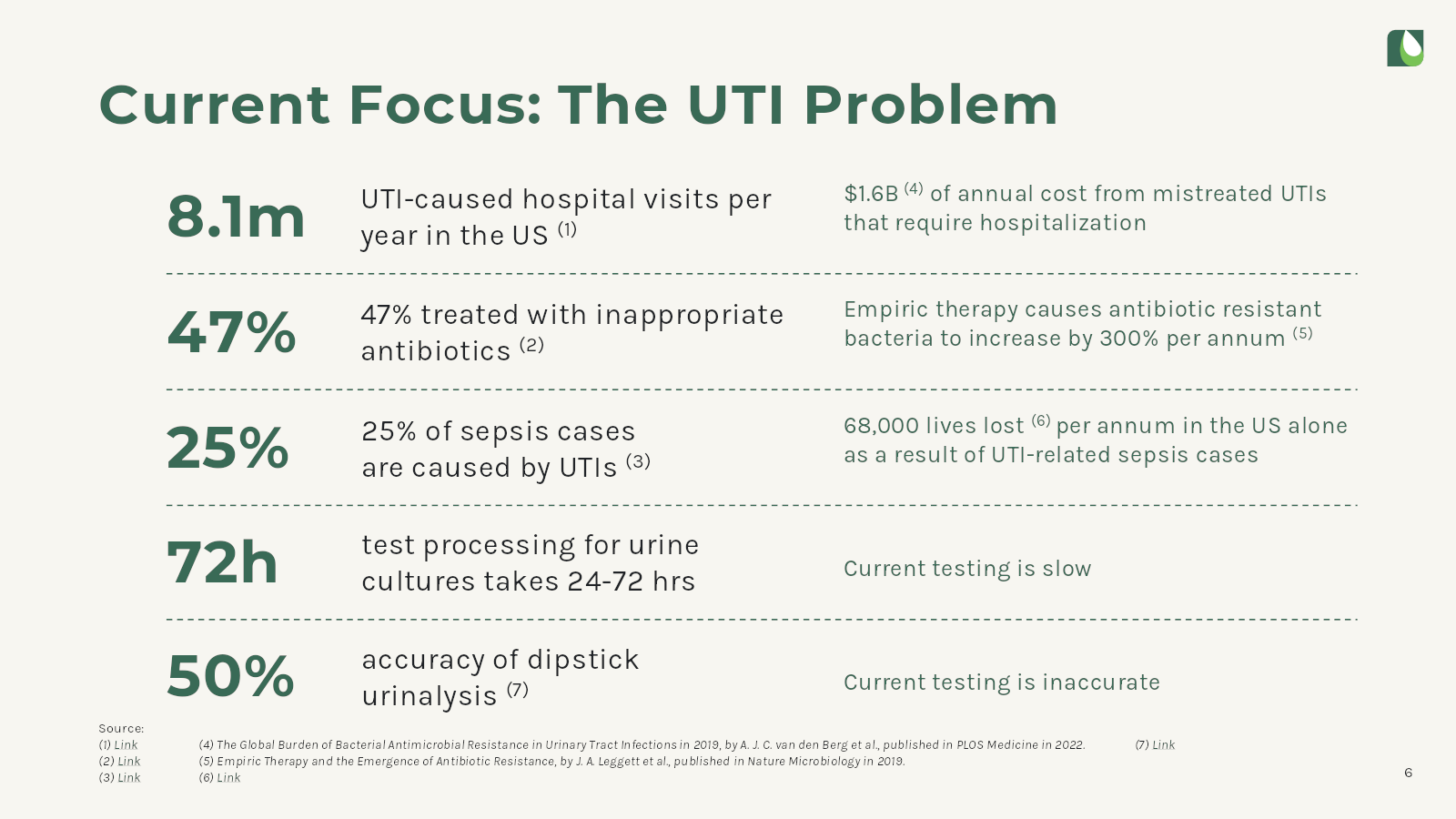

Where the AD pitch deck is serious , it ’s cracking : comprehensive , well - explore and well - designed . Slide 6 — the job statement — is a great model of all three coming into shimmer .

A comprehensive problem statement

explain the job in a tar deck of cards is all important because it lay the foundation for the great unwashed to sympathise the necessity and relevance of your inauguration . This section should captivate the audience by foreground a disruption or inefficiency in the market that the company aim to address . It set the context of use for the intact presentation , allowing investors to get the picture the order of magnitude and importunity of the result at script . Better still , explain the problem effectively help to validate the mart requirement for a product or service .

In this slide , Astek take the chance to present data and insight that back up its title , thereby reinforce the potential for outgrowth and success . This incision is a inauguration ’s first step in building a compelling tale that aligns its mission with the interests and investment goals of would - be investors .

On this playground slide , Astek paint an impactful picture : vast amounts of hospitalizations , unnecessary treatments , problems with velocity and accuracy . work these job , this chute advise , and almost 70,000 life per yr can be saved .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Another thing this slide does well . It describes the trouble , but what’sreallygoing to make investors lean forward is the immense proportionality of the trouble : 8.1 million hospitalizations indicates that there ’s a truly redoubtable market size at shimmer here .

Solid defendability

In biotech , a company is only as valuable as the ability to protect it , and experience a great moat is a fundamental part of building a startup for the ages . The fact that the party is thinking about IP security is reassuring , although I did have some questions about what each of these actuallymean .

One question I have here is why the Test Algorithm patent of invention is show with a publication number rather than the patent issue ; the patent ( US11,788,962 ) was granted in October 2023 . The second IP entry — the Fluidic Cartridge letters patent — is marked as pending , but it’savailable to the populace .

The third one had me gravel , so I chink withthe team at Run8 Patent Group . They explained that that number is neither a letters patent nor a publication number : It ’s a provisional patent number . We were n’t able to secernate whether the patent was converted to a non - provisional patent of invention , but at the very least , the language is confuse here .

The final entry on this listing — for a Rapid Cartridge Modification — is also confusing . It appears that ’s a law business firm schedule number , which is n’t much of an IP protection , and my friendly patent of invention attorney friends enjoin me that simply say “ filing in advancement ” may have been clearer and potentially a more fair description of what ’s going on here .

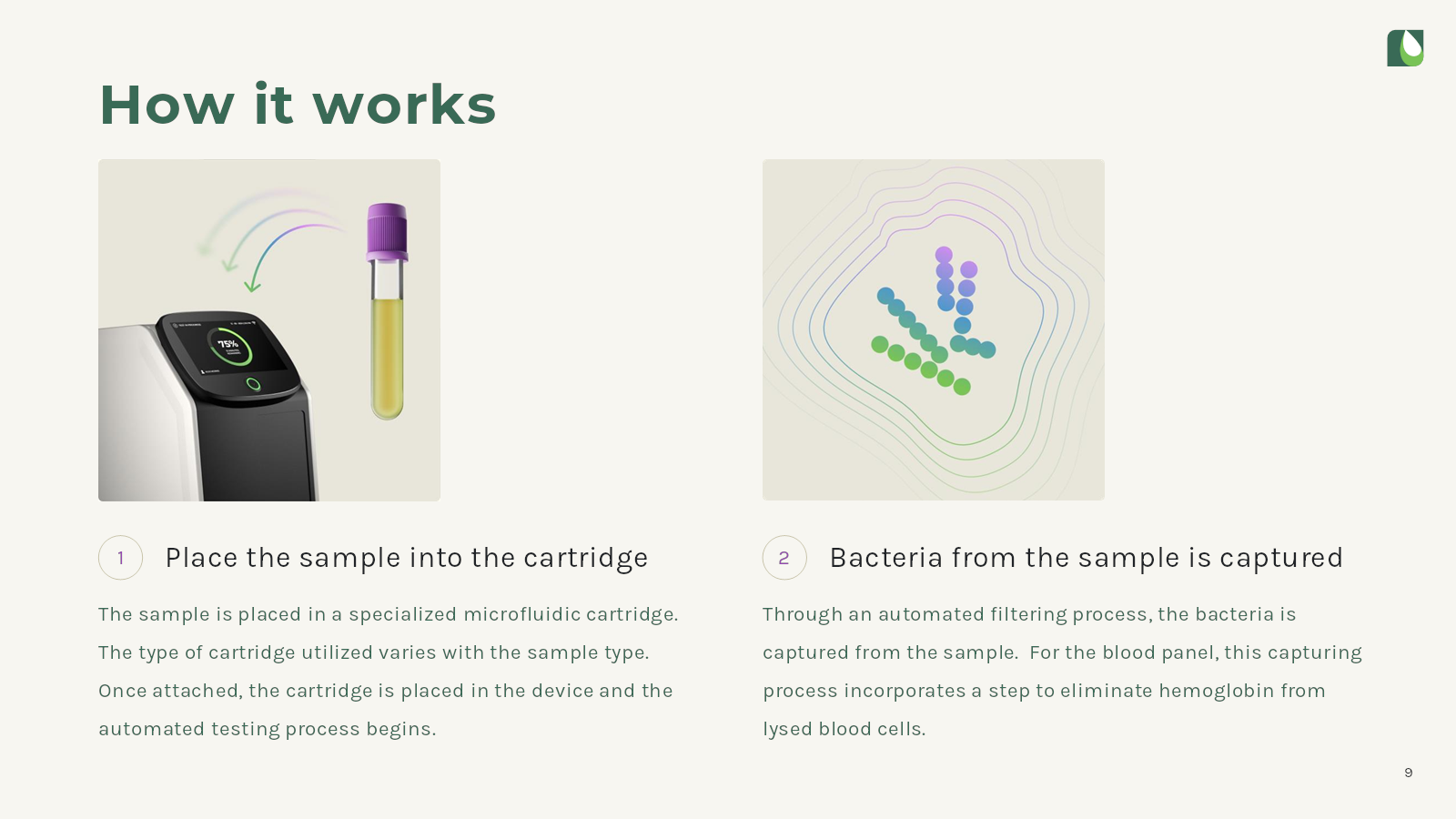

Easy to understand (but …)

In slides 9 and 10 , the society get to it very light to understand how the system works :

These two coast do a sound business explaining how a user would use the product . Insert sample , bacterium are captured , then tested , then you’re able to read what the simple machine found . From a gross sales view — if I were a buyer of one of these machines — that ’s a great top - storey opinion over how a user would practice the machine .

But , fromthe perspective of a consumer , this is how I wouldexpecta political machine like this to solve . If I , a non - medically - trained individual , were to take the air up to this machine , I think I could use it . the expectation of user experience is so high now , that this is n’t an initiation : This is how thingsshouldbe . Of naturally , in medical devices , user experience is sometimes not a high-pitched precedence , and perhaps the repose of usance is a selling point for the machine , but the manner these slides are project , I kind of go “ Yes , and so what ? ”

What I ’d really do it to have run across here is context . If all the other machine are much harder to utilize , recount that tarradiddle . If the political machine is way faster , show that compare . If there is a major applied science breakthrough , thatis what I would be curious about as an investor .

The product slide should n’t show how to hit the minimal feasible drug user experience . It ’s better to explain what it is about the product that make it peculiar , defendable and deserving investing in .

Three things that Astek Diagnostics could have improved

There were a lot of likely learnedness opportunities — many more than I have time or space to go into in this pitch deck teardown , but let ’s pick out some takeout :

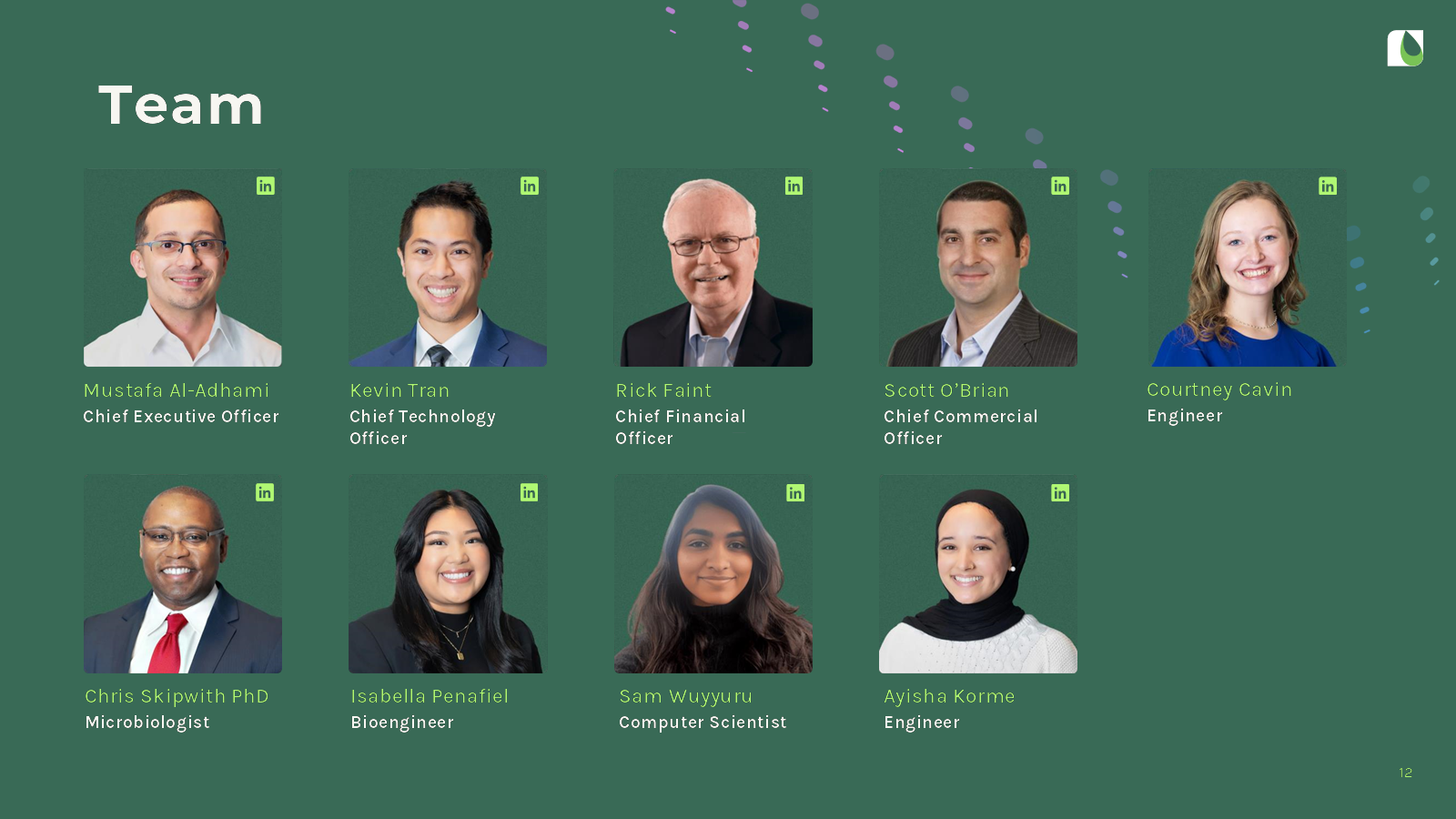

Tell the full team story

The squad coast has both too much and too picayune information on it .

The purpose of a team slide is to assure the write up of why a team is unambiguously positioned to work up this specific company . As an investor , I do n’t in particular care about technologist or computer scientists . The team playground slide is for highlight the institution team and older leadership , the family line that are trusted to carry this society through the next few rounds of financial support and product development . This playground slide needs more context of use to be utilitarian .

Astek does get fond cite for including LinkedIn links to each of the team members , but a brief description under each name would be easy .

Since the company put links to the whole team ’s LinkedIn profiles , I went looking to see what I could find — and I find some yellow flags . Kevin is listed as a co - father , not as CTO on LinkedIn . His visibility reads that he is “ a various full lot developer with a background in Chemical Engineering . My expertise lie in in developing web - based applications programme . ” So that ’s great and all , but computer hardware is hard , and aesculapian devices are extremely specialized . have a CTO that seems to have no startup or hardware experience could cause investor to involve some doubtfulness .

Rick is list as the ship’s company ’s CFO — it ’s perplexing why a fellowship erect $ 2 million would even necessitate a CFO — buthe does n’t list Astek Diagnosticson his LinkedIn at all .

On the slide , Scott is name as the company ’s chief commercial-grade police officer — again , a strange role for a company that does n’t have a ware in market yet — but he , too , doesn’t have Astek Diagnostic listed on his LinkedIn . On the bright side , he does look to have relevant experience from Specific Diagnostics as the CCO and as a dining table member of LEX Diagnostics .

In a nutshell , make certain whatever information you let in on your sliding board matches with public info that ’s available . If not , get ready for some burry questions from investor .

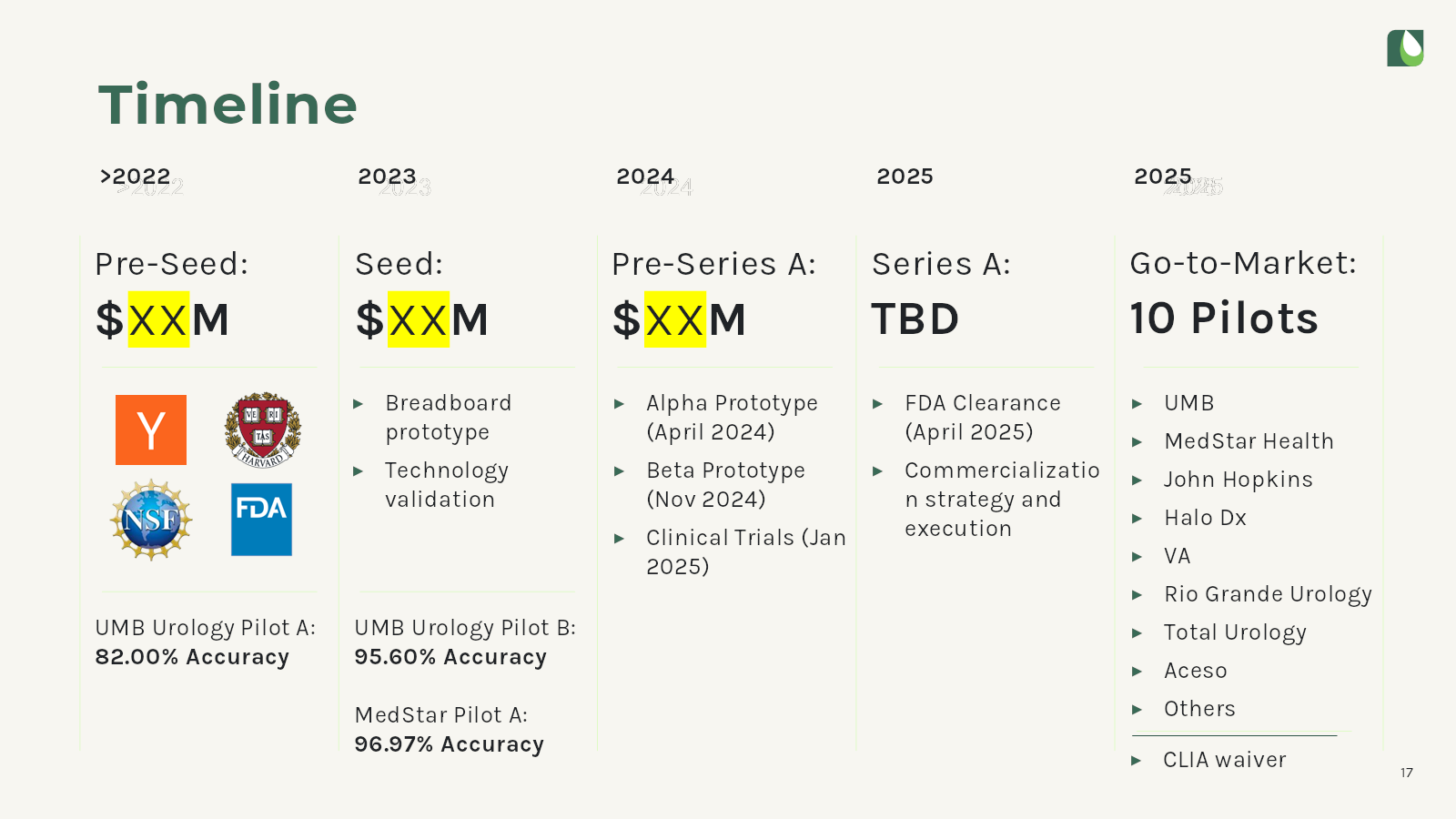

Let’s talk about the funding round …

The company has something going on on its timeline , showing three rounds of funding , all of them redacted . Putting apart for a moment that I ’ve never hear of a “ pre - Series A ” bout , this , too , raises some flags .

The irony , of course , is that a set of this selective information is available through other data reservoir . When investor assess whether to verbalise to a startup , they use whatever information is useable to see the status of the company . In this case , I look up the company on PitchBook and Crunchbase .

Crunchbase tracked a $ 125,000 pre - seed round , a $ 256,000 grant led by the NSF ( whichturns out to be $ 275,000 ) anda $ 2 million come roundled by Wexford SciTech Venture Fund , which wasreported in June 2023 .

PitchBook has a gang more selective information :

All of that is to say that I ’m not entirely sure why the ship’s company decide to edit this part of the pitch deck , since the information is so easily collect from public sources .

What worries me more , however , is the next slide :

There are a destiny of things to worry about on this sliding board : produce an amount to “ get to Series A Target Milestones ” helps answer why the company write “ pre - Series A ” in the late coast : It ’s a span round . That could intend two thing :

In the case of the first choice , that mean that the founders did n’t have a respectable roadmap for what it needed to achieve so as to raise its next round . That ’s a scarlet flag : It ’s crucial to have a strong set of goals , assure that the troupe has a cleared route to make its milestone and being able-bodied to raise its next round .

The other alternative is that the companydidhave a exculpated bent of finish , but it failed to hit them . That bechance all the time , and there ’s no shame in that . However , this deck of cards cook the job bad : It does n’t clearly outline what the troupe thinks the “ Series A Target Milestones ” are , and nowhere in the deck does it explain what the milestones are , or what it thinks it needs to do in edict to hit those milestones .

The final red flag here is that the party is trying to pre - negotiate the deal : I appreciate that the founders have an opinion on what they think the cap and deduction are , but they do n’t get to localize those ; the lead investor does . It ’s potential , of course , that this pack of cards was updated after the party already had a condition - canvas in bridge player , but if that is n’t the case , this slide does n’t come across as founders who are live in the fundraising process .

Most of the VC industry has barricade using convertible Federal Reserve note these daylight , using YCombinator ’s post - money SAFEsinstead . The supererogatory uncanny matter here is thatAstek Diagnostics is , in fact , a Y Combinator alumnusfrom the accelerator ’s S21 batch . It ’s perplexing why the company would go with something other than the standard investiture term .

The simple matter would be to just get disembarrass of this slide whole . When raising a specific amount , the terms are always up for negotiation and will depend on which room the VC wind is blowing in that special bit .

Get rid of the “exit” slide

Sophisticated investor are astutely aware of comparable exits in the space they ’re invest in . A startup ’s mission is to build an highly worthful troupe . As soon as founder start talking about passing , they’rearguing against themselves .

Amazingly , Astek Diagnostics included not one , buttwoexit strategy slide :

This exit scheme lantern slide chance upon me as spectacularly defensive , in improver to sending the wrong signal . Trust high - quality investors to know their market place . Founders should explicate how they ’re going to build up a multibillion - dollar ship’s company and worry about M&A or IPO another clock time .

The full pitch deck

If you require your own sales talk deck teardown featured on TechCrunch , here ’s more information . Also , hold back outall our Pitch Deck Teardownsall collected in one handy office for you !